Best Payday Loan Apps

Payday loan apps can let you borrow up to $1,000 without a credit check. And most of them are free. So what's the catch?

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

|

The best loan apps to help you make it to payday are:

- Dave for small amount advances

- Albert for no late fees

- Brigit for flexibility to choose repayment date

- Chime for overdraft protection

- EarnIn for hourly wages loan

- MoneyLion for multiple features

- Tilt (formerly Empower) for instant cash advance

- Payactiv for financial coaching

- Vola for same-day cash advance

- FlexWage for reloadable debit card

The middle of the week can be frustrating. You're so close to your payday that you can almost taste it. But your rent is due today and your bills can't wait!

A quick solution: Payday loan apps. These are apps that can get you your earnings before your payday. Plus, there's no interest and no credit check needed.

Keep reading to learn about the best apps and their features, how much you can borrow, and more.

10 Best Payday Loan Apps

Payday loan apps have different selling points. Some charge their services with a subscription fee from $1.00 to $8.99. But most apps are free.

Let's look into their different loan amounts, processing times, and features to see which payday loan app is best for you.

| Cash Advance App | Best for | Loan Amount | Standard Processing Time |

|---|---|---|---|

| Dave | Small amount advances | Up to $500 | 1-3 days |

| Albert | No late fees | Up to $1,000 | Immediately |

| Brigit | Flexibility to choose repayment date | Up to $250 | 1-3 business days |

| Chime | Overdraft protection | Up to $200 | Immediately |

| EarnIn | Hourly wages loan | up to $150/day, and up to $1,000/pay period | 1-3 business days via ACH |

| MoneyLion | Multiple features | Up to $500 | 1-5 business days |

| Tilt (formerly Empower) | Instant cash advance | Up to $400 | Immediately |

| Payactiv | Financial coaching | Up to 50% of your pay | 1-3 business days[1] |

| Vola | Same-day cash advance | Up to $500 | Immediately |

| FlexWage | Reloadable debit card | Employer determined | Immediately |

This rule helps you remember the key aspects to consider when choosing a payday loan app:

- Fast: Ensure the app provides quick access to funds.

- Affordable: Look for apps with reasonable interest rates and fees.

- Secure: The app should have strong security measures to protect your information.

- Transparent: The terms and conditions should be clear and easy to understand.

Among the cash advance apps on the list, Vola is the fastest. They can get your advance within 5 hours.

Dave: Best for small amount advances

|

| CREDIT DAVE |

|

|

- Advance Amount: Up to $500.00

- Processing Time: 1-3 days for ACH transfers. For a fee, you can transfer to a connected account within minutes with express delivery.

- Settlement Date: On your next payday or the nearest Friday if Dave can't detect your payday.

Let's say you only need an extra $25 to fix a flat tire. Nothing crazy, just $25. Do payday advance apps let you borrow that little?

Dave offers ExtraCash™ advances up to $500. You can also get small advances. It works great for when you pop a tire or run an errand. But this small advance comes with a small catch.

Dave charges a small monthly membership fee of up to $5.[2] It is the lowest membership fee from payday advance apps on this list. (Stay tuned to see which app charges the most!)

You can get up to 2 "ExtraCash" transfers. You may be eligible to take both or one at a time on the same day, but there will be overdraft and express fees for each one. Once you pay off your ExtraCash balance, you could be eligible for additional ExtraCash as soon as it's settled.[3]

Features

- ExtraCash™

With ExtraCash™ you can get up to $500. There's no credit check, no interest, and no late fees.[4]To qualify for a higher advance, you need 3 or more recurring deposits, a total deposit of $1,000 or more per month, and an external account with a positive balance.[5]

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Users complain about the change in advance amount. One user reported being able to get an advance of $400 but now can only access $75.[6] If these complaints don't sit well with you, here are other apps like Dave you might want to consider.

Albert: Best for no late fees

|

|

- Loan Amount: Up to $1,000

- Processing Time: Immediately

- Repayment Date: 6 days from when you initially advance (can request up to a 7-day extension)

Albert can offer up to $1,000 with Instant Advance. You also don't need to worry about late fees or interest.

