$100 Loan Instant Apps

Short on 100 bucks? Loan instant apps can get you through a sticky money situation. And believe it or not, even with bad credit.

|

Here are the best instant loan apps you can choose from:

- EarnIn: Up to $1,000 with Cash Out

- Dave®: Up to $500 with ExtraCash™

- Chime®.: Up to $200 with SpotMe®

- PayDaySay: Up to $5,000 with a payday loan

- Tilt (formerly Empower): Up to $400 with Tilt Cash Advance

- Brigit: Up to $250 with Instant Cash

- MoneyLion®: Up to $1,000 with Instacash℠

- Payactiv: Up to 50% of unpaid salary with EWA

- Albert: Up to $1,000 with Instant Advance

You're barely making it to your next paycheck, but that utility bill or home repair can't wait.

If this sounds familiar, a $100 loan app could be the instant solution.

Check out these 9 best loan instant apps for your immediate financial needs.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

9 Best $100 Loan Instant Apps

These loan apps are part of the growing "fintech" trend. They're gaining popularity because they're convenient, and people need fast access to money.

EarnIn: Up to $1,000 with Cash Out

|

| credit earnin |

- How soon do I get the money? Within 1-3 business days via ACH

, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

- When do I pay it back? Upcoming payday.

- What fees can I expect?

Interest rate 0% Mandatory fee $0 Fast transfer fee $2.99 to $5.99/transfer[1]

App Rating:

- 4.7 out of 5 ✰ from 276K+ reviews on Google Play[2]

- 4.8 out of 5 ✰ from 359K+ reviews on App Store[3]

Why Choose EarnIn

EarnIn is not a payday lender. It is a mobile app featuring different financial products, most notably Cash Out. It has no credit checks, allowing its Community Members to access a portion of their earned wages days, even weeks before their official payday.

With Cash Out, you can transfer up to $150/day, and up to $1,000/pay period.[4]

While you can enjoy this feature at no additional cost, you can tip the service, which is deducted from your paycheck proceeds.

|

|

EarnIn Cash Out requirements:

- Sign up for an EarnIn account if you're at least 18 and with a valid U.S. mobile number.

- A checking account where paychecks are received consistently.

- Employment details.

Dave®: Up to $500 with ExtraCash™

|

| CREDIT DAVE |

- How soon do I get the advance? Within seconds to a Dave® checking account, or within 3 business days to an external bank account for free.

- When do I pay it back? Next payday or nearest Friday

.

- What fees can I expect?

Interest rate 0% Mandatory fee up to $5/mo membership fee Fast transfer fee 1.5% of the transfer amount for external debit card transfers[5]

App Rating:

- 4.4 out of 5 ✰ from 565K+ reviews on Google Play[6]

- 4.8 out of 5 ✰ from 743K+ reviews on App Store[7]

Why Choose Dave®

If you really don't need much, fintech apps with an interest-free advance feature like Dave® make perfect sense than regular payday or personal loan apps that automatically charge interest.

With ExtraCash™, an advance is treated as an overdraft. So, if you get it, you may notice a negative bank account balance. No worries, you won't be penalized for it with overdraft fees caused by overdrawing your account.

But if you need your advance in a flash, you can transfer your ExtraCash to your Dave® checking account for free. For external bank accounts, you'll pay 1.5% of the transfer amount.

|

|

Dave® ExtraCash™ eligibility contributing factors:

- Sign up for a Dave® account.

- Linked bank account details or Dave® checking account with a positive balance.

- Have at least 3 recurring deposits.

- Minimum $1,000 total monthly deposit.

