What is a Merchant Account?

Find out why a merchant account could be vital for your business growth. Learn how to process credit card payments with ease.

|

For any business, it's important to be able to take debit and credit card payments.

But this isn't something you can do yourself. Accepting card payments requires the help of a merchant account.

What is it, and how do you get one?

We'll discuss exactly that in this ultimate guide. Read on.

- What is a merchant account?

- Why do I need a merchant account?

- How do merchant accounts work?

- What does a merchant account provider do?

- How much does a merchant account cost?

- How to Get a Merchant Account

- Merchant Account Alternatives

- How to Choose the Right Merchant Account

- Merchant Account Providers to Consider

What is a Merchant Account?

A merchant account is a type of bank account that allows businesses to accept credit and debit card payments. When you take these payments, the money doesn't go straight to your bank account. Instead, payments are held in your merchant account.

The merchant account provider will deduct processing fees before transferring your money to your business bank account. It usually takes 1-2 days.

That said, you don't actually have access to this merchant account. It's just a "holding account." It's all part of how credit card processing works.

A merchant account is an account to hold your credit card payments until the merchant account provider transfers the funds to your business bank account. A business account, on the other hand, typically refers to a business checking account. This is the account where you manage your business finances.

Types of Merchant Account

There are 5 types of merchant accounts. One type is more suited for your business than the other. Let's compare.

- Retail Merchant Accounts

Retail merchant accounts cater to physical stores, offering low fees for setup and applications. But they do require a certain percentage of swiped card transactions. - Mobile Merchant Accounts

Mobile merchant accounts help businesses on the move to accept card payments using phones or tablets. These wireless card readers are usually affordable or free. - eCommerce Merchant Accounts

eCommerce merchant accounts are suitable for online businesses. Your customers will pay through an encrypted page. But these typically have higher transaction fees. - Telephone Merchant Accounts

These accounts work if you're taking payments over the phone. Just enter the customer's payment information on your terminal or computer (software). Other merchant accounts offer this as an add-on. - Mail Order Merchant Accounts

Just like with telephone merchant accounts, you'll input the customer's information through the terminal or computer. It's suitable if you accept credit cards on mail orders.

Now, applying for a merchant account isn't easy. Because of the rigorous process of application, you might ask, do you really need a merchant account?

Why Do I Need a Merchant Account?

You can begin to take credit card payments if you have a merchant account. Compared to PSPs or an umbrella account, having your own merchant account provides more security.

You can also negotiate for lower processing fees if you have a high volume of sales. Plus, you don't need to worry about frozen funds.

But because of the underwriting process, merchant accounts aren't suitable for startups or new businesses. They're better for large and established ones.

Get a traditional merchant account if you're:

- a large and established business

- have steady sales (at least $5,000 a month)

- looking to save on processing rates

At this point, you might be convinced that you need a merchant account. How does it exactly work?

How Do Merchant Accounts Work?

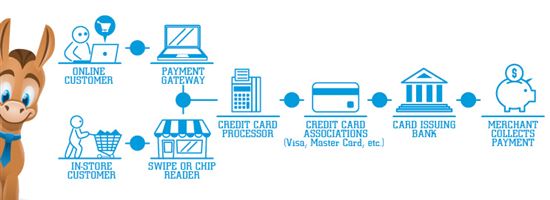

|

| © CreditDonkey |

Your merchant account provider acts as the "middleman" that connects you with the banks. They request approval from the customers' banks and receive the payments for you.

Here's how it works:

- Your customer pays with a credit card in person or online.

- The card details are sent to your merchant bank. The info is forwarded to the card association (Visa, Mastercard, etc.) and on to the customer's issuing bank.

- The issuing bank approves or denies the transaction in real-time.

- If approved, funds from credit card sales are held in your merchant account.

- Finally, your provider transfers the funds from your merchant account to your bank account in 1-2 days (minus the fees).

Now that you know how merchant accounts work, let's talk about what merchant account providers do.

What Does a Merchant Account Provider Do?

A merchant account provider offers the equipment, technology, and services to help you process card payments.

Here's what they can do for your business:

- Accept and process debit cards, credit cards, and other electronic payments

- Provide the hardware and software needed for processing (card readers, POS, payment gateways, and virtual terminals)

- Maintain PCI compliance to protect your customers' credit card data

- Provide online tools that can track transactions, monitor employees and inventory, manage customer data, view sales trends, and more

Essentially, you get an all-in-one processing solution. The merchant account company can provide these services directly themselves or offer them through a third party.

