Best Cash Advance Apps Like Dave

Dave can let you take an advance of up to $500 for a membership fee of up to $5/month. It's a great deal. But do you have better options? Read on to learn more.

|

Here are 13 best apps like Dave:

- EarnIn: Up to $1,000

- Klover: Up to $200

- Brigit: Up to $250

- MoneyLion: Up to $500

- Tilt (formerly Empower): Up to $400

- Chime SpotMe: Up to $200

- Varo: Up to $500

- ONE@Work: Up to 50% of your pay

- Branch: Up to 50% of your pay

- Albert: Up to $1,000

- Payactiv: Up to 50% of your pay

- DailyPay: Up to 100% of your earned wage

- Possible: Up to $500

Dave is a reliable cash advance app when you need to get an advance of up to $500. But what if you need more than that?

You never know when you can use an extra buck. And sometimes, you need it right away.

It's a good thing there are other cash advance apps like Dave. So if you're ever cash strapped, all hope is not lost.

Read on to learn your options.

Access between $25 - $500* in instant cash

- No FICO or check check required

- No interest, APR, late fees, or tipping

- Free Extensions on repayment

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

The SMART rule helps individuals remember the key aspects to consider when choosing an app like Dave:

- Speed: Look for apps that offer fast access to funds.

- Minimal fees: Ensure the app has low or no fees.

- Accessibility: The app should be easy to use and accessible on multiple devices.

- Reliability: Choose a reputable app with positive reviews.

- Transparency: The app should have clear and transparent terms.

13 Best Apps like Dave

Here are 13 good Dave alternatives for when your cash runs low. They each have their own perks too.

Let's start with an app for the employed.

EarnIn

|

| credit earnin |

Loan amount: up to $150/day, and up to $1,000/pay period [1]

Processing time: 1-3 business days via ACH, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

Repayment date: On or after your payday

|

|

Why we like it:

Need a bit more than Dave's $500 maximum? EarnIn steps in to bridge that gap. Depending on your earnings, you can cash out up to $150/day, and up to $1,000/pay period.[1]

With EarnIn Cash Out, you get access to your pay before payday through seamless transfer to your linked bank account. Need funds in a flash? Their Lightning Speed transfers your money in minutes — starting at just $2.99/transfer.

There are no credit checks, interest, or mandatory fees. Plus - no late fees, so there's no risk of dinging your credit if you miss a repayment. Just an optional tip if you like what they do (but there's zero obligation).

EarnIn's Lightning Speed can transfer your earnings in minutes. It costs $2.99-$5.99 depending on your amount and direct deposit.[2]

EarnIn Requirements:

Here's what you need to use EarnIn Cash Out:[3]

- Permanent work location, an electronic timekeeping system, or a PDF timesheet to track your hourly earnings

- A linked Checking account

- Regular pay schedule

Other Features:

EarnIn's Balance Shield feature acts as a safety net. If your checking account balance falls below your selected threshold amount (0-$500), EarnIn can automatically transfer $100 of your earnings to keep you afloat.[4]

EarnIn will not affect or hurt your credit score. They will not report you to a bank or debt collector. If you fail to pay, you will receive an email.

Klover

Loan amount: Up to $200

Processing time: 1-3 days; or within 24 hours for a fee ($1.49 - $21.99)[5]

Repayment date: Automatically based on your next payday

|

|

Why we like it:

Klover is quick and easy to get started, and there's no monthly fee. As soon as you're approved, you can get up to $200 cash advance, even if your paycheck is still 2 weeks away.

But that's not all - Klover gives you ways to win even more cash! You can earn points by doing simple things like taking surveys, watching ads, and scanning receipts. And then cash out your points for a bigger advance.

Or you can use points to enter the daily sweepstakes. Everyday, Klover awards a $100 winner and five $20 winners. Who knows, you just might get lucky.

Klover Requirements:

Here's what you need to use Klover Balance Advance Service:[6]

- At least 3 direct deposits sent to your primary checking account within the last 60 days

- Checking account must be in good standing and active for the last 90 days

Other Features:

The Klover app also has helpful tools to level up your money game. You can create budgets and savings goals and track your credit score. Get spending insights so you see where you can cut back.

