Best Cash Advance Apps Like Albert

Albert is best known for their instant cash advance. But is it the best app there is? Read on to find a better fit.

|

Emergencies are unpredictable. And sometimes, they come with a hefty price tag.

So when faced with an urgent crisis, it's good to have an app that's got your back.

And although Albert Instant Advance offers up to $1,000, not all users will qualify for $1,000.

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

These 12 cash advance apps can give you more options.

Here are other cash advance apps like Albert:

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

12 Best Apps like Albert

Albert is not for everyone. Sometimes, it's due to the loan amount available. Other times, it's because of the subscription fee needed to access most features. Whatever the reason, here are other apps to check out.

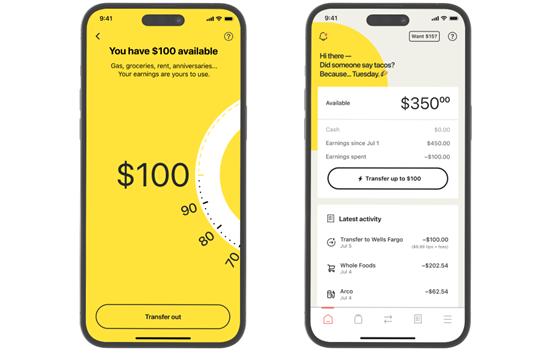

EarnIn

|

| credit earnin |

|

|

Loan amount: up to $150/day, and up to $1,000/pay period[1]

Processing time: 1-3 business days via ACH, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer

Repayment date: Automatic deduction on or after your payday

You can get access to up to $1,000 of your salary with EarnIn Cash Out. This is one of the highest amounts in all cash advance apps, and there's no interest.

You can access up to $150/day, and up to $1,000/pay period.[1] In comparison, Albert Instant Advance limits range from $25 - $1,000.

EarnIn is a good choice for employed users. Since they base the maximum amount you can access on your pay, you can make sure to pay back what you owe without burying yourself in deep debt.

EarnIn Cash Out does not have a monthly fee.

EarnIn Requirements:

Before you can use Cash Out, EarnIn has to ensure you are employed. Here's what they need:[2]

- A regular pay schedule

- A permanent work location or an employer-provided email address

- Valid U.S. cell phone number

- A linked checking account

- Paychecks from a verified employer

Other EarnIn Services:

EarnIn also offers Balance Shield, which can automatically transfer $100 of your earnings when your balance falls below your selected threshold amount ($0-$500).[3]

Dave

|

| CREDIT DAVE |

|

|

Advance amount: Up to $500

Processing time: 1-3 days for ACH transfers. For a fee, you can transfer to a connected account within minutes with express delivery.

Settlement date: On your next payday or the nearest Friday if Dave can't detect your payday

For up to $5/month membership fee,[4] you can try out Dave ExtraCash™ account. It's a handy app for small to large advance needs. Included in the monthly membership fee are various services such as access to account monitoring, notification services, and maintaining a connection to your external bank account.

Might not be able to pay on your due date? No worries! Dave doesn't charge late fees. It also doesn't charge an ATM fee to access your money at nearly 40,000 MoneyPass ATMs.

Dave ExtraCash™ Eligibility Contributing Factors:

Here's what you'll need to get a higher advance:[5]

- 3 or more recurring deposits

- Total deposit of $1,000 or more per month

- An external account with a positive balance

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

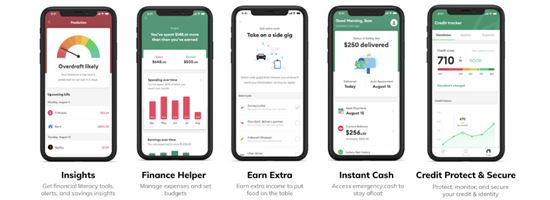

Brigit

|

| CREDIT hellobrigit |

|

|

Loan amount: Up to $250

Processing time: 1-3 business days; within 20 mins. for a fee

Repayment date: Flexible repayment date

Instant Cash is Brigit's cash advance feature that can get you up to $250. There are no credit checks and no interest.

