How to Open a Checking Account

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Looking to open a checking account? Learn exactly what you need and follow these easy steps for a pain-free process.

|

A checking account is essential for your everyday banking activities. Without one, it's hard to do tasks like paying bills and making deposits.

Opening a checking account is straightforward. Just provide some basic information and fund it. The hard part is picking the right bank out of hundreds of options.

How to Open a Checking Account

|

| © CreditDonkey |

Step-by-step guide

Most banks and credit unions allow new customers to open an account online or in-person (if they have physical locations). Usually, you just have to be over 18 and be a US citizen or legal resident.

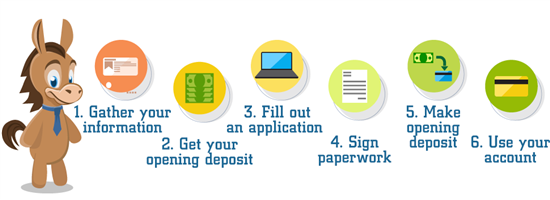

Here's the step by step guide on how to open a checking account.

- Gather your information

Typically, banks will require the following:- Government issued ID, like a driver's license

- Social Security Number

- Proof of address (lease or utility bill)

- Contact information (name, home address, email address, phone number)

- Date of birth

To open a checking account, banks will usually require two forms of identification. You will need to provide a photo ID, such as a driver's license, state ID, or passport. In addition, you may also need a secondary ID, such as a Social Security card, birth certificate, or credit card. - Government issued ID, like a driver's license

- Have money for an opening deposit

Take note of this if the bank requires a minimum deposit for the checking account. It can be as low as $25. However, there are banks that don't have a minimum, including a lot of online banks.Making an initial deposit at a credit union is slightly different. You'll usually be required to "buy a share" of the credit union. Shares can be as low as $5 each. Once you buy a share, the money will stay in your account as long as it's open. - Fill out an application

You can do this online or in-person. Most financial institutions will run a credit check on you to see your past banking history and then approve or deny you for the account. - Sign paperwork

You'll need to sign the final paperwork to activate the account. If you're applying online, you should be able to sign electronically. But some banks may want you to mail in or fax your signature. - Make opening deposit (if required)

You can fund your account by electronic transfer, wire, or physical check. It may take a few days for the funds to be available. - Use your new checking account

Now, just start using your account. Set up your online account and get the mobile app. You'll usually receive your debit card and checks in the mail a few days after opening. You can set up direct deposit, add bill pay, and link other bank accounts.If you opened an account in-person, you may be able to get a temporary debit card to use in the meantime.

Checking Account Promotions

Key Select Checking® - $500 Bonus

- Open a Key Select Checking® account online by May 22, 2026.

- Make the minimum opening deposit of $50 and make a total of $5,000 or more in eligible direct deposits within the first 90 days of account opening.

- Your $500 cash bonus will be deposited into your account within 60 days of meeting requirements. Account must not be closed at the time of gift payment.

Looking for more rewards? Check out these bank offers where you could earn a $500 checking account bonus by opening a new account.

Why Open a Checking Account

|

| © CreditDonkey |

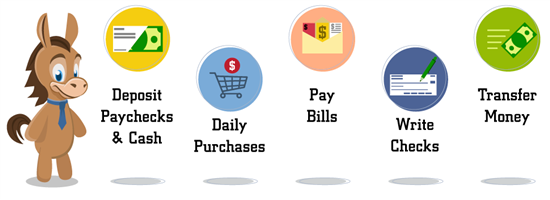

You need a checking account for everyday transactions and banking activities. With a checking account, you can do things like:

- Deposit your income

- Pay bills online

- Make purchases with your debit card

- Withdraw cash from ATMs

- Write checks

You can freely use the money in your checking account at any time. You can make deposits, transfers, and withdrawals with no limits (as long as you have enough money in the account).

Checking accounts are meant to be used often, so the money is easily accessible and there's no withdrawal limit. Savings accounts are meant as places to save money and let your funds grow, so they often offer higher interest rates. But you're limited to only 6 withdrawals each month.

Where to Open a Checking Account

The first step is to find the right financial institution to bank with. You have 3 main options. Each one has their pros and cons.

