Chime Review: Is It Good?

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Chime has no monthly fees, so what's the catch with the app? Find out how you can get paid two days early and grow your savings.

Overall Score | 4.5 | ||

Savings | 5.0 | ||

Checking | 5.0 | ||

Mobile App | 5.0 | ||

Customer Service | 3.0 | ||

Pros and Cons

- No account fees

- Get paycheck 2 days early

- Up to $200 overdraft coverage

- Hard to deposit cash

Bottom Line

Banking app that offers an online account with early paycheck access and credit builder features

Chime launched in 2014 as a mobile-only app with a free checking and savings account. Since then, it has continued to improve with excellent features like early direct deposit and free overdraft coverage.

Opening an account is free and only takes about two minutes.

Is it right for you? Read on to learn how it works

Overview: What is Chime?

Chime offers three main services:

- Spending account with a Visa debit card

- Savings account with a competitive APY

- Secured credit card to help you build credit

All accounts are free with no monthly service fees, no minimum balance requirements, and no opening deposit.

Chime is online and mobile-only. There are no physical branches, though it has a wide ATM network so withdrawing money is not a problem.

Also, unlike traditional banks, Chime does not check your credit or ChexSystems report when opening your account. So it's a great choice for those with bad credit or poor banking history.

Who Chime is Best For

|

Chime may be right for you if:

- You're looking for a simple checking account with no fees

- You need help growing your savings

- You don't qualify for standard banking accounts

Chime Fees

As mentioned before, all Chime accounts are free. Chime has:

- No monthly service fee

- No minimum balance fee

- No overdraft fees

- No foreign transaction fee

- 50,000+ fee-free ATMs at convenient locations like Walgreens, 7-Eleven, CVS and more

- Free direct deposit

- Free mobile check deposit

The only fees you may encounter are if you use an ATM out of the network, if you withdraw cash over-the-counter, or if you deposit cash with cash deposit partner.

How is a completely free account possible? Chime makes money every time you use their Visa card. Visa pays them a small percentage of your purchase every time you swipe your card.

Now, let's go over some of Chime's great features.

Early Direct Deposit

If you set up paycheck direct deposit, you can get access to your funds up to two days early. That means if your usual payday is on Friday, you can get it on Wednesday.

Usually, when your employer submits your payment, banks hold it for a couple of days while they process it. But Chime makes it available as soon as the payment is received.

Everyone is eligible for this, as long as you set up direct deposit.

SpotMe Overdraft

Accidental overdrafts happen. Most traditional banks charge a $30-$35 overdraft fee when you go below zero. Banks make billions a year off of overdrafts.

Not only does Chime not charge overdraft fees, they even spot you for free. Chime will spot you up to $200, and there's no interest. You just repay it when you make your next deposit.

If you try to make a purchase over your SpotMe limit, then the transaction will be declined.

You can be eligible to enroll if you get at least $200 in direct deposits every month. Your SpotMe limit depends on your account activity and history.

Chime Checkbook

Sometimes, you still need to send a paper check, like for rent or a loan payment. Chime doesn't give you a set of paper checks, but it will send checks for free on your behalf.

You can directly send a check in the mobile app without having to deal with stamps and the post office. Just use the Mail-a-check feature to fill out the recipient information and amount. Chime will mail the check for you.[2]

Note that it can take between 3 and 9 days for the check to be processed and sent, so make sure you plan accordingly. The maximum amount you can send per check is $5,000.00.

Automatic Savings

When you open a Chime Spending Account, you also have the option to open a Chime Savings Account.

If you're the type to forget to save money, Chime's automatic savings features helps you put aside money without thinking. There are a couple of ways to automatically save:[3]

- Round up Chime debit card purchases and bill payments and save the spare change

- Automatically transfer a percentage of every paycheck to your Savings Account

Putting your savings on auto-pilot helps reach your goals faster. According to Chime, members who used both savings options saved an average of $382 a month.

Chime Secured Credit Card

Chime's newest offering is the Credit Builder Visa Secured Credit Card. There's no annual fee, no interest, and no credit check.

Here's how it works.

- Transfer money from your Chime Spending account to your Credit Builder secured card.

- The amount you transfer will become your spending limit. If you want more to spend, just transfer more.

- Use your card for daily things like purchases, eating out, and gas. At the end of each month, use the money in your secured account to pay off your balance.

Chime reports to all three major bureaus to help you build credit when you pay off your balance. You can turn on a Safer Credit Building feature to automatically pay on time each month.

On average, Chime secured card users increase their credit score by 30 points.[4]

How to Open an Account

When you sign up for a Chime account, you automatically get a "Spending Account" (or checking account, as most people know them). This account comes with a Chime Visa Debit Card for you to use at specific ATMs.

You also have the option to open a Savings Account at the same time. If you choose to wait, you can always open the savings account down the road.

|

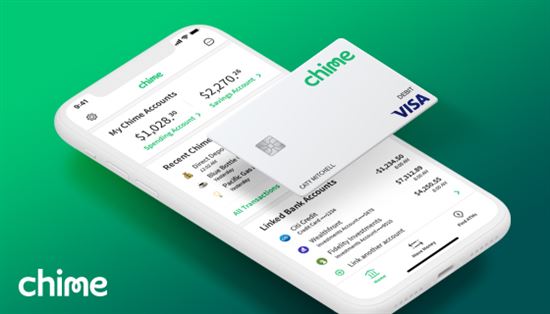

| Screenshot of Chime |

Signing up for a Chime account requires the following information:

- Name

- Address

- Social Security number

- Birthdate

It takes just a couple of a minutes. Chime doesn't run a credit check or ChexSystems report. If you have past banking issues and can't open a regular banking account, Chime gives you a second chance to get back into the game.