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

This next app provides more than a cash advance. It also helps you build and protect your credit. Read on.

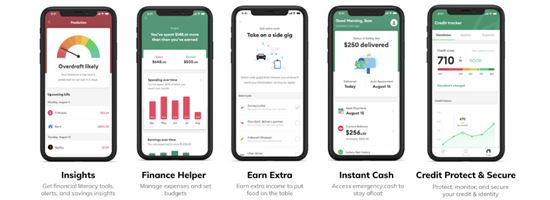

Brigit

|

| CREDIT hellobrigit |

Loan amount: Up to $250

Processing time: 1-3 business days; w/in 20 mins. for a fee

Repayment date: Flexible repayment date

|

|

Why we like it:

Compared to Dave's up to $5/month membership fee, Brigit charges $8.99 - $14.99 a month.[7] But you get more features that could be worth the fee.

Brigit's cash advance feature is called Instant Cash. There are no credit checks or interest fees. And you can choose when to repay, which can help you budget according to your own terms.

It also offers peace of mind with credit monitoring and up to $1 million in identity theft reimbursement.

Premium members get access to the Credit Builder. This lets you build credit by saving as little as $1/month. Payments are reported to the credit bureaus, and you get a nice little savings nest egg at the end.

Brigit Requirements:

To get Brigit Instant Cash, you need:[8]

- A checking account that has been active for at least 60 days

- More than $0 in your balance

- 3 recurring deposits on your account from the same source

Other Features:

The Brigit app helps you find side gigs to make extra cash. You can also get offers and discounts from Brigit's partners.

But if you just need a little help with budgeting, the app comes with free tools to help you keep track of spending, earnings, and bills.

Access between $25 - $500* in instant cash

- No FICO or check check required

- No interest, APR, late fees, or tipping

- Free Extensions on repayment

No, using Brigit Instant Cash will not affect your credit score.[9]

This next app offers many features. It's particularly useful if you want to get into investing.

MoneyLion

Loan amount: Up to $500

Processing time: 2-5 business days; w/in minutes for a fee

Repayment date: Next payday

|

|

Why we like it:

Known for having multiple features, MoneyLion can be your all-in-one finance app. MoneyLion's Instacash is free and gets you up to $500 cash advance.

Regular delivery to an external bank account takes 2-5 business days. But you can get your money quickly for a fee. Just opt for Turbo delivery.

There are also finance tools you can use to manage your money better. This makes MoneyLion a great app for making better financial decisions.

MoneyLion Requirements:

To access their no-interest and no-credit-check service, here's what you need:[10]

- An account that has been active for two or more months

- A positive balance on the account

- A history of recurring income deposits in the account

Other Features:

Crypto Auto Invest helps you start your crypto portfolio, specifically Bitcoin and Ethereum. You need a RoarMoney account to access crypto through MoneyLion, which costs $1 monthly.

On the other hand, Managed Investing is a beginner-friendly investing feature. Through it, MoneyLion can help you kick-start the right investments.

Need a faster processing time? This next app provides just that.

Tilt (formerly Empower)

Loan amount: Up to $400

Processing time: Instantly

Repayment date: Next payday

|

|

Why we like it:

Tilt Cash Advance lets you take a $400 cash advance within 15 minutes if you pay for instant delivery. It's good for emergencies.

However, this fast processing time comes at a cost. Their subscription fee costs $8/month.[11] There are also no interest, late fees, and credit checks.

Other Features:

The Tilt Card is a debit card you can get with no overdraft fees. It has up to 10% cashback offers.[12] And you can get instant cash advance delivery for free.

Tilt (formerly Empower) is not a bank, but a financial technology company. Tilt Line of Credit is provided by FinWise Bank, and Tilt Credit Cards are issued by WebBank.[13]

Speaking of overdraft fees, do you need spotting features? You can go for Chime instead.

Chime SpotMe

|

| credit chime |

Loan amount: Spot $20 to $200

Processing time: Immediately

Repayment date: On your next deposit or payday

|

|

Why we like it:

SpotMe is Chime's card feature that can spot you up to $200. With no need for a credit check or minimum balance, you can automatically avoid overdraft fees.

