Best Money Borrowing Apps

Money borrowing apps can be your saving grace when you're strapped for cash. But how much can you borrow? Are these apps legit? Read on.

|

The 10 best apps for borrowing money are:

- EarnIn for payday advances

- Dave for small amount advances

- MoneyLion for multiple features

- Chime SpotMe for overdraft protection

- Albert for no late or overdraft fees

- Brigit for flexible repayment dates

- SoFi for large amounts & perks

- Possible for grace periods for late payments

- Branch for early payments

- ONE@Work for budgeting tools

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrowing from friends can be difficult. But borrowing money from banks can be even worse. You just want to borrow money with your head high, without hours of paperwork and high interest rates.

That's where the best money borrowing apps come in.

You can borrow up to $100,000 without an awkward conversation. Most don't have lengthy application processes either. Some don't even charge interest.

Read on to find out the pros, cons, and how much you can borrow with money borrowing apps.

10 Best Money Borrowing Apps

Money borrowing apps offer different loan amounts and processing times. Here's a quick look at what you get. We'll cover each app in detail below, including how you can qualify.

| Money Borrowing Apps | Loan Amount | Standard Processing Time |

|---|---|---|

| EarnIn | Up to $1,000 | 1-3 business days via ACH |

| Dave | Up to $500 | 1-3 days |

| MoneyLion | Up to $500 | 2-5 days |

| Chime SpotMe | Up to $200 | Immediately |

| Albert | Up to $250 (overdraft spot) | Instantly |

| Brigit | Up to $250 | 1-3 business days |

| SoFi | Up to $100,000 | Usually within the day |

| Possible | Up to $500 | Usually 1 hour |

| Branch | Up to 50% of your pay | 3 business days |

| ONE@Work | Up to 50% of your pay | 1 business day |

The BORROW rule helps you remember the key aspects to consider when choosing a money borrowing app:

- Budget-friendly: Ensure the app offers loans that fit your budget.

- Options: Look for a variety of loan options to meet different needs.

- Repayment terms: Check for flexible and reasonable repayment terms.

- Reliability: Choose a reliable app with good reviews and a solid reputation.

- Overdraft protection: Look for apps that offer features like overdraft protection.

- Withdrawal ease: Ensure funds can be easily withdrawn when needed.

Yes, money borrowing apps on this list are legit and reputable. They also take security measures to make sure the information you share with them stays safe.

EarnIn: Best for payday advance loans

|

| CREDIT earnin |

- Loan Amount: up to $150/day, and up to $1,000/pay period [1]

- Processing Time: 1-3 business days via ACH

, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

- Repayment Date: EarnIn will automatically deduct your payment on or after your payday.

Why Choose EarnIn:

EarnIn lets you Cash Out up to $150/day, and up to $1,000/pay period [1] Unlike other money borrowing apps, the amount you can access from EarnIn will be based on your pay. This works great for making sure you can afford to pay back the money.

They also have a Balance Shield feature that can automatically transfer $100 of your earnings when your balance falls below your selected threshold amount (0-$500).[2] Perfect for emergencies.

Using EarnIn Cash Out does not have a monthly fee.

|

|

EarnIn Cash Out Requirements:[3]

- A regular pay schedule

- A linked checking account

- A permanent work location, an electronic timekeeping system, or a PDF timesheet to track your hourly earnings

Your credit score will not be affected. However, EarnIn will put your account on hold and send you an email about your repayment.

Need to borrow money for your next coffee run? Check out our next app.

Dave: Best for Small Amount Advances

- Advance Amount: Up to $500

- Processing Time: ACH transfer to a bank account takes 1-3 days at no charge. For a fee, you can transfer to a connected account within minutes with express delivery.[4][5]

- Settlement Date: On your next payday or the nearest Friday if Dave can't detect your payday.

Why Choose Dave:

Whether you need last-minute support for a flat tire or a medicine prescription, Dave ExtraCash™ account has your back.

For a $1 monthly membership,[6] you can get up to $500 with ExtraCash™. The monthly membership fee covers a range of services, including access to account monitoring, notification services, and maintaining a connection to your external bank account.