- Traditional bank

Traditional banks have physical branches. These can be large nationwide banks (like Chase and Wells Fargo) or smaller regional banks. They can provide in-person service, but they tend to have more fees and balance requirements. - Online bank

Online banks don't have any branches. Because of the less overhead, they often eliminate many typical banking fees. But you have to be comfortable with banking entirely online. - Credit union

Credit unions often provide better personalized service and lower fees. They usually service a certain area, so the availability may not be as great. But many credit unions now also offer online accounts that anyone can open.

Think about your needs before settling on one. For example, if you often get paid in cash tips, you may want a physical bank to make cash deposits.

If an online bank is FDIC insured, it's perfectly safe to use. Online banks are under the same regulations as physical banks and often use the same, if not stronger, security measures.

How Much Money Do I Need to Open a Checking Account

Many banks let you open a checking account with $0. Most online checking accounts don't require an opening deposit. Popular banks like Ally Bank and Capital One all have no minimums.

It's also possible to open checking accounts with physical banks for no (or very little) money. Chase Total Checking has a $0 opening deposit. Wells Fargo Everyday Checking only requires $25 to open.

Each bank will have different requirements for their checking accounts. Make sure you can meet them before applying.

What Credit Do I Need

You don't need very good credit to open a checking account. However, if you have a poor credit history (such as not repaying debts), you may not be approved.

Most banks will conduct a soft credit pull when reviewing your application. This will not negatively impact your credit score.

What's more important is your ChexSystems report. This reports any previous negative banking activities, like overdrafts, bounced checks, unpaid fees, etc. If you have a poor ChexSystem report, you could be denied a new bank account.

Features to Look for in a Checking Account

Different banks will offer different features for their checking accounts. Think about what kind of services you will need. Here are some things to consider:

Minimum balance requirements

Some banks require that you maintain a certain balance or there will be a monthly service fee. Is the balance reasonable for you to maintain? If you don't want to be limited, look at banks with no balance requirements.

ATMs

Most people still need to withdraw cash. See if the bank has any free ATMs near you. Many online banks work with ATM networks (like Allpoint or MoneyPass) to provide free ATM access.

Banking fees

Some checking accounts waive a lot of banking fees. But some may charge for things like overdrafts, paper checks, insufficient funds, etc.

Be aware of all the potential costs and if there is any way to waive them.

Physical vs. online

Do you often need in-person banking services? Think about if you'd be okay just doing them online or over the phone.

Rewards Checking - Up to 3.30% APY

- Build your own APY with up to 3.30% APY*

- Zero monthly maintenance fees

- Zero overdraft or NSF fees

- Zero minimum monthly balance reqs

- No initial deposit requirement

- Unlimited domestic ATM fee reimbursements

- Online debit card management

- Simple, 3-step process for direct deposit

Other services

Do you want to open a savings account and/or credit card from the same bank? Or maybe you'd possibly need a loan in the future? If so, look for a full service bank.

Availability

Do you travel often and need to use your bank while traveling? If so, you may want access to physical locations and ATMs nationwide or even globally.

Requirements for Special Types of Checking Accounts

If you're looking to open a special type of checking account, know these extra requirements.

Joint account

This is a checking account where 2 people are both owners. You will need to provide the information (ID, SSN, contact, etc.) for both people. But if you don't have an SSN, consider checking out our list of banks that don't require social security number.

Teen account

These accounts are for teens under 18. A parent will need to be a joint owner until the teen turns 18.

College checking

A lot of banks offer special accounts with less fees for college students. You will also need to provide a valid student ID or proof of enrollment/acceptance.

Second chance checking

Second chance bank accounts are for people with credit issues who have trouble getting a traditional bank account. There are no special requirements to open, however, some of these accounts have monthly fees and limited features.

What the Experts Say

A checking account can help you manage your money and keep it safe. But figuring out the right checking account and bank to use can be tricky.

As part of our series on banking and saving, CreditDonkey asked a panel of industry experts to answer some of readers' most pressing questions:

- What should consumers look for in a checking account?

- Do you recommend opening a checking account at a physical bank, online bank or credit union?

- Are online banks as safe as physical banks?

Here's what they had to say:

Bottom Line

Opening a checking account is easy when you have all of your materials gathered. Before you commit to one, take a look at everything you'll need to do to maintain it and possibly avoid any extra fees.

Free Checking Account for Small Business Owners

- Sign up in 3 minutes; no credit check

- No account fees - $0 monthly fee, overdraft fee, foreign transaction fee, or ATM fees at approximately 40,000 locations

- Automatic Savings

- Get paid up to 2 days early

Write to Anna Johnson at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|