Borrow $50 Instantly with $50 Loan Apps

Need 50 bucks? $50 Instant Loan Apps can help you out. But they can also offer a little more than that. Read on to find your best option.

|

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Do you ever find yourself short on cash but just by a few bucks? Where do you get the money then?

You can't just enter a bank and ask for really small amounts. Not to mention, processing loans from them can be a hassle.

Well, $50 Instant Loan Apps can help with that. They're more convenient than banks and other financial institutions. They can process your loans more quickly, too.

We've got the best ones on this list. Just select a suitable option if you're ever cash-strapped.

Here are the best instant loan apps you can choose from:

- Brigit: Up to $250

- EarnIn: up to $150/day, and up to $1,000/pay period

- Dave: Up to $500

- Albert: Up to $1,000

- Chime SpotMe: from $20 to $200

- MoneyLion: Up to $500

- Cleo: from $20 to $250

- PayDaySay: from $100 to $5,000

- Branch: Up to 50% of your pay

- DailyPay: Up to 100% of your pay

- Payactiv: Up to 50% of your pay

- Tilt (formerly Empower): Up to $400

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

12 Best $50 Instant Loan Apps

Although these are trusted loan apps, not all of them are the same. Be sure to consider the loan amount, app requirements, and other features you may need!

Brigit

|

| CREDIT hellobrigit |

Loan Amount: Up to $250

Processing Time: 1-3 business days; within 20 mins. for a fee

Repayment Date: Choose your own repayment date

Why Choose Brigit:

Brigit offers cash advances (through Instant Cash) with flexible repayment dates. You don't need to worry about automatic repayment.

Do take note that it comes with a $8.99 subscription fee.[1] But you unlock other features with that price tag. Flexible repayment gives you extra time to repay your loan, while auto advances will cover you to help you avoid overdrafts.

You can also enjoy features like identity theft protection, credit protection, and credit builder.

|

|

Brigit Requirements:

Here are the things you need to use Brigit:[2]

- More than $0 in your balance

- A checking account that has been active for at least 60 days

- 3 recurring deposits on your account from the same source

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Now, what if you need a little more than $250?

EarnIn

|

| credit earnin |

Loan Amount: up to $150/day, and up to $1,000/pay period[3]

Processing Time: 1-3 business days via ACH, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

Repayment Date: On or after your payday

Why Choose EarnIn:

EarnIn Cash Out can get you up to $1,000 of your pay - an amount larger than what the previous apps offer. Although the amount depends on your hourly wage.

Just like the other apps, EarnIn doesn't charge interest or perform credit checks. Your cash out will not affect your credit score. There are also no mandatory fees.

Running a little late on repayment? You will also not be charged late fees.[4] EarnIn Balance Shield can even automatically transfer $100 of your earnings when your balance falls below your selected threshold amount ($0-$500).[5]

|

|

EarnIn Requirements:

What you need to get $1,000 from EarnIn:[7]

- Regular pay schedule

- Permanent work location, an electronic timekeeping system, or a PDF timesheet to track your hourly earnings

- A linked checking account

$1,000 is a huge amount of money. But maybe you don't need a lot. You might just need 5 bucks, even. Dave's got your back.

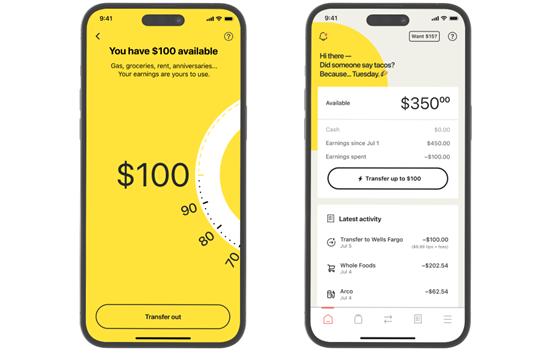

Dave

|

| CREDIT DAVE |

Advance Amount: Up to $500

Processing Time: 1-3 days for ACH transfers. For a fee, you can transfer to a connected account within minutes with express delivery.

Settlement Date: On your next payday or the nearest Friday if Dave can't detect your payday.

Why Choose Dave:

Sometimes, you don't really need a lot of money when you're cash-strapped. And Dave understands that very well. But other times, you might suddenly need to fix your car. Hence, you'll need a lot more than 50 bucks.

Dave's range for an advance (through ExtraCash™) can help you in both instances. They also don't charge interest or perform credit checks. Plus, there are no withdrawal or processing fees at nearly 40,000 MoneyPass ATMs.