Your merchant account provider also takes on the risk of processing card transactions. Anytime a business accepts credit cards, there's some risk of payment fraud. This is why there's an approval process to open a merchant account.

Of course, none of this comes free. Let's talk about the costs.

How Much Does a Merchant Account Cost?

|

| © CreditDonkey |

Merchant account providers charge the following fees:

- Commission for each transaction (bulk of your fees)

- Monthly fees for various services (such as payment gateway, PCI compliance, etc.)

- One-time incidental fees (such as chargebacks)

In total, you can expect the overall cost to be 2.5% - 3.5% of your processing volume. This means if you have $10,000 in credit card sales each month, your processing fees will be $250 - $350.

Different providers have different fee structures. It's important to find the right one that fits with your business. If you choose one whose pricing is too high, you could be paying hundreds (or even thousands) in processing fees.

But let's say, you already have the budget. The next step is to take action. Let's talk about what you have to do.

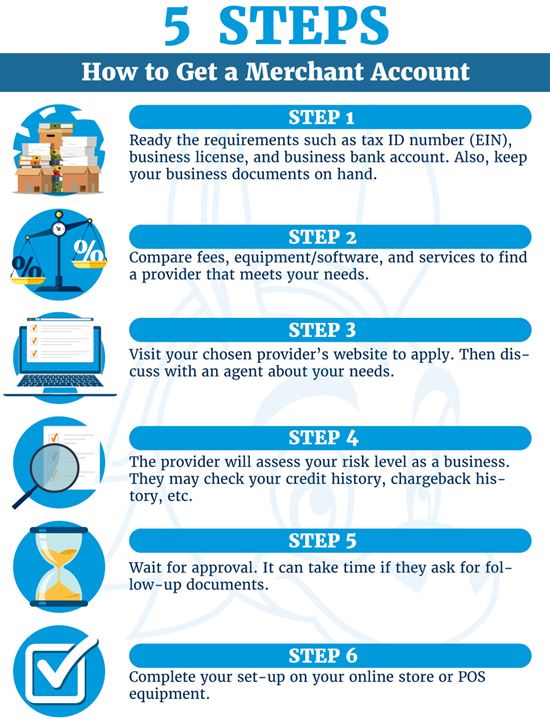

How to Get a Merchant Account

|

You must go through an underwriting process to open a merchant account. The provider wants to know that you're a legit business and understand how risky you'll be to them. This is so they can avoid any potential fraud.

Maybe this isn't your first time applying for a merchant account. You could already be taking card payments but decided to switch providers. Your application could get rejected if your business experiences tons of chargebacks.

You'll want to reduce them first before you apply. Or you could just opt for high-risk merchant accounts. After all, it's hard to reduce chargebacks if it's associated with the nature of your business.

Here are the steps to take when opening a merchant account:

- Prepare the requirements

- Shop around and get several quotes

- Apply to your chosen merchant account provider

- Go through the underwriting process

- Wait for the approval

- Complete your account set-up

You can start taking card payments online immediately after approval. For in-person payments, just wait for your equipment or finish setting up what you already have.

The underwriting process could take time. If you have good credit and have provided sufficient business information, you can get approved in a day. Otherwise, it could take a few weeks. You can start taking card payments the moment you get approved for an account.

It's not the end of the world if you can't get approved for a merchant account. There are some alternatives.

Merchant Account Alternatives

New or small businesses don't need a full-fledged merchant account (and may not even qualify for one). Here are some options to receive payments without a merchant account.

Third-party Payment Services Provider (PSP)

PSPs let you process card payments without opening your own merchant account. Instead, your transactions are processed into one huge merchant account shared with many other businesses.

Even if you're not familiar with the term "PSPs", you've probably heard of Square, Stripe, and PayPal processing. These are some of the most popular PSPs. They're easier to apply for since there's no underwriting process.

But in exchange for convenience, the processing rates are higher. That's why you'll want to switch eventually to a merchant account provider when your business grows.

Money Transfer Service

P2P money transfer services like Venmo, PayPal, or Zelle let customers send money directly to you electronically. If they use Venmo or PayPal, the customer can even use a credit card to pay.