How to Deposit Money

- Direct deposit: You can set up direct deposit of your paychecks into your Chime account. You can even be eligible to receive your paychecks 2 days early.

- Bank transfer from an external bank: If you use another bank, link the checking or savings account to your Chime account to transfer money between them. The funds may take up to 5 business days to be available for use.

- Mobile check deposit: You can deposit a check with the mobile app by taking a photo.

- Cash deposit partner: If you have cash to deposit, you can go to one of Chime's 90,000+ cash deposit partners. They're in popular stores like Walmart, Walgreens, and 7-Eleven. All you have to do is tell the cashier you want to make a deposit to your Chime account. They may charge a fee.

For cash deposits, you can deposit up to $1,000 per day and $10,000 per month.

How to Spend or Withdraw Money

- Visa debit card: Pay for purchases anywhere the Visa brand is accepted.

- Free ATM withdrawals: If you need to take cash out, you get free access to 50,000+ fee-free ATMs at convenient locations like Walgreens, 7-Eleven, and CVS. You can find the ATM nearest you in the Chime app. They're usually in places like 7-Elevens, your local grocery stores, and banks.

- Cash back at register: This is a convenient way to get cash back when making an in-store purchase with your debit card. Most places like grocery stores, gas stations, and drugstores let you do this.

- Chime Checkbook: If you need to send a paper check, go into your app and fill in the check information. Chime will write and send the check for you for free.

Compare Savings Account Promotions

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

App

|

You will need the Chime app in order to get the full benefit of this program. You can do the basic things, such as check your balance, pay a bill, or transfer money between Chime accounts. The app provides several other features as well:

- Receive alerts: You can opt in to receive push notifications for transactions, daily balance updates, direct deposit payments, etc. You don't need to log into Chime to know your balance.

- Mobile check deposits: Deposit a check from anywhere by snapping a photo.

- Mobile payments: Chime supports Apple Pay, Google Pay, and Samsung Pay.

- Pay bills or people: If you owe someone money, whether it's a business or a person, you can send it directly to them with the Chime app. If you pay a person and they don't have Chime, you can use Venmo, Cash App, or PayPal to send the money.

- Get help: You can find ATMs near you and contact customer service all from the app as well.

- Lock card: If your card was lost or stolen, you can automatically put a freeze on it in the app to prevent fraudulent activity on your account.

Chime Downsides

While Chime has revolutionized mobile banking, there are some downsides to consider.

- No joint accounts: At this time, Chime doesn't offer joint accounts or secondary cards. This could make it difficult if you have a partner that you share banking with, as only one of you can have a Visa Chime Card.

- Hard to deposit cash: You have to go to one of Chime's cash deposit partners, and they could charge a small fee.

How Chime Compares

Varo Money

Varo is another free mobile app with no monthly service fees. Just like Chime, it doesn't check your credit, so everyone is welcome to apply.

It has some similar features, like 2 days early direct deposit and a secured credit card. But instead of overdraft SpotMe, Varo offers up to $250 instant cash advance. You can borrow up to $250 for a small fee, and then pay it back within 30 days.

Varo uses the Allpoint ATM network. You get access to 40,000+ ATMs in places like Target, CVS, and Walgreens.

GO2Bank

GO2Bank (by Green Dot) is a neobank that also offers checking and savings accounts, and credit building. Like Chime and Varo, it doesn't check your credit or ChexSystems. It also offers 2 days early direct deposit.

You can deposit cash with your card or the app at 90,000+ retail locations. And if you need to take out cash, they have a large network of 55,000+ fee-free ATMs.

It does have a $5 monthly fee, but it can be waived as long as you have direct deposits each month.

Ally Bank

Ally Bank is a full-service online bank. Besides banking products, it also offers investment services and loans.

The checking account is pretty bare-bones (no special features), but there's no minimum balance or monthly service fees.

You might also consider:

Online Savings Account - 3.20% APY

$0 minimum opening deposit. No minimum balance requirement. No fees to open or maintain account.

High Yield Savings - 3.50% APY

$0 minimum opening deposit. No minimum balance requirement. No fees to open or maintain account.

High Yield Savings Account - 3.80% APY

- No fees

- $1 minimum deposit

- 24/7 online access

- FDIC insured

Bottom Line

If you are looking for a simple way to manage money on the go and without high fees, Chime offers a secure option. It offers some unique features that banks don't have.

References

- ^ Chime. What does SpotMe cover?, Retrieved 03/13/2025

- ^ Chime. Can I send a check using my Chime Checking Account?, Retrieved 03/13/2025

- ^ Chime. Automatic Savings Account, Retrieved 03/13/2025

- ^ Chime. Chime Credit Builder Secured Visa Credit Card, Retrieved 03/13/2025

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q1AFL26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

Business Essentials: $400 bonus with $5,000 new money deposits, daily balance, and 6 qualifying transactions.

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank Mobile Check Deposit, electronic or paper checks, Bill Pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.

Member FDIC

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

Compare: