Best Payday Advance App

Fast cash requirement? Find the top payday advance apps including their benefits and drawbacks.

|

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

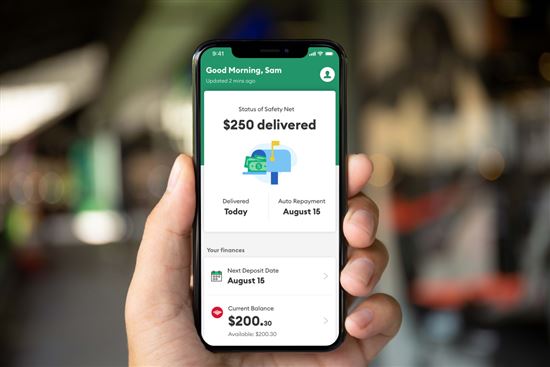

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Look. Life is unpredictable. It's not your fault.

When you're strapped for cash, it's tempting to get a payday loan. But this is a BAD idea. Payday loans can bleed you with high-interest rates. They might even leave you in worse financial shape than before.

So what's the alternative? You still need money fast.

Payday advance apps are a much safer option. Find out what these apps are and how they work.

Here are the best apps to get money before payday:

What are payday advance apps?

Payday advance apps (also known as cash advance apps) allow you to borrow money before payday. It's an alternative to payday loans. Some apps don't charge interest while others deduct a small amount from your paycheck before you receive it.

You can find a breakdown of the pros and cons of popular payday advance apps (like Dave and EarnIn) below.

Keep in mind: If you have a lot of debt to pay off, it's recommended to use a personal loan to help you save money on interest and potentially get out of debt faster. Check rates on Fiona (does not affect credit score) to see if you qualify.

Apps You Can Download on Your Own

|

| © CreditDonkey |

Some payday advance apps allow you to independently link your own bank account. Most will monitor your account's spending and earning history. And then automatically withdraw any advanced funds when you get your paycheck.

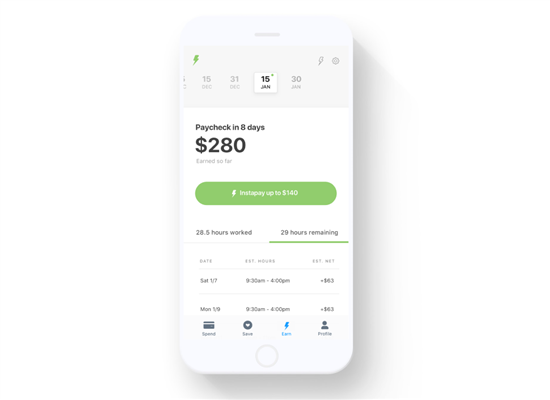

🏆 Earnin - Best Free App

|

| Credit: Earnin |

EarnIn gives workers access to their pay as they work the hours to earn it, rather than waiting for payday.

There are no mandatory fees or interest to use but it does ask for optional "tips" with every withdrawal. Users can withdraw up to $150/day, and up to $1,000/pay period[1]. The app also offers automatic overdraft protection deposits and alerts.

Depending on when you make a cashout request, the money could arrive in 1-3 business days. If you choose to use Lightning Speed feature, cashout requests will be processed in minutes for a fee, starting at just $2.99/transfer.

Pros

- No interest and no hidden fees

- No credit checks

- Offers automatic overdraft protection

Cons

- Encourages tipping with every transaction

- Not accessible for freelancers

- May require GPS location sharing

How it works

In order to use EarnIn, you must meet the following requirements:[2]

- You must get paid consistently, whether weekly, bi-weekly, or monthly.

- A fixed work location, or an employer-provided email address.

- Living in the US with a valid US phone number

- A linked Checking account

- Paychecks from a Verified Employer

That makes EarnIn essentially unusable by freelancers and anyone who doesn't receive regular payments.

Brigit - Best app for iPhone

|

| credit: brigit |

Brigit's payday advance services cost $8.99 per month for Plus plan.[3] The app offers advances between $50 and $250, depending on an individual's needs and ability to repay.

Brigit also monitors linked bank accounts. If the app's algorithm detects that an account is nearing an overdraft, it will automatically lend up to $250 to avoid it.

Cash arrives before the end of the day if it is requested before 10 a.m. EST on a business day. Any requests made later than that will arrive the following business day.

Pros

- No interest or late fees

- Funds arrive quickly

- Offers automatic overdraft protection

Cons

- Costs $8.99 per month if you'd like to access the cash advance feature.

- Only allows one advance at a time

- Requires minimum Brigit score to get advances

How it works[4]

- You must have a primary checking account to use daily

- The bank account must be at least 60 days old.

- Have a minimum of three consistent deposits from the same employer.

- You must also have a positive bank account balance.

This is how Brigit knows you will have enough to pay the advance back without overdrafting.

Brigit also calculates a "Brigit score," which ranges between 0 and 100.[5] You need a minimum score ranging from 40 to 100 (depending on app evaluation) in order to receive cash advances. Brigit calculates this score by looking at your:

- Bank account's historical balance and activity

- Spending habits

- Earning history

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

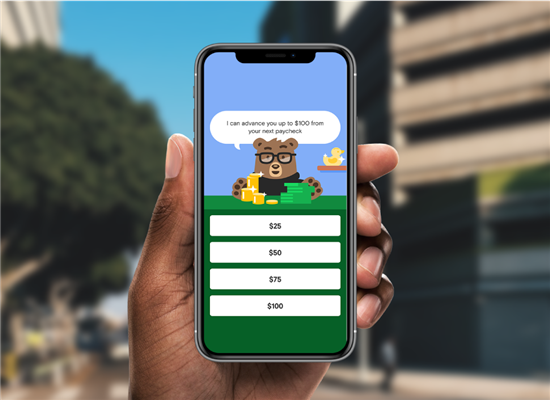

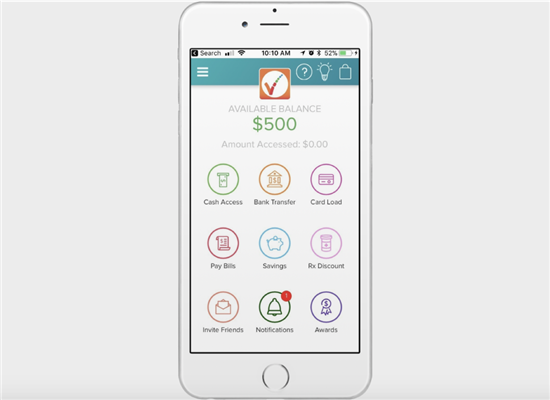

Dave - Best app for small amount advances

|

| Credit: Dave |

Dave operates as a membership service. For a $1 monthly membership fee, Dave offers ExtraCash™ advances up to $500.[6] This also includes other services such as access to account monitoring, notification services, and maintaining a connection to your external bank account.

If Dave's algorithm predicts that you have an upcoming overdraft, it will automatically deposit cash into your account.

All of Dave's advances have a 0% interest rate. They can take up to three business days to transfer into your bank account via ACH but will transfer immediately for a fee.

On the pre-set settlement date, Dave will automatically try to pull the advanced amount from your account. If you can't settle the advance, you get banned from the app.

Pros

- No interest fees

- Option to set up automatic settlement

- Sends overdraft warning alerts

Cons

- Charges monthly membership fee

- Encourages additional tipping

- Charges fee for immediate transfers

How it works

After you connect your checking account (they don't link to savings accounts), Dave monitors your balances and upcoming expenses. There aren't any hidden fees, but Dave does recommend "tipping" them for the advance.