But the downside is that membership costs up to $5 per month.[8] It's quite expensive if you only plan to advance a small amount. But the monthly fee also covers other services, including access to account monitoring, notification services, and maintaining a connection to your external bank account.

|

|

Dave ExtraCash™ Eligibility Contributing Factors:

What you need to qualify for higher advance:[9]

- An external account with a positive balance

- Total deposit of $1,000 or more per month

- 3 or more recurring deposits

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Next up, let's talk about Albert. You can get a cash advance and access to your salary up to 2 days earlier. Check out which app is more suitable by comparing their features.

Albert

Loan Amount: Up to $1,000

Processing Time: Instantly

Repayment Date: 6 days from when you initially advance (can request up to a 7-day extension)

Why Choose Albert:

With Albert Instant, you can get an instant cash advance of up to $1,000. You won't be charged interest or late fees. There are also no credit checks needed.

There's also a debit card offered through Albert Cash. You'll get access to your salary up to 2 days earlier by setting up your direct deposit with Albert Cash.

|

|

Albert Instant Requirements:

Here are what Albert requires from you:[10]

- An active bank account linked to an Albert Cash account

- Smart Money feature set to "Automatic" schedule on the app

- An Albert Cash account in good standing

- Set up qualifying direct deposits with Albert Cash to potentially raise Instant limit

Chime SpotMe

|

| credit chime |

Loan Amount: You can spot $20 to $200

Processing Time: Immediately

Repayment Date: On your next payday or deposit

Why Choose Chime SpotMe:

Chime offers immediate spotting through SpotMe, an overdraft-free service with no credit checks. It can save you a lot if you're used to paying hefty overdraft fees. You also don't need to worry about credit scores (unlike with a typical bank loan).

This option comes with a separate debit card for ATM withdrawals and debit card purchases. There are also no monthly fees or minimum balance required.

|

|

Chime SpotMe Requirements:

Here's what you need to borrow $200 from Chime:[11]

- You should be at least 18 years or older.

- An activated Chime Card

- A deposit account that is connected to Chime

- A qualifying deposit of $200 and above, 34 days before requesting an overdraft spotting

Now, borrowing money can get you stuck in a loan-and-repayment cycle. This next app has useful finance tools that can help prevent that.

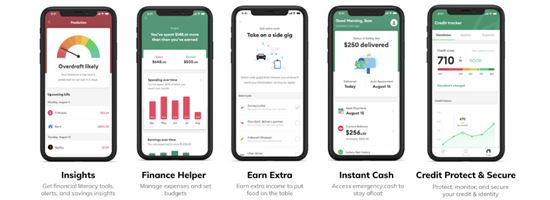

MoneyLion

Loan Amount: Up to $500

Processing Time: 2-5 business days; instantly for a fee

Repayment Date: Next payday

Why Choose MoneyLion:

MoneyLion can do more than lend you 50 bucks. Through Instacash, you can get a cash advance of up to $500 with no interest. There are also no credit checks or subscription fees with the app.

And if you need the money right away? You can get your loan instantly for a fee through Turbo Delivery. Depending on your loan amount, it can cost $1.99 - $8.99 (the higher the loan amount, the higher the fee).[12]

But what gives MoneyLion an edge is its tools that help you grow your money. You can use Credit Builder, Crypto Auto Invest, and Managed Investing, among other features.

|

|

MoneyLion Instacash Requirements:

Here's what you need to get $500 from MoneyLion:[13]

- An account that has been active for two or more months

- A history of recurring income deposits in the account

- A positive balance on the account

This next app you can get a cash advance and overdraft protection.

Cleo

Loan Amount: Up to $250 after the first repayment

Processing Time: Up to 4 business days; instantly for a fee

Repayment Date: Next payday; can extend up to 2 weeks

Why Choose Cleo:

Cleo offers Salary Advance, where you can get up to $250 of your paycheck with no interest. But this will only be available after your first repayment.

For your first advance, you can only borrow from $20 to $100. This may help alleviate their risk considering there are no credit checks. You can also receive the money quickly for a fee of $3.99.[14]

The cash advance feature is free. But you can also upgrade to Cleo Plus for $5.99/mo for more features. You can get personal financial management tools, overdraft protection, and special rewards with it.

You can use Cleo salary advance for free by emailing team@meetcleo.com. Just state that you would like to use Salary Advance without subscribing.

|

|

Cleo Requirements:

Cleo doesn't explicitly specify how to be eligible for a cash advance. But here are some tips to increase your chances:[15]

- Connect all the bank accounts you use

- Inform Cleo of your income and cash flow

- Pay subscription fees on time

- Limit cash withdrawals

- Make a budget and avoid negative balances

PayDaySay

Loan Amount: $100 to $5,000

Processing Time: Depends on the lender

Repayment Date: On your next payday (or when specified)

Why Choose PayDaySay:

PayDaySay is not actually a direct lender. Instead, they connect you with one. You can get personal, emergency, and installment loans. And you can ask for $100 up to $5,000.