And compared to Dave, Chime doesn't charge monthly fees. But you would need a monthly qualifying deposit of $200 or more.

Because spotting is immediate, it's convenient for urgent needs.

Chime Requirements:

Here's what you need for Chime SpotMe:[14]

- A qualifying direct deposit of $200 or more within the past 34 days

- An activated Chime Card

- You should be at least 18 years old or older

Other Features:

With a Chime Checking Account, you get no overdraft or monthly fees. And it can get you your wages 2 days before your payday.

Next, let's talk about a cash advance app that can help you avoid impulsive buying.

Varo

Loan amount: Up to $500

Processing time: Instantly

Repayment date: Choose your own (within 15 to 30 days)

|

|

Why we like it:

Varo Advance is an interest-free $500 cash advance app. But unlike Dave, Varo doesn't charge a monthly subscription fee.

Instead, there's a fee for every cash advance. So it's definitely on the pricier side. Here's how much it can cost you:

| Loan Amount | Varo Fee |

|---|---|

| $20 | $1.60 |

| $50 | $4 |

| $75 | $6 |

| $100 | $8 |

| $150 | $12 |

| $200 | $16 |

| $250 | $20 |

| $300 | $24 |

| $400 | $32 |

| $500 | $40 |

The fee per cash advance can help you control your spending, however. Is paying $40 for a $500 cash advance worth the impulsive buy? It can make you think twice.

Varo Requirements:

If you want to take Varo's deal, here's what you'll need:[15]

- Varo Bank Account that is active and in a positive standing

- At least $800 in qualifying direct deposit to your Varo Bank Account

Other Features:

With a Varo Bank Account, you can access Varo's banking service with no monthly maintenance and overdraft fees.

Now, what if you need more than these loan amounts? The next apps may just offer what you need.

ONE@Work

Loan amount: Up to 50% of your salary

Processing time: 1 business day (no extra charge)

Repayment date: On or after your payday

|

|

Why we like it:

With ONE@Work (formerly Even), the cash advance amount depends on your pay. You can access up to half of it before payday. So if you make $1,000 per payday, you can get up to $500 with ONE@Work.

And it's employer-sponsored. That means your company will handle everything you need to get the account ready.

You can claim your cash advance through your bank. Or you can pick it up at a Walmart MoneyCenter.

Other Features:

There are also budgeting tools on the app that can help your cash advance go a long way.

You just need to bring your valid ID.

Branch

Loan amount: Up to 50% of your pay

Processing time: 3 business days (bank account)

Repayment date: On your next payday

|

|

Why we like it:

Similar to ONE@Work, you can take up to half of your pay in advance using Branch. Their cash advance feature is called Earned Wage Access. And it's also employer-sponsored, so you don't have to worry about the requirements.

That said, the cash advance you can take would depend on your employer. You can withdraw the amount from your bank account. But if you need the money instantly, you can get it through the Branch digital wallet.

There are also built-in cashback rewards for all digital wallet users. You can use it for gas, food, and more.

Other Features:

Branch has a CashFlow feature which gives you information about your spending. It can help you create budgets too.

This next app offers more than instant coverage and finance tools. Check it out.

Albert

Loan amount: Up to $1,000

Processing time: Instantly

Repayment date: 6 days from when you initially advance (can request up to a 7-day extension)

|

|

Why we like it:

Albert has an all-in-one financial tool where you can get your paycheck up to 2 days early or qualify for up to $1,000 with Instant Advance.

You won't be charged interest or late fees. There will also be no credit checks and no subscription needed.

Keep in mind that you can receive the cash advance instantly.

Albert Requirements:

Here's what you'll need for Albert Instant:[18]

- An active bank account linked to an Albert Cash account

- Has activated Smart Money feature on the app

- Has turned on overdraft coverage in app settings

- An Albert Cash account in good standing

Other Features:

Albert Cash is Albert's debit card feature. You can access your paycheck 2 days earlier with it.

Next, we have another employer-sponsored app with many financial tools.