- Pay monthly membership fee.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

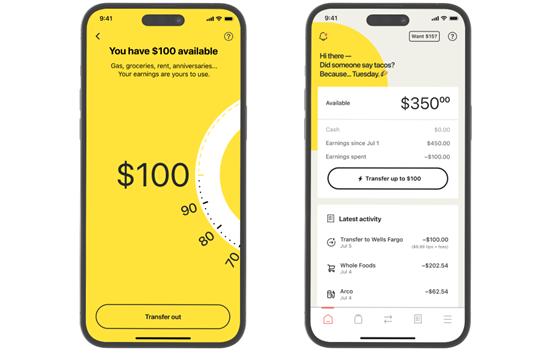

Chime®: Up to $200 with SpotMe®

|

| credit chime |

- How soon do I get the money? Immediately after initiating a SpotMe® transaction.

- When do I pay it back? On your next direct deposit or fund transfer, whichever comes first.

- What fees can I expect?

Interest rate 0% Mandatory fee $0 Fast transfer fee $0

App Rating:

- 4.4 out of 5 ✰ from 907K+ reviews on Google Play[8]

- 4.8 out of 5 ✰ from 1.2M+ reviews on App Store[9]

Why Choose Chime®

Chime® is a mobile banking app loved by users for its no-fee approach. However, it goes beyond just saving you money.

Its unique SpotMe® feature lets you overdraft up to $200 without penalty fees; a safety net when you need it most. Use any of its 47,000+ fee-free ATMs to withdraw cash up to your SpotMe® limit.

You can also make a debit card purchase, cash back transaction, or over-the-counter withdrawal to access your overdraft.

|

|

Chime® SpotMe® requirements:

- Apply for a Chime® debit card or Credit Builder card.

- Activate SpotMe® in your app settings.

- Have at least a $200 qualifying direct deposit (from an employer or benefits provider) on a regular basis.

PayDaySay: Up to $5,000 as payday loan

- How soon do I get the money? Next business day.

- When do I pay it back? Starts on your upcoming payday.

- What fees can I expect?

Interest rate APR varies by lender[10] Mandatory fee $0 Fast transfer fee $0

App Rating: 3.8/5 ✰ from 2.45K+ reviews on Google Play[11]

Why Choose PayDaySay

PayDaySay is a mobile app that acts as an intermediary between lender and lendee. It matches you with the most suitable lenders using algorithms, but there's a catch.

You must agree to an annual percentage rate before taking out a loan. Rates vary by creditor, although most have zero to low minimum credit score requirements.

Because there's interest, use this only if you need more than $100.

|

|

PayDaySay payday loan requirements:

- Must be over 18.

- With a steady income source.

- Filled out online form.

- Possess an active checking account.

- Other documents may be required depending on the lender.

Tilt (formerly Empower): Up to $400 with Cash Advance

- How soon do I get the money? Within 1 minute to a Tilt debit card, or within 1 business day to your paycheck account.

- When do I pay it back? Next payday.

- What fees can I expect?

Interest rate 0% Mandatory fee $8 monthly subscription fee[12] Fast transfer fee Tiered fee starts at $1/transfer[13]

App Rating:

- 4.7 out of 5 ✰ from 267K+ reviews on Google Play[14]

- 4.8 out of 5 ✰ from 200K+ reviews on App Store[15]

Why Choose Tilt (formerly Empower)

Tilt (formerly Empower) is a multipurpose financial app with budgeting, savings, and cash advance features.

Notably, its zero-interest cash advance feature doesn't do credit checks. Instead, your checking account's paycheck transactions indicate how much you can get.

You can repay any time without late fees. However, outstanding balances prevent you from additional advances.

|

|

Tilt Cash Advance requirements:

- Download the Tilt app or go to tilt.com.

- Link your bank account where you get paid.

- Check if you're eligible for a Cash Advance under the Cash Advance section in the Tilt app.

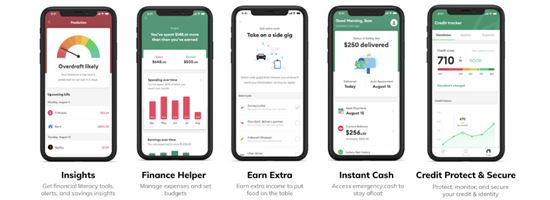

Brigit: Up to $250 with Instant Cash

|

| CREDIT hellobrigit |

- How soon do I get the money? Within 1 business day at the earliest for free, or 20 minutes using Express Delivery.

- When do I pay it back? Your next payday or preferred date using an extension.

- What fees can I expect?

Interest rate 0% Mandatory fee $8.99/mo. Plus plan or $15.99/mo. Premium plan[16] Fast transfer fee Starts at $0.99/transfer;[17] free for Premium members[18]

App Rating:

- 4.8 out of 5 ✰ from 298K+ reviews on Google Play[19]

- 4.8 out of 5 ✰ from 417K+ reviews on App Store[20]

Why Choose Brigit

Brigit's cash advance product uses its own scoring system and eligibility criteria. It looks into the following:

- Your bank account health

- Earnings profile

- Spending behavior

Ultimately, make sure you have a steady source of income to get the highest possible cash advance limit. Because unlike other instant advances, this amount is fixed once it's assigned to you.

Meanwhile, Brigit will be proactive if you turn on your Auto Advances setting. Based on your account activity, it can detect when to send you cash to avert an overdraft.

|

|

Brigit Instant Cash requirements:

- Sign up for a paid Brigit subscription.

- Link an external bank account with a minimum 60-day history, 3 recurring deposits from the same source and a positive balance.

- Maintain a minimum average end-of-day balance on scheduled paydays.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

MoneyLion®: Up to $1,000 w/ Instacash℠

- How soon do I get the money? Within minutes for a fee, or at least 1 business day via standard transfer.

- When do I pay it back? On the scheduled repayment date, usually based on your next paycheck.

- What fees can I expect?

Interest rate 0% Mandatory fee $0 Fast transfer fee Tiered fee starts at $0.49/transfer[21]

App Rating:

- 4.5 out of 5 ✰ from 195K+ reviews on Google Play[22]

- 4.8 out of 5 ✰ from 274K+ reviews on App Store[23]

Why Choose MoneyLion®

MoneyLion®'s Instacash℠ offers zero-interest cash advances of up to $1,000. However, you may be limited to $500 if you are linking an external checking account.

For higher cash advance limits, faster standard transfers, and lower Turbo Fees, consider opening a RoarMoney℠ account and switch your qualifying deposits.

Alternatively, become a MoneyLion® WOW member and get up to $5 rebates on your 1st Turbo fee and every 10th after that.

|

|

MoneyLion® Instacash℠ requirements:

- Sign up for a MoneyLion® account.

- Link your checking account with a minimum 60-day history and a positive balance.

- At least 3 direct deposits from the same source or payroll provider into the linked account.

Payactiv: Up to 50% of your salary with Earned Wage Access

- How soon do I get the money? At least 1 business day for free or real-time for a fee

.

- When do I pay it back? On your next payday.

- What fees can I expect?

Interest rate 0% Mandatory fee $0 Fast transfer fee Starts at $2.49/transfer[24]

App Rating:

- 4.4 out of 5 ✰ from 39K+ reviews on Google Play[25]

- 4.7 out of 5 ✰ from 69K+ reviews on App Store[26]

Why Choose Payactiv

Payactiv is a financial wellness platform offering Earned Wage Access (EWA). It's an employer-provided benefit that allows employees to access up to 50% of their earned but unpaid wages.

You can access your EWA funds through Walmart Cash Pickup. However, to avoid fees, consider getting a Payactiv Visa® Card. This, or an affiliate card, must be set up with a direct deposit of at least $200 per deposit to receive money immediately and for free.

|

|

Payactiv EWA requirements:

- Check if your EWA is available with your employer first.

- Sign up for a Payactiv account.

Albert: Up to $1,000 with Instant Advance

- How soon do I get the money? Immediately into Albert Cash account (no additional fee) or within minutes to an external account for a fee.