It has no interest or credit check. Definitely useful when you need an advance on short notice.

|

|

Dave ExtraCash™ Eligibility Contributing Factors:[7]

- An external account with a 60-day history

- 3 or more recurring deposits

- Total deposits of $1,000 or more per month

No, Dave doesn't charge a late fee. But if you can't pay them back, your account will be suspended.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave is not a bank. Banking services provided by Coastal Community Bank, Member FDIC. The Dave Debit Card is issued under a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved within 5 minutes, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers. See dave.com.

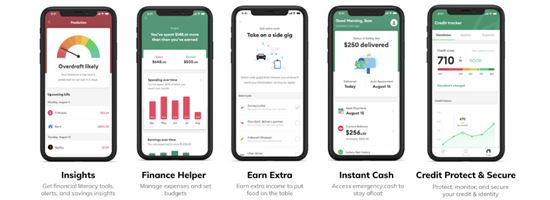

MoneyLion: Best for multiple features

- Loan Amount: Up to $500

- Processing Time: Regular delivery to an external account takes 2-5 business days. But you can get your loan within minutes through their Turbo delivery for an extra fee.

- Repayment Date: On your next payday

Why Choose MoneyLion:

For a more all-in-one money borrowing solution, try MoneyLion.

Similar to EarnIn, MoneyLion Instacash doesn't charge interest or check your credit. Unlike these apps, MoneyLion only lets you borrow up to $500. But they have multiple features and can help you with short-term loans or long-term financial solutions.

|

|

MoneyLion InstaCash Requirements:[8]

- A bank account that's been active for two or more months

- A history of recurring income deposits

- A positive balance

In addition, MoneyLion also offers features to help you improve your finances. Financial Heartbeat is a free money-monitoring tool that tracks your spending, savings, and credit health.

- Managed Investing

- Crypto Auto Invest

- Credit Builder Plus (costs $19.99)[9]

For more money borrowing apps with helpful financial tools, also check out Albert or Brigit.

Chime SpotMe: Best for overdraft protection

|

| credit chime |

- Loan Amount: You can get from $20 to $200 with Chime.[10]

- Processing Time: Chime can spot you immediately.

- Repayment Date: Repayment will be on your next deposit or payday.

Why Choose Chime:

With the Chime Debit Card, they will spot you up to $200 for free to cover overdrafts from cash withdrawals or debit card purchases. It is useful for those who tend to withdraw beyond their account balance.

Since many banks will charge you $30 or more for overdrafts, you could save hundreds of dollars in overdraft fees over the life of your account with Chime SpotMe. And it comes with no credit check, minimum balance, or monthly fees.

An overdraft fee is charged by your bank when you exceed your account balance. It is usually around $30.

They also offer a checking account that can get you access to your pay 2 days earlier.

|

|

Chime SpotMe Requirements:[11]

- An activated Chime Visa Debit Card.

- A deposit account connected to Chime.

- A qualifying deposit of $200 and above, 34 days before you request for an overdraft spotting.

- At least 18 years old.

Try SoFi. They can loan you from $5,000 to $100,000.

Keep scrolling if you are searching for an app that can do more than spot your overdraft.

Albert: Best for no late or overdraft fees

- Loan Amount: You can access up to $250 overdraft coverage on Albert Instant. [12]

- Processing Time: Instantly.

- Repayment Date: Automatic upon Albert Cash account fund deposit.

Why Choose Albert:

Albert Instant offers overdraft coverage (up to $250) without late fees, interest, or credit checks. But you may get a temporary suspension from accessing additional overdrafts if any repayments are 10 days overdue.

And if you want to receive your paycheck up to 2 days earlier, Albert can help as long as you set up your direct deposit with Albert Cash.

There are budgeting and financial advice tools in the app too. You can improve your financial health and make the right budgeting decisions using Albert.

|

|

Albert Instant Requirements:[13]

- An active bank account linked to an Albert Cash account

- Has activated Smart Money feature on the app

- Has turned on overdraft coverage in app settings

- An Albert Cash account and Genius account in good standing

Albert is not a bank. Albert Savings accounts are held in FDIC-insured banks like Wells Fargo. This means your funds are protected by the federal government up to $250,000. It also has 4.6 stars on the App Store with more than 184,000 ratings.

Most payday loan apps on the list have a free money-borrowing feature or a low-cost subscription. Would an app with a higher subscription fee work better? Let's find out.

Brigit: Best for flexible repayments

|

| CREDIT hellobrigit |

- Loan Amount: Up to $250

- Processing Time: Brigit takes 1-3 business days. But if you pay a small fee, they can process it within 20 minutes.

- Repayment Date: Set your own repayment date. You can pay earlier or get an extension if you need more time.

Why Choose Brigit:

The previous apps have an automatic repayment date on your loan. But with Brigit Instant Cash, you can get up to $250 with no interest, no credit check, and flexible repayment. So if you're looking for an app that lets you decide your repayment day, Brigit's a good one.

The $250 cash you can borrow from Brigit is similar to Albert and MoneyLion. Compared to the two, Brigit charges a $8.99 subscription fee.[14] This includes Auto Advances, which automatically covers you when you're at risk for an overdraft.

|

|

Brigit Instant Cash Requirements:[15]

- A checking account has been active for at least 60 days

- More than $0 in your balance

- 3 recurring deposits on your account from the same source

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

SoFi: Best for large amounts & perks

- Loan Amount: $5,000 to $100,000[16]

- Processing Time: Usually, SoFi can get you your loan within the day your loan is approved.

- Repayment Date: You can pay your SoFi loans monthly within 2-7 years.

Why Choose SoFi:

SoFi is a personal loan app where you can borrow from $5,000 to $100,000 with no pre-payment needed. It is great for a home renovation or even starting your own small business.

Compared to apps that let you borrow a smaller amount, SoFi charges a fixed interest, which means the interest rate stays the same throughout the life of your loan and you will pay the same amount each month.

But paying the loan gets tricky if you suddenly get unemployed. For this, SoFi has unemployment protection where they can modify your payment and even help you find a new job.

SoFi will request a full credit report from consumer reporting agencies. This is a hard credit inquiry, which will usually ding your credit score by 5 points or less. However, if you pay your loan on time, it could help improve your credit.

|

|

SoFi Loan Requirements:[17]

- You need to be in the age of majority in your state (usually 18 years old).

- You must be a U.S. citizen, permanent resident, or non-permanent resident alien.

- You must be employed, have sufficient income, or have an offer of employment to start within the next 90 days.

- Credit report

Can you borrow $500 when you have bad credit? It's possible.

Possible: Best for grace periods for late payments

- Loan Amount: Depending on your state, you can borrow up to $500.00. But if you're from California, the maximum loan amount with Possible is $250.

- Processing Time: Loans usually take about an hour, if it is transferred to your debit card.But if you choose an ACH transaction, it will take around 1-2 business days.

- Repayment Date: You can repay your loan in 4 equal payments within 2 months (8 weeks).[18]

Why Choose Possible:

Possible Loan lets you borrow up to $500 even with bad credit. And when your loan gets approved, Possible can process your loan within minutes.

But what makes Possible different is how you can pay in installments. No matter how often you get paid, you will repay your loan in 4 equal payments for 2 months.[19]

And if you can't pay on time, don't worry. Possible has a penalty-free 29-day grace period.

|

|

Possible Loan Requirements:[20]

- Valid state-issued ID or driver's license

- Social Security number

- Checking or savings account with 3 months transaction history, recent income deposit, and positive account balance

Possible will only accept new loan applications from Alabama, California, Delaware, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nevada, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, and Washington State.

Your employer or company also has access to some paycheck advance apps. Read below to know what these are.

Branch: Best for early payments

- Loan Amount: Depending on your employer, you can get up to 50% of your pay before payday.

- Processing Time: You can get the advance instantly using the Branch digital wallet. Or you can withdraw the advance from your bank account in 3 business days.

- Repayment Date: On your next payday

Why Choose Branch:

Branch offers Earned Wage Access where you can borrow up to 50% of your pay. It's similar to EarnIn, where you can get your pay in advance.

But compared to EarnIn, Branch is employer-sponsored. You don't have to set up the account yourself. Instead, your employer will set it up for all their employees.

To see if you can use Branch, check with your company or employer to see if they're partnered with Branch.

|

|

If your employer doesn't use Branch, maybe you can use this next app.

ONE@Work: Best for budgeting tools

- Loan Amount: Up to 50% of your salary

- Processing Time: With no extra charge, you will receive your money through your bank account in one business day. Or you can get your money through a Walmart MoneyCenter.

- Repayment Date: On or after your payday

Why Choose ONE@Work:

Similar to Branch, ONE@Work is an interest-free employer-sponsored cash advance app. But compared to the previous app, ONE@Work has a faster processing time.

ONE@Work Instapay can give you access to 50% of your pay before payday and deliver it within 1 business day to your bank account. Or you can get it from a Walmart MoneyCenter.

Plus, ONE@Work has handy savings and budgeting tools too.

|

|

First, you need to request a cash pick-up in the ONE@Workapp. At the Walmart MoneyCenter, you'll need to provide: your 11-digit reference code in your ONE@Work app, a valid ID (like a driver's license), and your SSN.

Other Money Borrowing Apps

If you're still searching for other options, we got you. Here are a few more money borrowing apps that may work for you.

- Varo

Varo can get you up to $500 cash advance without impacting your credit score. They charge a flat fee depending on your loan amount. And instead of paying on your next payday, you can pay for your Varo loan within 30 days. - SoLo Funds

SoLo Funds is a peer-to-peer lending platform where you can borrow $20 to $575. It's great when you need a little more wiggle room for repayment because you can repay your SoLo Funds loan in 35 days. - Empower

Empower charges an $8 monthly subscription for up to $300 cash advance. They can deliver your cash instantly for a fee with no interest and no credit check. They also offer a debit card with tons of cashback deals.

How Money Borrowing Apps Work

Money borrowing apps can lend you up to $100,000. And they're more flexible than traditional lenders. Most apps don't require a credit check and have lower interest rates.

Some apps don't charge interest at all.

Also, money borrowing apps have a more flexible repayment schedule. You can pay automatically on your next payday, pay earlier, or pay in installments. And most of them don't charge a penalty or late fee.

Yes, because most money-borrowing apps would check your account (not your credit) to see how much money you can borrow.

Pros and Cons of Money Borrowing Apps

Pros:

- Cheaper fees

Most apps let you borrow money without a subscription or extra fee. And compared to traditional lenders, they have a lower interest rate. Some don't charge any interest. - Useful for emergencies

Most money borrowing apps don't have a credit check. Asking for a loan takes minutes, and you can get your money within minutes to a few days. This makes them a great choice in emergencies. - Budgeting tools

Money borrowing apps feature helpful budgeting and finance information tools you can use to manage your money better. - No late fees, flexible repayment

Plenty of money borrowing apps are forgiving regarding repayment. And they come with different repayment plans, so you can choose which one you can handle.

Cons:

- Loan amount depends on your eligibility

You won't always be eligible to receive the maximum loan amount. - Increase your debt

Because money borrowing apps are convenient, you may overly rely on them. And when you do, you could be stuck in deeper debt. So use these apps wisely.

Yes, money borrowing apps have their specific safety measures to protect their users such as encryption and data protection.

Is it Smart to Use Apps to Get a Loan?

Money borrowing apps are a good safety net for quick financial emergencies. They have lower fees, and most don't require a credit check.

Whether it's a few bucks for gas or a couple hundred for a much-needed doctor's appointment, you can count on an app to get a loan. They're also good for once-in-awhile purchases that you'll quickly pay off on your next payday.

For urgent needs, you can take advantage of their fast processing time and even instant delivery. But when you depend on these apps for a lot of your expenses, you could get trapped in more debt.

No matter how quickly you need the cash, be sure to take your time to choose the most suitable app for your needs.

Among the cash advance apps, Possible is among the fastest. They take about an hour to transfer money to your debit card.

How to Choose the Best Money Borrowing App

Borrowing money is a decision you need to make carefully. To help you with that, we have some tips on how you can choose the best money borrowing app.