You'll get matched with a lender that fits your needs. And if you're thinking twice about the loan? You can still cancel it within 24 hours (with most lenders) if you ever change your mind.

Although the lender doesn't always check your credit, they will charge interest for the loan. So just keep that in mind.

|

PayDaySay Loan Requirements:

Here are the things you need for approval:[18]

- Must be at least 18 years old

- Proof of stable income

- Valid bank account

- Completed PayDaySay online application form

- Documents specified by the lender

Now if you want to skip the hassle of loan requirements, check out Branch to get an employer-sponsored cash advance.

Branch

Loan Amount: Up to 50% of your salary

Processing Time: 3 business days; instantly (digital wallet)

Repayment Date: On your next payday

Why Choose Branch:

Branch Earned Wage Access can get you up to 50% of your salary in advance. Although, this amount will ultimately depend on your employer. That said, if you're making $1,000 in a pay period, you can get up to $500 in cash advance.

It's employer-sponsored, meaning your employer handles the requirements. So if you're interested in the app, ask your employer if the company offers this opportunity.

Withdrawal to your bank account will take 3 days. But if you need the money right away, you can access it instantly using Branch digital wallet.

If 50% of your salary is not enough, how about all of it in advance? Be careful though, it could get tricky to budget your money through the next cut-off.

|

|

DailyPay

Loan Amount: Up to 100% of your salary; up to $1,000 per day

Processing Time: 1 business day; instantly for a fee

Repayment Date: Automatically deducted from your salary

Why Choose DailyPay:

DailyPay On-Demand Pay offers a reloadable card where you can advance your whole salary. And you can use the card in any store that takes Visa debit cards.

For your first three pay periods, however, you can only advance up to 50%. So make sure to budget accordingly.

Also, just like Branch, DailyPay is employer-sponsored. So you don't need to worry about the requirements. You don't even need a pre-existing bank account to qualify.

|

|

Payactiv

Loan Amount: Up to 50% of your salary

Processing Time: 1-3 business days; instantly for a fee

Repayment Date: On your next payday

Why Choose Payactiv:

Payactiv Earned Wage Access is another employer-sponsored cash advance, just like Branch and DailyPay. Although, unlike DailyPay, you can only advance up to 50% of your salary. The exact amount will ultimately depend on your employer.

It can be a more convenient option, however. Since you can claim your cash through Walmart Cash Pickup. Or just pay your bills directly through the app itself!

Free ACH bank transfers will take 1-3 business days to process. But to get the money instantly (for a fee), you'll need debit/payroll cards or Walmart Cash Pickup. There's no fee for same-day transfer to a Payactiv card with direct deposit of $200 or more per pay period.[20]

|

|

Tilt (formerly Empower)

Loan Amount: Up to $400

Processing Time: Instantly

Repayment Date: On your next payday

Why Choose Tilt (formerly Empower):

Although the loan amount is not as large as the others on this list, Tilt Cash Advance gives an edge with 1-day standard delivery to your external bank account. There are no credit checks, interest, and late fees, too.

They even offer a Tilt Card with no overdraft fees. The card comes with up to 10% cashback deals and free instant cash advance delivery. You can use these bonuses to save some money!

The downside would be that Tilt (formerly Empower) charges an $8/mo subscription fee.[21] It's not ideal to have subscription fees considering you wouldn't want to "regularly" borrow money.

|

|

What is a $50 Loan Instant App?

Without the hassle of complicated paperwork, apps on the list can give you the $50 you need within an instant to a few days. And for most of the apps, you can repay it on your next payday.

Through their simple sign up process, you can gain access to $50 (even up to $500), and their additional features such as financial budgeting tools, credit builder, and more.

Yes, all the $50 loan instant apps on the list are safe. Additionally, here's our list of the best payday loan apps that also practice security standards that prioritize their users' safety and information security.

But if you don't know where to start with which app to choose on the list, keep reading.

What To Look For In $50 Instant Loan Apps?

Although it's easier to apply for these apps than bank loans, you'd still want to make the "right" choice.

Here are some of the major things to consider:

- Requirements

Some apps need a qualifying deposit, a positive account balance, or an account that's been active for months. So check if you have the loan requirements before signing up.Pro tip: To avoid the hassle of requirements, you can ask your company if they offer employer-sponsored cash advance programs. They might already use apps like Branch, DailyPay, and Payactiv. - Loan Amount

All apps on the list can get you a $50 loan if you're eligible. But a higher loan amount can provide more leeway during emergencies. It's not ideal to get cash-strapped because you didn't borrow enough! - Processing Time

If you need money right away, most apps offer express delivery. But if you'd rather save a couple of bucks, waiting for standard delivery takes around 1-3 business days. - Fees

Extra features and extra fast delivery could mean extra fees. Express delivery and subscription fees are top additional costs to look out for when choosing a $50 loan instant app. - Repayment Date

Most apps set repayment dates on your next payday. Take note of these dates to pay on time. That said, some apps don't charge late fees, like Tilt (formerly Empower), Albert, and EarnIn.

Yes, you can borrow from loan instant apps even with poor credit history. Brigit, EarnIn, Dave, and more apps on the list don't require a credit check.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

When Should I Borrow From $50 Instant Loan Apps?

One way to make the most out of instant loan apps is to use them for emergencies. If you're ever in a pickle, just click on one of these apps, and you're faced with a potential solution.

Whether it's for groceries, new textbooks, or a trip to the car mechanic, $50 instant loan apps can get you far financially. After all, the apps on this list are here to make your life more convenient during unexpected circumstances.

How often can I borrow from a $50 loan instant app?

For most apps on the list, you can only borrow once at a time. Until you've repaid it, you can't make another loan. But for Chime, Branch, and DailyPay, you can borrow multiple times until your loan amount limit is reached.

Borrowing from most $50 loan instant apps on the list (except PayDaySay) won't affect your credit score.

Alternatives to $50 Instant Loan Apps

If you're not qualified for instant loan apps, here are other things you can do to make a few bucks:

- Ask from friends and family

When you have good friends and family, borrowing from them may be more convenient than using loan apps. If you're lucky, you might even get a flexible repayment date. - Apply for a personal loan

Personal loans can get you a higher loan amount. You can typically borrow $5,000 to $100,000. They offer way more than 50 bucks. But watch out for high-interest rates. - Try Buy Now, Pay Later Apps

There are apps that let you buy now and pay later in installments. Borrowing from them lets you break large purchases into manageable payments. Some popular apps you can try are Affirm and Klarna. - Make Extra Cash

Loan apps can help you make ends meet. But to always have a spare $50, there are other money-making apps you can try.

How We Came Up With The List

When thinking of a loan, the first thing that comes to mind is tons of paperwork. But that shouldn't be the case when you just want to borrow $50. With these apps, you get to skip the paperwork and only worry about convenient and reasonable requirements.

We also considered the processing period. Because you're looking for an instant loan, we included apps that can get you your money fast. Most apps even offer express delivery. So you can get the money right when you need it.

Lastly, we took note of other financial features that can help you reach your money goals. That way, you don't just rely on the apps for urgent needs but for long-term use as well.

Bottom Line

Borrowing $50 is now easier with instant loan apps. This list offers the best ones you can trust.

Just make sure to take note of the maximum loan amounts, processing time, and repayment schedule. That way, you end up working with a suitable provider.

If you're ever short on the requirements, however, there are always alternatives to consider. We'd recommend making extra cash the most, so you don't end up in debt - even if it's just $50.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ Brigit. Pricing, Retrieved 10/22/2025

- ^ Brigit. How to access Instant Cash, Retrieved 10/22/2025

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. What Happens If You Default On a Payday Loan?, Retrieved 10/22/2025

- ^ EarnIn. What is Balance Shield?, Retrieved 10/22/2025

- ^ EarnIn. Lightning Speed fees and details, Retrieved 10/22/2025

- ^ EarnIn. Who can use EarnIn?, Retrieved 10/22/2025

- ^ Dave. Dave Membership, Retrieved 10/22/2025

- ^ Dave. ExtraCash eligibility, Retrieved 10/22/2025

- ^ Albert. How do I qualify for advances with Instant?, Retrieved 10/22/2025

- ^ Chime. FAQs: Who is eligible for SpotMe?, Retrieved 10/22/2025

- ^ MoneyLion. Pricing, Retrieved 10/22/2025

- ^ MoneyLion. How do I qualify for Instacash?, Retrieved 10/22/2025

- ^ Cleo. Terms & Conditions, Retrieved 10/22/2025

- ^ Cleo. Why am I not eligible for a cash advance?, Retrieved 10/22/2025

- ^ PayDaySay. Rates & Fees, Retrieved 10/22/2025

- ^ PayDaySay. FAQ, Retrieved 10/22/2025

- ^ PayDaySay. FAQ: How can I apply for the loan?, Retrieved 10/22/2025

- ^ DailyPay. What is the fee for Now instant transfer?, Retrieved 10/22/2025

- ^ Payactiv. Pricing, Retrieved 10/22/2025

- ^ Tilt. Debit Card Fee Schedule, Retrieved 10/22/2025

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|