In order to qualify for higher advance, you must:

- Have a U.S.-based checking account linked to Dave

- Have at least 3 consistent direct deposits from your employer

- A total deposit of $1,000 or more monthly

- Account must have a minimum 60-day history and a positive balance

- Have an ExtraCash™ Account in good standing

- Have activated the Dave "Top Up Rule"

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

MoneyLion - Best app with no credit check

MoneyLion is a mobile and financial membership platform. By linking your active checking account to the free MoneyLion app, you can request cash advances up to $500 without any added interest fees.

Pros

- No monthly fee[7]

- No interest

- No credit check

- Extra financial tools

Cons

- Instant funding costs extra

- Requires a checking account

How it works

Instacash is an optional service offered by MoneyLion that allows for interest-free cash advances. There's no interest and no monthly fee. But you can pay turbo fees to receive funding faster.

If you do take a cash advance, the money will be immediately transferred into your MoneyLion account. The owed amount will be automatically deducted from the same account approximately two weeks later.

Apps Your Employer Has To Use

|

| © CreditDonkey |

Most employer-sponsored payday advance apps work similarly to self-sign-up apps. Relying on your job's chosen app has benefits and disadvantages. Often, the withdrawal limits are higher than individual apps, but employers have more control over what employees can and can't do.

DailyPay - Best app with fast delivery

|

| Credit: Dailypay |

If an employer decides to sign up for DailyPay, employees will be able to access funds based on how many hours they work. Employees can transfer as much money as they want from their accumulated balance.

Each transfer is either free for next-day delivery or $3.49 or less for instant delivery into a linked bank account or prepaid debit card. Your paycheck amount is then reduced by any early transfers you've taken.[9]

Pros

- Money transfers quickly

- Automatically links to your paycheck

Cons

- Charges a fee to transfer money

- Only available through an employer

How it works

DailyPay has very few eligibility requirements aside from the need for an employer to sign up for the program. The requirements include:

- You must have a bank account, payroll card, or prepaid debit card linked for DailyPay to send your payments.

- You may need to provide some personal identifying information if your employer doesn't provide it.

- Have direct deposit for your paychecks

ONE@Work - Best app with cash pickup

|

| Credit: Even |

If an employer signs up for ONE@Work, all employees can access its benefits, including early access to up to 50% of their earnings as they work hours. ONE@Work also offers planning for spending, saving, and empowering employees financially.

All of ONE@Work's payday advances are interest-free. Employers have the option to subsidize those fees.

Withdrawn money is automatically taken out of your next paycheck.

Pros

- No interest fees

- Offers budgeting/saving tools

- Friendly customer support

Cons

- Only available through employers

How it works

You can have the money from ONE@Work transferred to your linked bank account in one business day. You can also pick up your funds at a Walmart MoneyCenter on the same day.

ONE@Work also helps you save automatically.

It sets aside a percentage of your paycheck each pay period and helps you budget appropriately. It spreads out your pay over the month. Rather than living with the paycheck-to-paycheck mentality.

PayActiv - Best app that gives the most

|

| Credit: Payactiv |

PayActiv is another employer-sponsored cash advance program that gives you access up to $500 of your earned money at once. The program is free for employers to set up and offer as a benefit to its employees.

In addition to cash advances, you can also conduct other banking transactions. These include:

- Paying bills

- Setting up a budget

- Creating a savings plan

Pros

- Advances up to $500

- Automatic deductions from paychecks

- No interest fees

- Free bill pay feature

Cons

- Only available through employers

- Charges per debit/payroll card/cash pickup transfer

How it works

If your employer signs up for PayActiv, you can then download the app and sign up for an account. If you need to access your earned wages before payday, you withdraw the funds via PayActiv.

They allow you to withdraw up to 90% of your earned wages with a $500 maximum at one time. The money you borrow is automatically deducted from your next paycheck and paid back.

The funds aren't a loan, but there is a processing fee of $2.49 to $3.49 per transaction if you use a service such as instant deposit or Walmart cash pickup.[10] Your employer may or may not cover it for you.