Payactiv

Loan amount: Up to 50% of your pay

Processing time: 1-3 business days; instantly for a fee

Repayment date: On your next paycheck

|

|

Why we like it:

Payactiv's cash advance feature is called Earned Wage Access. It can get you up to 50% of your pay per pay period. But because it is employer-sponsored, your employer determines the maximum loan amount.

You can get your money instantly for a fee. You can access it through your debit or payroll card. But you can also pick up the cash at Walmart. There is no charge for same-day transfer to a Payactiv card when you have a direct deposit of $200 or more each pay period.[19]

If you don't want to pay the fee, you can receive your money for free through an ACH bank transfer. You'll just have to wait 1-3 business days for it.

Other Features:

Practical tools are also accessible on Payactiv. They are useful for improving your finances, spending, and savings. You can even use the app to pay your bills.

There's also a Financial Counseling feature that gives you access to a certified credit counselor. It's useful for those looking for professional help in building their credit, managing debt, etc.

No, using Payactiv will not impact your credit score.[20]

This next app can give you the highest loan amount on this list. It can get you your whole pay in advance.

DailyPay

Loan amount: Up to 100% of your pay; Up to $1,000 per day[21]

Processing time: Instantly or up to 1 business day

Repayment date: Automatically deducted from your pay[22]

|

|

Why we like it:

DailyPay's On-Demand Pay can get you up to 100% of your earned pay. You read that right. Using DailyPay's reloadable card, you can get all of your earned pay before payday.

It's great for you when you need more than the $500 Dave offers. They have a quick processing time, too. But they do charge a fee for bank account, payroll, and debit card transfers.

Instant delivery costs $3.49 per transfer. Next business day transfers are free. You can also make up to 5 transfers per day.

Other Features:

You can use your DailyPay card in any store that takes Visa debit cards. There's no need for a pre-existing bank account.

There are also saving tools that can help you save portions of your money. You can use it for emergencies or future expenses.

This next app can help you manage your payments better. You won't need to worry about paying off your loan in one go.

Possible

Loan amount: Up to $500; Up to $250 (in California)

Processing time: 1-2 days (ACH); around 1 hr. (debit card)

Repayment date: 4 equal payments w/in 2 months (8 weeks)[24]

|

|

Why we like it:

Possible Loan lets you take a loan of up to $500, even with bad credit. And compared to all apps on the list, Possible takes repayment in installments.

There's a 29-day grace period which could provide some leeway for you. There are also no late fees.

Instant Possible transfer to your debit card takes around an hour. While ACH transactions take an average of 1-2 days. Although, the maximum processing time could be up to 5 days.

Possible Loan Requirements:

Here's what you'll need to get a Possible loan:[25]

- U.S. cellphone number

- Social Security number

- Valid state-issued ID or driver's license

- A checking or savings account with 3 months transaction history, income deposits of $750 per month or more, and positive account balance

Possible can only accept new loan applications from Alabama, Arizona, Arkansas, California, Delaware, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, North Carolina, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington state and Wyoming.[26]

Now that you've read about these apps like Dave, let's get you a refresher on what Dave actually offers. That way, you can make a better comparison.

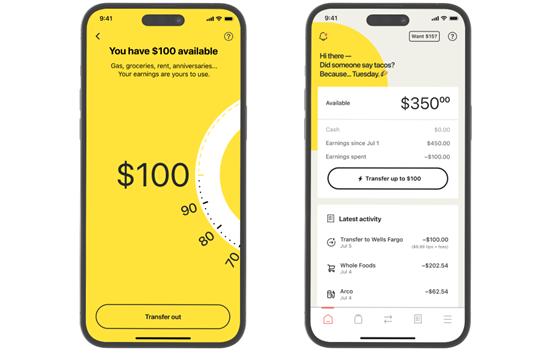

What is Dave?

Dave offers ExtraCash™ advances up to $500. It also doesn't charge an ATM fee to access your money at nearly 40,000 MoneyPass ATMs.

Compared to banks and lenders, Dave doesn't charge interest or late fees. There are no credit checks needed.