Features

- Albert Instant

It offers up to $1,000 cash advance with no credit check needed.To qualify for Albert Instant, you need:[7]

- An active bank account linked to an Albert Cash account

- Smart Money feature set to "Automatic" schedule on the app

- An Albert Cash account in good standing

- Set up qualifying direct deposits with Albert Cash to potentially raise Instant limit

- An active bank account linked to an Albert Cash account

- Albert Cash

It is Albert's debit card feature. You can get your paycheck up to 2 days early by setting up your direct deposit with Albert Cash. - Albert Budgeting

Track your spending and savings as well as get updates on hidden fees, bill increases, and overdrafts.

Albert has great features. If you're looking for similar options, here are apps like Albert.

Yes. Albert's banking services are from Sutton Bank and Stride Bank, which are members of the FDIC. Savings accounts on Albert are in FDIC-insured banks.

Brigit: Best for flexibility to choose repayment date

|

| CREDIT hellobrigit |

|

|

- Loan Amount: Up to $250.00

- Processing Time: Brigit takes 1-3 business days but with instant delivery, you can get your loan within 20 minutes.[8]

- Repayment Date: You can pay earlier or get an extension if you need more time. Brigit can also set an automatic repayment on your payday.

With no credit check needed, you can borrow up to $250 with Brigit. But their subscription fee starts at $8.99.[9]

It is the highest fee compared to other apps. Does it mean it's better? Well, that depends.

Brigit has a flexible repayment date with free repayment extensions. To improve your credit score, Brigit also has a credit builder. If that's what you need, then the fee could be worth it.

Features

- Instant cash

You can get a payday loan of up to $250. It comes with no credit check, no interest, no late fees, and free repayment extensions.But to unlock instant cash advance, here are Brigit's requirements:[10]

- Checking account that has been active for at least 60 days

- Balance greater than $0

- 3 recurring deposits from the same source

- Checking account that has been active for at least 60 days

- Credit Builder

You can improve your credit history by applying for a loan and keeping it in a deposit account. As you pay off the loan, you build your credit score.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Chime: Best for overdraft protection

|

| credit chime |

|

|

- Loan Amount: $20.00 to $200.00

- Processing Time: Immediately

- Repayment Date: Next deposit or payday

Overdraft occurs when there are insufficient funds in your account to cover a transaction. Your bank pays for the expense but charges you an overdraft fee.

With a Chime Debit Card, however, you can get immediate spotting up to $200 without overdraft fees. They also won't be performing a credit check.

Overdraft fees are around $35.[11] And some banks can even charge multiple overdrafts per day. So if you take overdrafts from banks, you would have to pay your expense + $35!

Features

- Chime SpotMe

Get spotting up to $200 in overdraft from cash withdrawals or debit and credit card purchases. There are no monthly fees or credit checks.[12]Chime's only requirements are:

- At least 18+ years in age

- A deposit account connected to Chime

- Activated Chime Card

- A qualifying deposit of $200 and above, 34 days before you request an overdraft spotting.

- At least 18+ years in age

- Chime Checking Account

This lets you access your earnings up to 2 days earlier than your payday.

Chime is a financial technology company with banking services from The Bancorp Bank, N.A. and Stride Bank, N.A which are members of FDIC.

It only gets better from here, as more apps on the list have a higher loan amount.

EarnIn: Best for hourly wages loan

|

| CREDIT earnin |

|

|

- Loan Amount: up to $150/day, and up to $1,000/pay period[13]

- Processing Time: 1-3 business days via ACH

, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

- Repayment Date: On or after your payday

You can take a cash out from EarnIn of up to $150/day, and up to $1,000/pay period.[13] It is one of the highest amounts from payday loan apps. But this depends on your work hours.

Unlike Chime, EarnIn works with your current bank account. So there's no hassle with opening a separate debit card.

They have no mandatory fees, interest, or hidden costs. Tips are also optional. When you are in a tight situation, you can trust EarnIn cash out.

Features

- Cash Out

With EarnIn's Cash Out, you get access to your pay before payday. To release your earned wage, EarnIn verifies your employment through a few requirements:- A linked checking account

- A regular pay schedule

- A permanent work location, an electronic timekeeping system, or a PDF timesheet to track your hourly earnings

Setting up your account will only take a few minutes and verification takes about 1-2 business days.[14]

- A linked checking account

- Balance Shield

This can give you access to $100 of your earnings when your account balance falls below your selected threshold amount ($0-$500).[15]

If you fail to pay your EarnIn Cash Out, you will receive an e-mail to solve the problem. Your credit score will not be affected.[16]

Want more features? Check out our next apps.