And compared to Albert that sets an automatic repayment schedule, Brigit gives you a say on when you pay. You can even pay early or get an extension. This can help you be more in control of your budget or cash flow.

Unfortunately, it comes with a price. Subscription starts at $8.99/mo. It's quite expensive, but it does unlock many features.

Brigit Requirements:

Here's what you need to access the cash advance feature:[6]

- A checking account that's been active for at least 60 days

- More than $0 in your balance

- 3 recurring deposits on your account from the same source

Other Brigit Services:

You can get auto-advances with Brigit that automatically cover you when you're at risk for an overdraft. Their Earn & Save feature also shows you several opportunities to increase your income.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

For $8.99, you can enjoy credit monitoring, and identity theft protection.[7]

Cleo

|

|

Loan amount: Up to $250; first advance is from $20 to $100

Processing time: 4 business days; $3.99 to $9.99 express fee[8]

Repayment date: On your payday; 14-day extension[9][10]

Cleo Salary Advance can get you up to $250 of your salary with no credit check or interest charged. While Albert Instant Advance offers up to $1,000.

On the plus side, Cleo provides an extension if you can't pay your dues on your payday. In contrast, Albert will suspend you from accessing additional overdrafts if you're overdue by 15 days.[11]

You also won't need to worry about your debt getting out of hand. Cleo is known for their attitude in helping you save money. They have sassy notifications that can make you think twice before making a purchase.

Other Cleo Services:

If you opt for Cleo Plus ($5.99/mo), you can check your credit score, use their personal financial management services, and access their Debt Reset feature.

Cleo Personal Financial Management Services will give you information and insight into your spending. This overview can help you save and see where your money is going.

And if you're concerned about your credit, you can also subscribe to Cleo Builder ($14.99/mo). You'll get credit score coaching and unlock your credit builder card. You will also have access to all features of Plus and Pro, and early paycheck access (with direct deposits).[8][12]

Cleo Credit Builder is a good option if you're a student. The roast mode can help you improve your credit. Students and recent graduates might also receive a 33% discount on subscriptions if offered.

Spending a lot on overdraft fees? You can go for this next option.

Chime SpotMe

|

| credit chime |

|

|

Loan amount: Spot $20 to $200

Processing time: Immediately

Repayment date: On your next deposit or payday

Chime SpotMe can spot you up to $200 for free without the credit check, minimum balance, or monthly fees. If you frequently get overdraft fees from your bank, it can be a big help.

Chime works a little differently. You have to open a Chime account, direct deposit your paycheck into your account, and use their card (whereas with Albert Instant, you need to open an Albert Cash account, and you need to connect your current bank account to your Albert account).

You can use your debit card right away, which makes it great for emergencies. You can also use it for ATM withdrawals to get cash fast.

Chime Requirements:

Here's what you need to set up Chime SpotMe:[13]

- A qualifying direct deposit of $200 or more within the past 34 days

- An activated Chime Card

- You should be at least 18 years old or older

Other Chime Services:

With a Chime Checking Account, you can get access to your pay 2 days before payday. It has no overdraft with zero monthly fees.

Yes, Chime is legit. It has a 4.8/5 rating on the App Store from 1.1M reviews. Their banking services are provided by Bancorp Bank or Stride Bank, which are members of FDIC.[14]

Need a cash advance with faster processing time? This next app won't disappoint.

Tilt (formerly Empower)

|

|

Loan amount: Up to $400

Processing time: Instantly

Repayment date: Next payday

Tilt Cash Advance has one of the quickest cash advances in the market. Sometimes, it only takes a minute to get your money. And there are no credit checks needed.