These work best for freelancers, local professionals, or B2B businesses. If you have a trusted customer relationship, they may not mind accommodating your payment request.

How to Choose the Right Merchant Account

|

| © CreditDonkey |

You want to find a merchant account provider with the best processing fees while providing the services you need.

Here's what to consider:

- Processing fees

It's important to get the right pricing structure for your business. Interchange-plus pricing works for most businesses. But larger, high-volume businesses can save with a subscription-based provider (like Stax or Payment Depot).Found a provider offering tiered pricing? You wouldn't want to go for that. It's the most confusing pricing structure AND the most expensive. - Other fees

Pay attention to other account fees and miscellaneous charges. There could be setup fees, monthly maintenance fees, payment gateway fees, chargeback fees, etc. These fees add to the total cost of processing card payments. - No contract

Merchant accounts used to have long-term contracts (3 years). Nowadays, many providers have done away with it. You should be able to cancel whenever you want with no termination fees. - Services and features

Do you need a virtual terminal for phone orders? What about inventory and employee management features? See if the provider is charging for these services. - Equipment

What equipment does the provider offer and for how much? Already have your own equipment? Ask the provider if they reprogram third-party equipment to work with their POS. - PCI compliance

Does the provider help you maintain PCI compliance? Or do they leave it up to you? Do they charge a fee? PCI compliance is essential, so this is something to take note of.

Okay, now that you have the criteria, it's time to go shopping.

Merchant Account Providers to Consider

Here are some of our top picks for merchant account providers:

Payment Depot

Payment Depot is great for high-volume businesses. It offers fixed-rate pricing that can be cheaper than other pricing models.

The basic plan costs:

- $79 per month (process up to $250,000/year)

- In-store: Interchange rate + $0.10

- Online: Interchange rate + $0.18

The membership fee includes a payment gateway and virtual terminal. There are no markups. You only need to pay for the wholesale rates.

That also means you get direct access to the interchange rate.

Dharma

Dharma offers low pricing that's best for mid-large companies processing more than $10,000 per month.

Here's how much it costs:[1][2]

- In-store: Interchange + 0.15% + $0.08

- Online: Interchange + 0.20% + $0.11

- $20/month for retail, online, restaurant

Note that markup for AMEX transactions is higher.

Also, there are no contracts or monthly minimum requirements with Dharma. And each account includes free access to a payment gateway from MX Merchant, which includes a virtual terminal.

Frequently Asked Questions

How hard is it to get a merchant account?

It's not hard to open a merchant account as long as you can prove that you're a legit business and have a good financial track record.

If you have poor credit, a history of missed payments, or an excessive amount of chargebacks, that could make opening a merchant account harder.

If your business is in the high-risk category, look for a provider that specializes in high-risk merchant accounts.

Can anyone get a merchant account?

You must be a legit business to get a traditional merchant account. This means small indie sellers without an official license most likely will not be approved. If you're not sure about opening a merchant account, look to a processing service like Square.

What is required for a merchant account?

You'll typically need a business license, EIN (SSN for sole proprietors), and a business bank account to open a merchant account. Some providers may also request financial statements, previous processing history, and company policies.

Is PayPal or Square a merchant account?

No, PayPal and Square are third-party payment services providers. The main difference is that you don't get your own dedicated merchant account. And there's no underwriting, so you can just sign up and get started very quickly.

The downside is that your account is more prone to holds and freezes since you weren't vetted beforehand. The processing fees are also higher. If you are an established business, we recommend getting a traditional merchant account.

What the Experts Say

As part of our series on entrepreneurship and small businesses, CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

A traditional merchant account is the best option for established businesses with a steady cash flow. They offer full service and better account stability. This will usually be more affordable for businesses that process a large number of credit card transactions.

If you decide to use a merchant account, do your research and get quotes from at least three providers. Pay close attention to the per-transaction fee, monthly fees, and any miscellaneous charges.

If your business is new or you only process credit cards occasionally, you may be better off with a payment services provider that offers pay-as-you-go pricing.

References

- ^ Dharma Merchant Services. Small Business & Retail Rates, Retrieved 07/05/2025

- ^ Dharma Merchant Services. Virtual & Online Rates, Retrieved 07/05/2025

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

|

|

| ||||||

|

|

|