Its convenience is definitely one of the reasons why it's rated 4.8 out of 5 stars on the App Store, and 4.4 out of 5 stars on Google Play Store.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

What are Cash Advance Apps Like Dave?

Cash advance apps provide an advance that is usually paid on your next payday. They have low fees (some are even free!), zero interest, and require no credit checks. Most also offer tools that can help you save money, keep tabs on your bills, and more.

In comparison to credit unions and banks, the amount you can loan from these apps is lower; perfect for urgent, cheaper expenses.

For no extra delivery charge, Chime, Varo, Albert, and DailyPay are at the top of the list for apps with faster processing time (instant or within the day). Most cash advance apps like Dave on the list can process your advance within 1-3 days.

If you need a smaller loan, these $50 loan instant apps could be your solution.

When should you use Dave?

You can pull Dave out of your pocket during emergencies. It takes 1-3 days to transfer your advance into your bank account via ACH. But you can opt for the express delivery option to transfer immediately for a fee.

If you struggle with spending, however, you may want to keep Dave out of your phone. Its convenience can make it easy to get trapped into a debt cycle.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

How Does Cash Advance App Like Dave Work?

You don't have to wait for your next payday anymore. Here's how to get your first advance with apps like Dave:

- Check their eligibility requirements

Make sure you are eligible for a cash advance from your chosen app. Common requirements they ask for are:- An active account on the cash advance app

- A positive balance on the app

- Social Security number and/or valid state-issued ID

- Signing up

You can download the best cash advance apps on Google Play Store or the App Store. Then sign up for an account. - Request cash

For most apps, your loan amount will vary based on how well you fit their eligibility criteria and/or the frequency of your deposits. - Repay

Payments are automatically set on cash advance apps, usually it's on your next payday. But be sure to check and mark it on your calendar.

Cash advance apps like Dave can loan you $500 instantly. Using express delivery, you can get an instant $500 cash advance with EarnIn and MoneyLion. But with Varo and DailyPay you don't need to pay the express delivery charge. Instead, Varo charges per cash advance, and DailyPay charges for bank account, payroll, and debit card transfers.

Why are Apps Like Dave better than Payday Loans?

Payday loans can be tricky to apply for. But with cash advance apps like Dave, you get to have clearer requirements. They also have lower fees and charge no interest.

Most apps don't even need credit checks. While others, like Possible, let you borrow cash even with bad credit.

These make the apps very accessible to anybody. And instead of going to physical banks and lending offices, you can get an advance at a swipe of a screen. It's quick and easy to use.

If you haven't found your pick in our list of cash advance apps like Dave, check out our guide on the best payday loan apps.

Access between $25 - $500* in instant cash

- No FICO or check check required

- No interest, APR, late fees, or tipping

- Free Extensions on repayment

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

How to choose from apps like Dave?

Getting an advance from apps like Dave can be the best solution to your financial hurdle.

But before you sign up for any of them, here are some of the things to consider:

- Processing time

When you're in a rush, the processing time is a top priority. It will determine how fast you can get the money. Most apps take less than 24 hours to 3 days to process loans. But many of them offer express delivery. - Loan amount

Most apps cap their loan at around $250 to $500. So before signing up, check if the app offers the amount you need.If you only need a hundred bucks fast, try out these $100 loan instant apps. - Repayment date

Many apps on this list set an automatic repayment on your next payday. But there are other repayment options too. Some apps let you pay in installments or let you choose your own repayment date. - Fees

Check for any possible fees that will be charged with your cash advance such as monthly subscription fees, and instant delivery fees.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Access between $25 - $500* in instant cash

- No FICO or check check required

- No interest, APR, late fees, or tipping

- Free Extensions on repayment

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Cash Advance Apps Like Dave Alternatives

Other than cash advance apps, here are other ways to access cash for emergencies:

- Borrowing money from a friend

Having good friends could be a lifesaver. If you're in a rush, you could consider borrowing a few bucks from a friend. - Buy Now, Pay Later Apps

With Buy Now, Pay Later apps, you can purchase and pay in installments. If there's something you've been needing to get your hands on but can't manage a huge one-time payment, this could be your answer. - Personal loan

For emergencies that call for more than a thousand dollars, taking a loan could be your best bet. But be sure to do proper research before making your final decision.