- When do I pay it back? Within a 6-day grace period

- What fees can I expect?

Interest rate 0% Mandatory fee $0[27] Fast transfer fee Starts at $5.99/transfer [28]

App Rating:

- 4.5 out of 5 ✰ from 137K+ reviews on Google Play[29]

- 4.6 out of 5 ✰ from 270K+ reviews on App Store[30]

Why Choose Albert

Albert has Instant Advance, a feature that provides cash advances of up to $1,000. There are no credit checks, no late fees, or interest.

A monthly fee is not required to use Instant Advance. You can access your Instant limit immediately without additional charge using your Albert Cash account. Otherwise, you'll pay $5.99-$19.99 based on the amount of your transfer.

Cash advances must be covered in six days, with a seven-day extension available. You can't request additional advances until you pay.

|

|

Albert Instant requirements:

- Activated Smart Money feature on the app

- An active bank account linked to an Albert Cash account

- Set up qualifying direct deposits to potentially raise your Instant limit

Now that you have a range of great loan instant apps to choose from, let's re-learn the basics.

What Is A Loan Instant App?

Loan instant apps, also called cash advance apps, allow you to take out a quick cash loan or paycheck advance.

They have no lengthy processes and credit history checks typically associated with traditional personal loans. However, most require consistent paychecks on your linked checking account.

The cash loan amount is usually small, ranging from $50 to $1,000. Repayment is often automatically deducted from your checking account on the next payday.

Pros:

- Quick access to funds

- Convenient

- More affordable

- No credit checks

- Flexible repayment terms

- No interest rates

Cons:

- Short repayment periods

- Limited loan amounts

- Potential monthly subscription/immediate transfer fees

- Risk of repeated borrowing

Although not all instant apps are created equal, they are generally safe. Most of them operate under regulatory frameworks that require them to be licensed and to comply with consumer protection laws.

When to Consider a Loan Instant App

Loan instant apps may be useful during these situations:

- Unexpected expenses

If you encounter an emergency medical bill or home repair that isn't that costly but you don't have anything set aside for it, a loan instant app can be a savior. - Cash flow gaps

Small dollar loans in the form of cash advances can help you tide over when in between paychecks and need money for a few more groceries and other essentials. - Time-sensitive opportunities

Getting a limited-time deal that couldn't wait until your payday may be a good excuse to use a loan instant app service.

Most loan apps will suspend your access to cash advances, overdraft coverage, or loan requests if they are unable to deduct the amount from your linked account on your scheduled payment date or extension period. Despite that, they usually don't charge late fees.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

How to Choose the Best Loan Instant App

If you need $100 right now and don't know which loan instant app is best for you, here are some tips:

- Look for an app that can provide advances of more than $100, say, up to $200 or $300.

- Check for fees in terms of monthly subscription, expedited delivery, and option for tipping.

- To get the most out of the app, open their checking account to potentially save money from express fees.

- Read the fine print to understand the loan agreement and what you're really getting.

- Review the repayment process and ensure there are no penalties should you decide to pay your loan earlier.

- Consider additional features like budgeting and savings tools that help you become more financially savvy.

By following the above practices, you don't only get to land the right loan app, but also help you make smart financial decisions.

Since many loan instant apps skip hard and soft credit checks, taking out an advance or overdraft from them will not impact credit scores.

Can I pay my loan instant app early?

Loan instant apps often set the repayment date on your next paycheck, but you could repay ahead of schedule.

With EarnIn for example, you simply click View and Pay in your app, and confirm your payment details.

In the case of Albert Instant Advance, you just have to deposit the funds in your Albert Cash account within the first couple of days of your grace period.