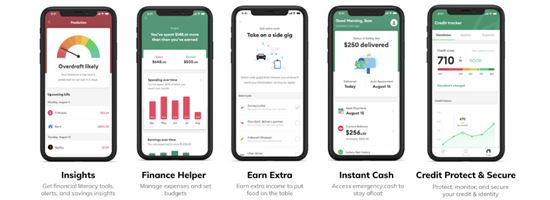

MoneyLion: Best for multiple features

|

|

- Loan Amount: Up to $500

- Processing Time: Standard delivery takes about 1-5 business days. But with Turbo delivery, you can get your money within minutes.

- Repayment Date: Next payday

No subscription fee, no problem. MoneyLion offers a cash advance loan of up to $500 with no credit check required.

And if you're looking to make the most out of your money, they've got you covered. MoneyLion has plenty of features that can help you learn about building your credit and making investments such as crypto.

Features

- Instacash

This lets you take a cash advance of up to $500 with no membership requirement. It doesn't require a credit check or a subscription.To get cash advance from MoneyLion, here is their criteria:[17]

- An active account for two or more months

- A history of recurring income deposits in the account

- A positive balance on the account

What's the easiest app to get a cash advance?

MoneyLion is an easy app to get a cash advance from. It doesn't need a subscription fee, no credit check, no insurance, and it doesn't require a high minimum account balance. For more similar apps, check out our list of apps like MoneyLion. - An active account for two or more months

- Financial Heartbeat

This monitors your credit health, savings, and spending for free.

Tilt (formerly Empower): Best for instant cash advance

|

|

- Loan Amount: Up to $400

- Processing Time: 1-minute instant delivery with a Tilt card; for other paycheck accounts, there's a 1 business day processing time[19]

- Repayment Date: Next payday

Money comes and goes so fast. And sometimes, the standard processing time for your payday loan can't keep up. But Tilt (formerly Empower) can.

Tilt (formerly Empower) can send your loan instantly. It has a quick loan processing time which comes in handy for emergencies.

You can get your money within 15 minutes. Just pay for the instant delivery fee.

Features

- Tilt Cash Advance

You can borrow up to $400 without the hassle of waiting for days. Receive your loan the same day without the interest, late fees, and credit checks. - Tilt Card

This is a debit card feature that has no overdraft fees. It gets your payday loan delivered within 1 minute for free. And to top it off, you can get up to 10% cashback deals.Keep in mind that there's a monthly subscription worth $8 for its services.[20]

If you prefer getting your cash at Walmart, however, this next app is more suited for you.

Payactiv: Best for financial coaching

|

|

- Loan Amount: Because it is an employer-sponsored program, your employer determines the maximum loan. They can set it to up to 50% of your pay.[21]

- Processing Time: ACH bank transfers take 1-3 business days with no extra charge. But you can receive it instantly through your debit or payroll card, or Walmart Cash Pickup for a fee. There's no fee for same-day transfer to a Payactiv card with direct deposit of $200 or more per pay period.[22]

- Repayment Date: On your next paycheck

Payactiv gives you access to up to 50% of your earnings per pay period. For a $2.49 to $3.49 fee, you can receive it instantly through your debit card or Walmart Cash Pickup.

The app also has practical features. It can help you manage your spending, plan your finances, and improve your savings.

Features

- Earned Wage Access

This lets you take up to 50% of your earnings. You can also use it to pay your bills using the app.Keep in mind that this is an employer-sponsored payday advance program. That means you can only use this feature if your employer uses Payactiv.

- Financial Counseling

You can talk to a certified credit counselor with Payactiv. Learn how to build your credit, manage your debt, etc.

Sit tight, we're down to our last 2 apps.

Vola: Best for same-day cash advance

|

|

- Loan Amount: Cash advance of up to $500

- Processing Time: Around 5 business hours (bank account); Immediately (Vola Card)

- Repayment Date: Repay on your payday or choose a repayment date using the app[23]

Vola is at the top when it comes to processing time while Tilt (formerly Empower) comes at a close second. It can process a cash advance of up to $500 within 5 business hours. And it comes at no extra cost.

Cash advances don't require a credit check. They also don't charge interest.

To help with your finances, they even have budgeting tools and income and expense tracking that you can use for free.

