How Much to Really Spend on a Car

Learn how much of your income you can afford to spend on a car. Get the car buying rule everyone should know to avoid common mistakes.

|

| © CreditDonkey |

Cars aren't cheap (and often the cheap ones end up costing the most.) Besides monthly payments, you'll need to pay for regular maintenance, repairs, insurance and gas.

Make sure you know what you can afford before you head to the dealership. There are other factors to consider as well, including:

- Choosing between a new or used car

- Safety and other important features

- Whether financing is right for you

In this guide, you'll learn:

Check prices and discounts for:

What's Your Financial Situation?

|

| © CreditDonkey |

Before you start shopping for a new car, consider your budget.

How much disposable income do you have? These are the funds left over after you pay your monthly obligations, such as the mortgage, utilities, consumer debts, and food.

Knowing this figure will give you an idea of how much room you have for a car payment. Now consider:

- Is the money left over after paying your bills just cutting it?

- Do you have plenty of money for daily living without sacrificing?

- How will a car payment affect your bottom line?

After you know how much you can reasonably afford, you should research pricing online. You can stretch your buying power by finding the best discounts before going to your local dealerships. At the minimum, you should at least visit CarsDirect for deals on new cars and used cars to get a better idea on how much vehicles really cost in your area.

Once you have a budget, you'll need to find a price range you can afford. Keep reading to learn how.

The "Rules" for Spending on a Car

|

| © CreditDonkey |

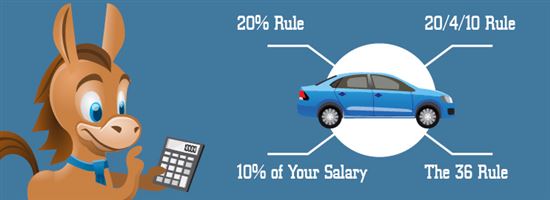

The "20% Rule" certainly sounds simple. But if you think about it, taking up 20% of your income just on your car payment leaves 80% for everything else.

Consider your mortgage, consumer debt, medical expenses, food, utilities, and the daily cost of living. You may stretch your budget outside of its limits.

These rules may work better for your lifestyle.

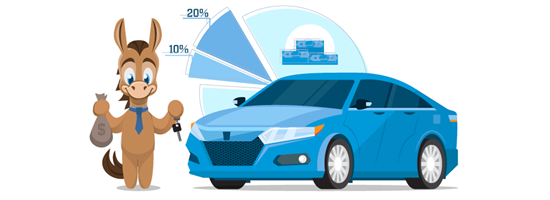

- 10% of your salary: If you want to be frugal about buying a car, stick to 10% of your annual salary. If you make $50,000 per year, that means you can spend $5,000.

That's probably not feasible for the average driver. This rule may only work if you need a car to literally get from Point A to Point B.

- The 36% Rule: With this rule, your total loan payments shouldn't take up more than 36% of your salary. This includes your mortgage, car loan, personal loans, student loans, and minimum credit card payments.

If you make $75,000 per year, your total loan payments shouldn't exceed $2,250 per month.

- The 20/4/10 rule: Put down 20% on a car, finance the car for no more than 4 years, and keep your car payment less than or equal to 10% of your salary.

This includes the principal and interest on the loan, plus monthly insurance expenses.

Instead of overspending at a local dealership, consider checking prices online. One trustworthy resource is CarsDirect. You can find deals on new cars and used cars to research how much vehicles really cost in your area.

Jeanne Kelly, credit coach

Below we'll teach you how to set reasonable expectations to save money.

Your Car Expectations

|

| © CreditDonkey |

If the car will be your main mode of transportation, you'll need to consider the following factors:

- Fits your needs: The size of your family and the age of your children may play a role.

If you have small children that you have to climb in to get situated in the car, you may want a minivan or other vehicle that is easily accessible. If you are a single male (or female), you may prefer something flashier and faster.

Think about safety, and your family size now and in the near future when thinking of your car needs.

- Fits into your lifestyle: Think of the functions you need/want out of your car.

Will you travel and need a lot of extra space for luggage? Will you run carpools? What type of conditions will you drive the car in?

These factors can help you choose the right style car.

- Has the latest features: Safety should probably hit high on your list of features, but there may be other "cool" features you desire, such as satellite radio. You can save some money by checking to see the current best SiriusXM deals.

List them from highest to lowest when you shop for a car. Know which features you absolutely cannot live without.

Curious about how much you might spend on a new or used car? Keep reading for the answer.

Average Cost of a Car

The average price of a new car is $31,000 while the average price of a used car is $19,700.

But there's more to consider than just the cost. New cars take a much larger depreciation hit than used ones. In other words, they lose their value much faster.

In the first year, you could lose as much as 19% of the car's value. By the 4th year, your car may be worth slightly less than half of what you paid.

If you plan to drive the car until it falls apart (literally), depreciation may not bother you. But if you are the type who trades cars in every 2 years, consider buying a used one that has already absorbed the depreciation.

Here's a list of current prices for popular new cars.