Alternatives to $100 Loan Instant Apps

Need quick bucks but couldn't qualify for a $100 loan instant app? Here are your other options:

- Ask from friends and family

Borrowing money from someone you know with spare cash can be an option. Family loans are even better if that's possible. Make sure to repay them on your agreed date to avoid straining relationships. - Check if your employer has a payroll advance

Some employers have their own earned wage access programs that allow you to get an advance on your upcoming paycheck without interest or fees. - Sell personal items

Consider selling stuff you no longer need online via Facebook, Instagram, or eBay to raise cash. - Pawn jewelry

You can use valuable items like gold jewelry or watches as collateral in exchange for a portion of its estimated worth. Pay it back within a given period to reclaim your pawned item.

Methodology

Although we managed to squeeze in one app that lets you borrow $100 or more with interest, the majority of the apps on the list don't charge it on their cash advances or overdraft coverage.

More importantly, we considered the time of processing and disbursement of funds. It should be a quick loan after all. So, most apps can transfer cash in minutes for a low fee (if not free) if the receiving account is from the same provider.

Lastly, we took note of other useful features for budgeting and savings, which can help you optimize the app long-term.

Bottom Line

The choice is clear: EarnIn is the best zero-interest $100 loan instant app for most employed individuals.

You can get a little more than $100 if needed, and pay only a minimal fee if you want to receive it immediately.

Nonetheless, there are 8 more on the list that may be a better fit depending on your specific financial situation and preferences.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ EarnIn. Lightning Speed fees and details, Retrieved 10/24/2025

- ^ Google Play. EarnIn: Make Every Day Payday, Retrieved 10/24/2025

- ^ App Store. EarnIn: Make Every Day Payday, Retrieved 10/24/2025

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ Dave®. What are ExtraCash Fees?, Retrieved 10/24/2025

- ^ Google Play.

Dave: Fast Cash & Banking, Retrieved 10/24/2025 - ^ App Store. Dave: Fast Cash & Banking, Retrieved 10/24/2025

- ^ Google Play.

Chime - Mobile Banking, Retrieved 10/24/2025 - ^ App Store. Chime - Mobile Banking, Retrieved 10/24/2025

- ^ PayDaySay. Rates & Fees, Retrieved 10/24/2025

- ^ Google Play. Cash Advance: Borrow Money App, Retrieved 10/24/2025

- ^ Tilt. What is Tilt's subscription fee?, Retrieved 10/24/2025

- ^ Tilt. Does a Cash Advance have fees?, Retrieved 10/24/2025

- ^ Google Play. Tilt (formerly Empower), Retrieved 10/24/2025

- ^ App Store. Tilt (formerly Empower), Retrieved 10/24/2025

- ^ Brigit. How much does Brigit cost?, Retrieved 10/24/2025

- ^ Brigit. Brigit Terms of Service, Retrieved 10/24/2025

- ^ Brigit. Our pricing, Retrieved 10/24/2025

- ^ Google Play.

Brigit: Borrow & Build Credit, Retrieved 10/24/2025 - ^ App Store. Brigit: Fast Cash Advance, Retrieved 10/24/2025

- ^ MoneyLion®. MoneyLion fee schedule, Retrieved 10/24/2025

- ^ Google Play. MoneyLion: Bank & Earn Rewards, Retrieved 10/24/2025

- ^ App Store. MoneyLion: Banking & Rewards, Retrieved 10/24/2025

- ^ Payactiv. Pricing, Retrieved 10/24/2025

- ^ Google Play.

Payactiv, Retrieved 10/24/2025 - ^ App Store. Payactiv, Retrieved 10/24/2025

- ^ Albert. What is the difference between advances and loans?, Retrieved 10/24/2025

- ^ Albert. How do I advance with Instant?, Retrieved 10/24/2025

- ^ Google Play.

Albert: Budgeting and Banking, Retrieved 10/24/2025 - ^ App Store. Albert: Budgeting and Banking, Retrieved 10/24/2025

Penelope Besana is a research analyst at CreditDonkey, a personal finance comparison and reviews website. Write to Penelope Besana at penelope.besana@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|