You can choose this app if you need money right away. Although, like Brigit, Tilt (formerly Empower) charges a fee of $8/mo.[15]

Other Tilt (formerly Empower) Services:

Tilt Card is a debit card feature with no overdraft fees. Its perks include free instant delivery of your cash advance and up to 10% cashback deals.[16]

MoneyLion

|

|

Loan amount: Up to $500

Processing time: 2-5 business days; within minutes through Turbo delivery (for a fee)

Repayment date: On your next payday

MoneyLion offers cash advances for free through Instacash. There are also no interest and credit checks needed. If you need short-term loans to solve your money problems, it's got you covered.

With numerous features, you can explore more financial tools and services that can improve your money management skills. It could greatly benefit those who want to get out of a debt cycle.

MoneyLion Requirements:

If MoneyLion Instacash sounds good to you, then you'll need:[17]

- An account that has been active for two or more months

- History of recurring income deposits in the account

- Positive balance on the account

Other MoneyLion Services:

You can get Financial Heartbeat which is a free feature that tracks your spending, insurance, savings, and credit health. It can help you make better financial decisions.

On the other hand, Managed Investing is a handy investing feature for beginners. MoneyLion will assess what investments fit you. If you want to take the leap, they will manage your portfolio.

There are also Crypto Auto-Invest and Credit Builder Plus ($19.99) features that can take your finances to a higher level.[18]

Looking for other financial tools? Maybe this next app can help you out.

Klover

|

|

Loan amount: Up to $200

Processing time: 1-3 days; 24 hrs. for a fee ($1.49 to $21.99)[19]

Repayment date: On your next payday

Klover Balance Advance Service gives you access to up to $200 even if your payday is 2 weeks away. There are also no interest or credit checks needed on your account.

You can even get your money quickly. But if you need the cash instantly, delivery fees can be expensive.

Klover Requirements:

To borrow from Klover, these are their qualifications:[20]

- A checking account that has received at least 3 direct deposits and has been consistent for 60 days

- Checking account must be in good standing for 90 days or more

- Must have no gaps in pay

- Paid on a weekly or bi-weekly schedule

Other Klover Services:

Klover+ features Personal Financial Management Services. This subscription feature, worth $4.99 per month,[21] also gives you access to Klover Cash Out Program and Budget Tools.

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

But what if you don't need all this? If the apps so far seem excessive, FloatMe might be what you're looking for.

FloatMe

|

|

Loan amount: Up to $100

Processing time: 1-3 business days; 8 hrs. for a fee[22]

Repayment date: Set your own repayment date[23]

For $4.99 per month, FloatMe can lend you up to $100 to get you through your next payday. This app is a good choice for those who want to borrow a lower loan amount.

There are no interest and credit checks. And they provide spending insights that you can use to improve your spending habits. It's an excellent app for those who want to borrow less and save better.

You can get your money in 1-3 business days for free through ACH transfers. But you can pay $1 to $7 if you need it in 8 hours. The money will be delivered to your debit card.

FloatMe Requirements:

To be eligible for a Float, you must:[24]

- Have a FloatMe User Account

- Have a recurring income and at least 2 consecutive bank deposits from an eligible source

- Have a valid debit card

Other FloatMe Services:

You can get a Personal Financial Management Service (PFMS) which can help you keep your finances in check and make better spending habits.

This next app comes with a monthly membership fee. But you can get instant advances without express fees.

B9

|

|

Loan amount: Up to $100 for a B9 Basic Plan; Up to $750 for a B9 Premium Plan[25]

Processing time: 1-5 business days; instantly for a fee

Repayment date: On your next deposit or paycheck

B9 is a cash advance app where you can advance your money instantly and 15 days before payday. This comes with no interest and no credit checks. But it does come with a cost.

B9 Basic Plan is priced at $11.99/mo. You can take up to $100 of your salary instantly. And with their B9 Visa Debit card, you can enjoy up to 5% cashback and zero-fee transfers.

Taking the cake for the highest cash advance, however, is the B9 Premium Plan. For $19.99/mo, you can get $750 of your pay in advance and instantly. You can also get the benefits of a credit report, credit bureau score, and credit score simulator.

B9 Basic Plan Requirements:

All you need to get a cash advance from B9 are:[27]

- A B9 account in good standing

- Direct payroll deposits to your B9 account

- Receive a direct deposit of $300 or more within the last 14 days

- Account balance equal to or greater than $0

- All previous cash advances paid

With B9 Premium, you will be eligible for an advance of up to $750 from your paycheck depending on your B9 account history, frequency of your direct payroll deposit, and other factors determined by B9.[27]

If you're worried about not being able to borrow because of bad credit, this next app is for you.

Possible

|

|

Loan amount: Up to $500; Up to $250 (in California)

Processing time: About an hour for debit card transfers; 1-2 business days for ACH transactions (5 days maximum)

Repayment date: 4 equal payments within 2 months (8 weeks)[28]

Possible Loan is an online loan app marketed as a payday loan alternative, where you can borrow up to $500 (even with bad credit). They can also process your loan in minutes. But what makes Possible stand out from the list is their repayment method.

You can pay in 4 equal installments for up to 2 months. And it comes with a 29-day grace period. There are also no late fees.

You can receive your Possible Loan funds within minutes and have more leeway in terms of repayment. If that sounds enticing, you can get on with the requirements.

Possible Requirements:

To get a Possible Loan, you need:[29]

- U.S. cellphone number

- Social Security Number

- Valid state-issued ID or driver's license

- A checking or savings account with 3 months of transaction history, income deposits of $750 per month or more, and a positive account balance

Possible can only accept new loan applications from Alabama, Arizona, Arkansas, California, Delaware, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, North Carolina, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington state, and Wyoming.[30]

This next app is a little tricky with its fees. But you can get a loan amount for free.

Varo

|

|

Loan amount: Up to $500

Processing time: Instantly

Repayment date: Custom repayment from 15 to 30 days

With Varo Advance, you can take a cash advance of up to $500 without interest. But compared to other apps on the list, Varo charges a fee for cash advances. Among all the apps on the list, it's on the pricier side.

Here's how much it can cost you:

| Loan Amount | Varo Fee |

|---|---|

| $20 | $1.60 |

| $50 | $4 |

| $75 | $6 |

| $100 | $8 |

| $150 | $12 |

| $200 | $16 |

| $250 | $20 |

| $300 | $24 |

| $400 | $32 |

| $500 | $40 |

There are pros and cons when comparing this to Albert. Although you can get the same amount ($250), the fee means you're really only getting $230. But while Albert offers a higher cash advance, you don't have to wait long for your cash advance with Varo.

Varo Requirements:

Here's what you need to use Varo:[31]

- A Varo bank account that is active and in a positive standing

- At least $800 in qualifying direct deposits to your Varo bank account

Other Varo Services:

Varo Bank Account provides a trustworthy banking service with no monthly maintenance and overdraft fees.

Now that you've seen your other options, here's a refresher on what Albert is and what you can get with it.

What Is Albert?

Albert is a financial app that allows you to take out an advance of up to $1,000 if you meet certain requirements.

But what makes it stand out from banks and lenders is that they don't charge interest, and there are no credit checks.

Yep, you read that right. Albert doesn't need to check your credit score before you can access an instant cash advance. That's one less requirement you need to worry about.

When should you use Albert?

You can use Albert during emergencies. You can get an instant cash advance of up to $1,000.

On the flip side, Albert may not be for you if you have trouble controlling your spending. Because Albert is convenient, it's easy to get trapped in a debt cycle.

But it can be an option if you're a bit strapped for cash and you can repay what you owe.

Why are Apps Like Albert better than Payday Loans?

Apps on this list were designed to give you access to money with just a tap on your screen. You can use it for emergencies. Compared to Payday Loans, these are more convenient.

On top of that, most apps on this list don't require a credit check, have no interest, and charge lower fees. They also have requirements that are easier to meet than those asked by banks and lenders.

How to pay cash advances faster and break the loan-and-repayment cycle?

Repaying a huge loan from cash advance apps could be challenging. Part of your salary is already going to be used for repayment. And the bills just keep on coming.

It can be hard to ensure you still have money to spend. Here are some tips to help you break the loan-and-repayment cycle:

- Remember your due dates

Plot your due dates on your calendar. This can help you adjust your budget while still paying off your loan. - Use budgeting and spending tools

Budgeting and spending tools can help you monitor your spending and learn how to budget correctly. It can kick-start your journey to understanding your spending habits. - Earn extra income

You can pay your loans faster by getting a side hustle. Or go for apps that can help you make some extra cash. - Have an emergency fund

Emergency funds can help you get by when urgent situations arise. Find out how much you need in one to help avoid bank loans and payday lenders.

How we came up with the list

Albert is a financial app known for its instant cash advance. So when making this list, we searched for apps that give fast access to cash when needed and with less hassle.

We looked into their features and the amounts you can get covered with or borrow. We also took note of the repayment dates, so you'll have options on when you want to repay.

Bottom Line

We get it. Albert is a useful and trusted app. But there are plenty of apps like it in the market. With a few of them on this list, you can potentially see a better fit for your needs.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

The extra services may even help you get your finances in better shape. But whether you need a small or large amount of cash, there's an option you can choose.

References

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Who can use EarnIn?, Retrieved 09/06/2025

- ^ EarnIn. What is Balance Shield?, Retrieved 09/06/2025

- ^ Dave. Dave Membership, Retrieved 09/06/2025

- ^ Dave. ExtraCash™ eligibility, Retrieved 09/06/2025

- ^ Brigit. How to access Instant Cash, Retrieved 09/06/2025

- ^ Brigit. Pricing, Retrieved 09/06/2025

- ^ Cleo. Terms & Conditions, Retrieved 09/06/2025

- ^ Cleo. FAQ: How does repayment work?, Retrieved 09/06/2025

- ^ Cleo. How do I extend my repayment date?, Retrieved 09/06/2025

- ^ Albert. How does Instant advance repayment work?, Retrieved 09/06/2025

- ^ Cleo. What is Cleo Builder, Retrieved 09/06/2025

- ^ Chime. How to use Chime's SpotMe, Retrieved 09/06/2025

- ^ App Store. Chime - Mobile Banking, Retrieved 09/06/2025

- ^ Tilt. What is Tilt's subscription fee?, Retrieved 09/06/2025

- ^ Tilt. What features are available on the Tilt app?, Retrieved 09/06/2025

- ^ MoneyLion. FAQs: How do I qualify for Instacash?, Retrieved 09/06/2025

- ^ MoneyLion. Moneylion Fee Schedule, Retrieved 09/06/2025

- ^ Klover. Pricing, Retrieved 09/06/2025

- ^ Klover. Eligibility requirements, Retrieved 09/06/2025

- ^ Klover. Membership fees, Retrieved 09/06/2025

- ^ FloatMe. 10.3 Float Delivery and "Instant" Floats, Retrieved 09/06/2025

- ^ FloatMe. Terms & Conditions, Retrieved 09/06/2025

- ^ FloatMe. 10.2 Your Eligibility for Floats, Retrieved 09/06/2025

- ^ B9. Subscription Plans, Retrieved 09/06/2025

- ^ B9. Is my money FDIC insured?, Retrieved 09/06/2025

- ^ B9. Terms of Service: The B9 Advance Service, Retrieved 09/06/2025

- ^ Possible Finance. What Are My Original Payment Dates?, Retrieved 09/06/2025

- ^ Possible Finance. Applying for a Loan, Retrieved 09/06/2025

- ^ Possible Finance. State Eligibility, Retrieved 09/06/2025

- ^ Varo. Varo Advance, Retrieved 09/06/2025

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|