- Check your eligibility

Your loan amount depends on your eligibility, so check how well you fit the criteria. The better you fit, the higher your loan amount will be. - Choose a comfortable repayment period

Money borrowing apps have different repayment periods. You can pay in installments, on your payday, or choose your own date. - Read user reviews

If you have chosen a money borrowing app, look into the user reviews. It can help you get a clearer picture of how a loan with that app would be. - Check for fees & interest

When using money borrowing apps, there are a few possible fees that you should look out for (late fees, subscription fees, express delivery fees, etc.). You need to consider these carefully to ensure you get a good deal.

APR = (Loan amount / Days in loan term/ Fees) x 365 days x 100.

Money Borrowing App Alternatives

If you're still on the hunt for other ways to get some cash, here are a few you can try out:

- Borrow from family or friends

Reaching out to a friendly face when you need financial support would be less intimidating than going to a bank. You can take a leap of faith when an emergency strikes and borrow from your family or friends. - 0% APR credit cards

Several credit cards offer 0% intro APR. These help you spend on what you need without the additional interest for a certain period of time. - Buy Now, Pay Later Apps

Buy Now, Pay Later apps break down your one big purchase into manageable payments. If you need to buy something right now but can't make a one-time payment, this is a good option. - Personal loan

Personal loans can offer you a higher loan amount than most money borrowing apps. But before making your first loan, do your careful research to make sure you choose the best one. - Credit Union Loans

Compared to banks, credit unions are often more flexible with their lending terms. And if you have bad credit, you can consider a credit union membership and check out their deals.

How we came up with the list

To make this list, we looked into money borrowing apps with the strongest features that cater to differing needs.

We started by considering the maximum loan amounts, and the time it takes to receive your loan. Since these apps are best for emergency use, the best apps will offer money quickly.

And for a convenient money borrowing experience, we included apps with uncomplicated eligibility requirements. This will help you make the best choice on which app to borrow money from.

Finally, we looked at the repayment options. Some offer repayment on your loan on your next payday, and others offer repayment dates months or years in the future. We made sure you have plenty of options.

Bottom Line

Hard times are unpredictable. And sometimes, borrowing money from your friends or family is not the best pick. So when you need cash urgently, you should have a few sources ready.

With money borrowing apps, you can borrow $200 and go as high as $100,000. You can pay on your next payday or pay in installments. There are plenty of apps to choose from.

Whether you need a few bucks or small business capital, there's a money borrowing app for you. Check them out and see which works for you.

References

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Why did I automatically receive a transfer?, Retrieved 07/29/2024

- ^ EarnIn. Who can use EarnIn?, Retrieved 07/29/2024

- ^ Dave. How the ExtraCash account works, Retrieved 07/29/2024

- ^ Dave. Dave Extra Cash Account Deposit Agreement and Disclosures: L. Fees And Fee Schedule, Retrieved 07/29/2024

- ^ Dave. Dave Membership, Retrieved 07/29/2024

- ^ Dave. Taking an ExtraCash advance + contributing factors, Retrieved 07/29/2024

- ^ MoneyLion. FAQs: How do I qualify for Instacash advances?, Retrieved 07/29/2024

- ^ MoneyLion. Moneylion Fee Schedule, Retrieved 07/29/2024

- ^ Chime. Fee-Free Overdraft with SpotMe, Retrieved 07/29/2024

- ^ Chime. FAQs: Who is eligible for SpotMe?, Retrieved 07/29/2024

- ^ Albert. Albert Instant, Retrieved 07/29/2024

- ^ Albert. How do I qualify for Albert Instant?, Retrieved 07/29/2024

- ^ Brigit. How much does Brigit cost?, Retrieved 07/29/2024

- ^ Brigit. How to access Instant Cash, Retrieved 07/29/2024

- ^ SoFi . Personal loans, Retrieved 07/29/2024

- ^ SoFi. Personal Loan Eligibility, Retrieved 07/29/2024

- ^ Possible Finance. What Are My Original Payment Dates?, Retrieved 07/29/2024

- ^ Possible. What Are My Original Payment Dates?, Retrieved 07/29/2024

- ^ Possible Finance. Approvals, Retrieved 07/29/2024

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|