Features

- Cash Advance

Take a cash advance of up to $500 with no interest and no credit checks. As long as you connect your Vola to your bank account that:[24]- Has been used for 3 months

- Is active on most days of the week

- Has a balance of $150+

- Has incomes or deposits

- Has been used for 3 months

- Vola Card

This is a buy now and pay later option with no extra fees.

If you feel safer with employee-sponsored apps, here's another option for you.

FlexWage: Best for reloadable debit card

|

|

- Loan Amount: Determined by your employer

- Processing Time: Instant

- Repayment Date: Next payday

Like Payactiv, FlexWage is an employer-sponsored cash advance. It comes with a FlexWage debit card so there's no need for a checking account.

You can get instant access to your pay whenever you need it. And you can use it in stores that accept Visa or Mastercard.

Fees for using FlexWage depend on the employer, but it is guaranteed to be lower than overdraft and short-term loans.

Features

- FlexWage Visa Pay Card

This is a reloadable debit card that's loaded by your employer every payday.[25] - OnDemand Pay

You can get your pay earlier in your FlexWage card.[26]

How a Payday Loan Works

Payday loan apps get you up to $1,000 of your earned wage before your payday. They have no credit check, so you don't have to worry about your credit score. And you can repay it on your next payday with no interest!

You read that right. Payday loan apps charge ZERO INTEREST fees. It beats credit cards and online lenders that charge from 15% to 35%[27] on interest.

On top of zero interest, payday loan apps have hassle-free requirements. Most apps only ask for an active bank account and a consistent income.

Yes, loan apps are safe. Payday loan apps take measures to protect your personal information and banking details. For example, Tilt (formerly Empower) uses federal law security measures to protect your personal information using computer safeguards and secured files and buildings.[28]

When to Consider Payday Loan Apps?

When you've run out of options, payday loan apps are great for urgent, short-term emergencies. You can use it to get cash without the hefty interest, bank fees, and meticulous paperwork.

But if you're looking to splurge, you should reconsider if the impulse purchase is worth the payday loan.

Convenience comes at a cost. Dave, Brigit, and MoneyLion could loan you $100 instantly, but with an extra charge. If you want to save a few bucks, Chime, Albert, and FlexWage could be good options.

Pros and cons of Payday Loans

If you're still on the fence about whether to apply for payday loans, these pros and cons might help you out.

Pros:

- No credit check

Payday loan apps are a good source of cash for those who have a bad credit score. - Fast processing time

It can take 1-3 days to receive your money. There are also express delivery options which are great for emergencies. - Learn about money

Some apps offer finance tools and resources. They can help you learn more about managing your money. - Low fees

Depending on your lender or bank, payday loan apps can offer lower fees.

Cons:

- Debt cycle

Making a habit of taking payday loans from apps is dangerous. It makes you depend on money you don't have yet. As much as possible, use it only when needed. - Fees add up

Low subscription fees and low express delivery fees add up to a high expense. But this expense is avoidable.If you can stretch your money a little more, it will be worth it. That way, you can save the money for the fees for emergencies.

- Loan amounts vary

Ultimately, the amount you can borrow depends on your qualifications. For employer-sponsored apps, it will depend on your employer.

How to Choose the Best Payday Loan App

Still in doubt? Here's our guide to choosing the best one:

- Payday Loan Amount

If you need $20 to $300, you can find multiple apps that fit the bill. But for a higher loan amount, your options would be more limited. - Processing time

Most apps take 1-3 days to process. For most apps, faster transfer means additional fees, so take the urgency of your payday loan into consideration. - Fees

When picking a payday loan app, common fees to look out for are express delivery fees and subscription fees that could go up to $8.99/month. - Additional Features

Payday loan apps have tools that can help increase your savings, boost your credit score, and teach you a few tricks or two. If you're looking for a specific finance feature, there's a payday loan app for you.

You can't go wrong with any of the payday loan apps on the list. But how can you be sure that it's not a scam? Keep scrolling to find out.

How to tell if it's a scam

The payday loan apps in this article are legit and not scams. But you could be interested in other payday loan apps.

If so, here's what you can do to ensure the lenders are trustworthy:

- Check their websites

The apps in this list have clear websites where you can read all of their privacy policies and terms and conditions. - Check if they are FDIC-insured

Legit finance companies are backed by the Federal Deposit Insurance Corporation (FDIC). So check if their services are FDIC-insured. - Read the reviews

There are plenty of reviews on payday loan apps you can read to see how safe these apps are.

Other ways to get a quick loan

Here are some other options for when you're cash strapped.

- Buy Now, Pay Later Apps

Apps like Klarna and Affirm let you buy now and pay later. They let you pay in installments to spread out your big purchase. - Personal Loans

These are unsecured, short-term loans you can pay within 2-5 years. Compared to payday loan apps, lenders have a higher loan amount of $5,000 - $100,000. - Ask a friend or family

If you are lucky to have reliable friends and family, ask if you can borrow money from them. It could be tricky, but at least there's no interest fee.

Check into the eligibility requirements of payday loan apps and see which one is the best fit for you. This can help you get a higher loan. Then sign up and make sure to pay on your next payday.

But some of these are BAD alternatives you should avoid.

- Payday Loans

These are loans with a high-interest rate of around 391%. This loan is paid in a lump sum and lenders secure the loan by gaining access to your bank account. In short: it's a trap. - Credit Card Advances

These are loans from your credit card you can take from an ATM. Credit card cash advance charges a fee and very high interest rates - often from the moment you take it out until it's paid off.You should only use a credit card advance as a last resort if you really need cash fast. And it's only suggested if you can pay it off right away.

How we came up with the list

In choosing what apps to add to the list, we looked for payday loan apps that were inexpensive. It was important that they were free or had low fees to make sure they were practical for our readers.

The article also includes what you would need to get a loan. We made sure that these payday loan apps would not need a bunch of paperwork that takes a lot of time.

We also considered finance tools. That way, these apps don't only give you access to a loan. They can also help you make better money moves.

Bottom Line

There are many payday loan apps that come in handy for a rainy day. You don't have to wait for your payday to buy your groceries. And you don't have to worry about a bad credit score or interest.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Each app will have its pros and cons. While some apps come with subscription fees, others are free to use. Be sure to compute the total cost of the loan before applying.

References

- ^ Payactiv. On-Demand Pay, Retrieved 10/20/2025

- ^ Dave. Dave Membership, Retrieved 10/20/2025

- ^ Dave. How do I take ExtraCash?, Retrieved 10/20/2025

- ^ Dave. ExtraCash advance, Retrieved 10/20/2025

- ^ Dave. ExtraCash eligibility, Retrieved 10/20/2025

- ^ Google Play. Dave - Banking & Cash Advance, Retrieved 07/20/2024

- ^ Albert. How do I qualify for Albert Instant?, Retrieved 10/20/2025

- ^ Brigit. When will I get the Brigit Advance?, Retrieved 10/20/2025

- ^ Brigit. How much does Brigit cost?, Retrieved 10/20/2025

- ^ Brigit. How to access Instant Cash, Retrieved 10/20/2025

- ^ FDIC. Overdraft and Account Fees, Retrieved 10/20/2025

- ^ Chime. Fee-Free Overdraft with SpotMe, Retrieved 10/20/2025

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Bank account verification and test transactions, Retrieved 10/20/2025

- ^ EarnIn. Balance Shield: How it works, Retrieved 10/20/2025

- ^ EarnIn. Why Debt Collection Has No Place at EarnIn, Retrieved 10/20/2025

- ^ MoneyLion. Qualifying for Instacash, Retrieved 10/20/2025

- ^ MoneyLion. Moneylion Fee Schedule, Retrieved 10/20/2025

- ^ Tilt. Terms of Service, Retrieved 10/20/2025

- ^ Tilt. What is Tilt's subscription fee?, Retrieved 10/20/2025

- ^ Payactiv. Access earned wages, Retrieved 10/20/2025

- ^ Payactiv. Pricing, Retrieved 10/20/2025

- ^ Vola. Vola's Terms of Service, Retrieved 10/20/2025

- ^ Vola. FAQs: What kind of bank accounts are supported on Vola?, Retrieved 10/20/2025

- ^ Flexwage. Pay Card, Retrieved 10/20/2025

- ^ FlexWage. OnDemand Pay, Retrieved 10/20/2025

- ^ Incharge. How Do Payday Loans Work?, Retrieved 10/20/2025

- ^ Tilt. Tilt Finance Privacy Policy, Retrieved 10/20/2025

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|