FlexWage - Best app with separate card

FlexWage is another employer-sponsored cash advance program. Employees who choose to use the service receive a FlexWage debit card for cash advances. They can use them even if they don't have their own individual checking account.

Employers who use FlexWage determine the:

- Fees to get a cash advance

- Minimum and maximum amount allowed for a cash advance

- Maximum number of available withdrawals per pay period, month, or year

Cash advances have a 0% interest rate and will automatically be taken out of an employee's next paycheck. Requested funds transfer instantly to the FlexWage card.

Pros

- Money transfers instantly to FlexWage card

- No required checking account

- No interest fees

Cons

- Only available through employers

- Requires FlexWage debit card

- Employers set limits on the amount of advances

How it works

After your employer offers the FlexWage benefit, they will share an enrollment link with you. After enrolling, you'll receive a FlexWage Visa card to which you can transfer your earned wages when necessary.

Flex Pay also offers a special program for restaurants and other companies that work on tips, commissions, or bonuses. The program gives you early access to your earnings as designated by your employer.

Branch - Best app with budgeting

|

| Credit: Branch |

Branch is another employer-sponsored cash advance app. Users can only access it if they belong to an organization that uses Instant Pay.

A 3-business-day transfer to an external account or debit card is free, while an instant transfer costs $2.99 - $4.99 depending on the amount you transfer.[12]

You can also add their direct deposit on there to unlock more benefits like a two-day early paycheck.

With either option, all advances are interest-free.

Pros

- Free transfer option available

- Fee-free checking account and debit card available

- No overdraft fees

- No interest or subscription fees

Cons

- Only available through an employer

- Instant transfers without Branch debit card cost $2.99 - $4.99

How it works

To use Branch, your workplace must have an official relationship with Branch. To be eligible for an advance, you must be verified on your employer's roster. You will be able to request an advance if you meet all other qualifications.[13]

Your advance payback is automatically deducted from the connected bank. It will not be removed from your paycheck. You can also still use the application's budgeting tools and alerts.

When your employer offers Branch as a benefit, you receive access to the Branch Wallet. Or you can connect your banking information. You can then advance up to 50% of your earnings.

Branch automatically deducts the amount borrowed from your next paycheck.

Branch also offers other financial and work-related benefits, including:

- Schedule management

- Overdraft warnings

- An earnings tracker

- Opportunities to pick up shifts

- A budgeting tool

What Experts Say

As a part of the series on credit and personal loans, CreditDonkey asked a panel of industry experts to answer some of readers' most pressing questions:

- What's your biggest piece of advice for people who use payday loans or apps?

- What should people look for in a payday advance app?

- What are alternatives to payday advance apps?

Here's what they said:

Bottom Line

Payday advance apps may help you in a pinch. Like when you need a little money to get through to your next payday. But they won't fund large expenses, like those that come up during emergencies.

It's important to find a way to save an emergency fund. And have access to other liquid funds should you find yourself in a financial bind.

References

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Who can use EarnIn?, Retrieved 3/28/2024

- ^ Brigit. How much does Brigit cost?, Retrieved 04/18/2024

- ^ Brigit. Bank Account Requirements, Retrieved 3/28/2024

- ^ Brigit. Brigit Score, Retrieved 3/28/2024

- ^ Dave. Dave Membership, Retrieved 04/05/2024

- ^ MoneyLion. Moneylion Fee Schedule, Retrieved 04/05/2024

- ^ MoneyLion. Determining Instacash Limits, Retrieved 4/10/2024

- ^ DailyPay. How does DailyPay work?, Retrieved 3/28/2024

- ^ Payactiv. Pricing, Retrieved 3/28/2024

- ^ Payactiv. Pricing, Retrieved 3/5/2023

- ^ Branch. Fee Schedule, Retrieved 4/10/2024

- ^ Branch. Am I Eligible for an Advance?, Retrieved 04/05/2024

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|