- Compact: $20k

- Mid-Size Sedan: $25k

- Full-Size Sedan: $34k

- Hybrid: $25k

- Fully Electric: $37k

- Mid-Size SUV/Crossover: $38k

- Mid-Size Pickup Truck: $32k

- Minivan: $34k

Make Your Rules Based on Your Budget

|

| © CreditDonkey |

Now that we've covered the rules, your expectations, and the average cost of a car, it's time to make your rule.

Going back to your budget, take a long, hard look at each rule.

- Does spending 10% of your salary make sense? If you make $50,000 per year, this probably won't work. That leaves you $5,000 for a car, which may or may not fit within your car expectations.

Even if you make $100,000 per year, that still only allows you $10,000 for a car.

- Does a car payment fit within the 36% rule? Look at your current debts. How much of your salary do they take up already?

Are you already at 36%? You may think you don't have room for a car payment then. Even if you are close, say 32%, that still doesn't leave much room.

If you make $75,000 per year, that leaves you with $250 for a car payment. Unless you have a decent down payment, you're looking at an inexpensive car. This makes you think long and hard about the need for another monthly payment.

- Do you have 20% to put down? The 20/4/10 rule requires a 20% down payment with the remaining amount financed for no more than 4 years.

The payment should also be less than or equal to 10% of your salary.

While these rules can guide your budget, you might also make your own based on your income and current budget constraints.

Still, try to avoid the temptation to finance your car for much longer than 4 years. Depreciation makes this a poor decision as you have a high likelihood of owing more on the car than its value.

If you have the misfortune of a car accident that totals your car, you may be left making payments on a vehicle that doesn't exist.

Your first instinct to buy a car is likely a dealership. They can make the car buying process easy, since they handle the paperwork and legal aspects of car buying.

But they may not offer the best deal. If you go this route, make sure you shop around with different dealers to get the best deal.

If you are shopping for a used car, independent dealers may have options for you. They generally have a used car lot with a variety of car brands.

Before you choose a car, though, do your research on the dealership. Read reviews and check out their ratings with the Better Business Bureau. It's also a good idea to request the CARFAX report to see the car's history.

Private sellers may offer a good deal on a used car, but it does require a little more work. You and the seller must handle the paperwork and legalities of the transaction.

Negotiating with a private seller may be a little less stressful for you, though, since the seller probably isn't using high-pressure sales techniques.

Exercise caution when buying from a private seller, though. Obtain a CARFAX report at a minimum. Having a mechanic inspect the vehicle may be even better.

Things to Consider

What's the primary use for the car? Focus on this reason before any others. If you're mostly planning to drive the kids around, a two-door coupe probably isn't the best idea.

What other large purchases will you make in the future? The average buyer keeps their car for 6 years. Consider what you plan to do in that time.

Will you buy a house, pay for college, or expand your family? These future expenses should weigh in on how much you spend on a car today, especially if you finance it.

Do you need the flashy expensive car? Has it been a lifelong dream or are you trying to keep up with the Joneses?

No one is paying the car payment and upkeep but you. Keep that in mind when you find yourself looking at the cars that may exceed your budget.

Should You Finance?

|

| © CreditDonkey |

If you can't afford to pay for the car in full, you may need to finance it. While it's not a bad idea to have a car payment, there are some factors to consider.

- Watch the interest: Check with the dealer, your bank, and even local credit unions to find the lowest interest rates available.

Remember: your car is NOT an investment since it depreciates. Paying too much interest could leave you upside-down (owing more than the car is worth).

- Watch the term: Don't finance a car for no more than 4 years. This allows you to pay the car off before it loses more than half of its value.

Those 6- or 7-year terms may seem enticing, but they cost you more in interest by the end.

- Consider other investment opportunities: If you can pay cash for a car, mull the opportunity cost of doing so.

Where else could you invest that money if you didn't buy a car? Do you have a retirement account funded? Do you have an emergency fund set up? If not, the opportunity cost of paying cash for a car may be too big, making financing a good choice.

More tips to save you money below!

How to Save Money on a Car

|

| © CreditDonkey |

Assuming you're buying out of necessity rather than a luxury, use the following tips to save money:

- Do your research. Know the average price for the car you intend to buy. Use Edmunds or Kelley Blue Book for these figures.

Look for any dealer incentives when buying a new car. Also, know the supply and demand of the vehicle.

Are they in demand and hard to find? Or do dealers have plenty sitting on their lot? These points will give you room for negotiation.

- Get quotes from several dealers or sellers. You can do a lot of your car shopping from home on the internet.

Email dealers and private sellers to ask for a quote on a specific car. Then compare those quotes to determine which provides the best deal.

- Find financing. Don't rely on the dealer's financing options alone—search out your own financing.

You may find better deals. This gives you more room for negotiation with the seller too, as it now becomes a cash deal for them.

- Be prepared to negotiate. You may go back and forth with the seller or dealer several times. If they don't provide the deal you want, walk out the door.

Chances are that the seller won't let the deal die; they will eventually meet your expectations. If they don't, there are other cars out there for you.

Bottom Line

When shopping for a car, make sure your expectations align with your budget.

Remember, your car will lose half its value in just four years. Plan long-term to help you make the smartest choice when buying a car.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.