Yes, cash advance apps like Dave on the list are safe. Cash advance apps have their own security measures and privacy policies that keep their consumers and their data safe. If you want to explore more options, here are other safe payday advance apps.

How to pay cash advance faster and break the loan and repayment cycle?

Repayment can sometimes be its own challenge. Budgeting your next pay for your loan and bills can be difficult.

But it's not impossible. Here are some tips for breaking the loan and repayment cycle:

- Use budgeting and spending tools

Many apps on this list offer budgeting and saving tools. You can use them to help improve your finances. It's a good first step to learning how to budget better. - Earn extra income

Instead of taking loans, you can go for apps that can make you some money. But you can also try a few side hustles to capitalize on your other skills. - Take note of your due dates

It's essential to be responsible when taking a loan. You can set reminders of your repayment dates. This can help you prepare and pay on time.

How we came up with the list

Dave is a reliable cash advance app. So when making this list, we looked for other apps that you can count on during emergencies.

We also made sure that they could offer you a range of loan amounts. Need only a couple hundred? No problem. Need your full pay right away? We got an app for that, too.

We also looked into their other features. We considered what tools could help you out in managing your finances. That way, we know you're in good hands every time you get strapped for cash.

Bottom Line

Although Dave is a great choice for a cash advance app, we know it's not for everyone. That's why it matters to shop around for what else you can get.

Apps like Dave offer different advance amounts, processing times, and settlement dates. Whether that's choosing your own repayment date, paying through installment, or accessing 100% of your pay before payday, there's an app for that.

When reviewing this list, you're likely to find one more suitable for your needs.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Access between $25 - $500* in instant cash

- No FICO or check check required

- No interest, APR, late fees, or tipping

- Free Extensions on repayment

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Lightning Speed fees and details, Retrieved 08/25/2025

- ^ EarnIn. Who can use EarnIn?, Retrieved 08/25/2025

- ^ EarnIn. What is Balance Shield?, Retrieved 08/25/2025

- ^ Klover. Pricing, Retrieved 08/25/2025

- ^ Klover. Eligibility Requirements, Retrieved 08/25/2025

- ^ Brigit. How much does Brigit cost?, Retrieved 08/25/2025

- ^ Brigit. How to access Instant Cash, Retrieved 08/25/2025

- ^ Brigit. Does Brigit affect my credit?, Retrieved 08/25/2025

- ^ MoneyLion. FAQs: How do I qualify for Instacash advances?, Retrieved 08/25/2025

- ^ Tilt. How does the Tilt subscription work?, Retrieved 08/25/2025

- ^ Tilt. What features are available on the Tilt app?, Retrieved 08/25/2025

- ^ Tilt. Empower is now Tilt, Retrieved 08/25/2025

- ^ Chime. How to use Chime's SpotMe, Retrieved 08/25/2025

- ^ Varo. Varo Advance, Retrieved 08/25/2025

- ^ OneWalmart. Benefits Guide, Retrieved 08/25/2025

- ^ Branch. Uber, Retrieved 08/25/2025

- ^ Albert. How do I qualify for advances with Instant?, Retrieved 08/25/2025

- ^ Payactiv. Pricing, Retrieved 08/25/2025

- ^ Payactiv. Not A Payday Loan Or A Credit Card, Retrieved 08/25/2025

- ^ DailyPay. FAQ: How much can I transfer?, Retrieved 08/25/2025

- ^ DailyPay. How does DailyPay work?, Retrieved 08/25/2025

- ^ DailyPay. An Earned Wage Access Platform Built for Today's Employees, Retrieved 08/25/2025

- ^ Possible Finance. What Are My Original Payment Dates?, Retrieved 08/25/2025

- ^ Possible Finance. Applying for a Loan, Retrieved 08/25/2025

- ^ Possible Finance. State Eligibility, Retrieved 08/25/2025

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Access between $25 - $500* in instant cash

- No FICO or check check required

- No interest, APR, late fees, or tipping

- Free Extensions on repayment

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: