Fight and Prevent Credit Card Chargebacks

Chargebacks are costly and time-consuming. Read on to learn how to fight credit card chargebacks and how to prevent them so you keep more profits.

|

In 2020, businesses lost 3.81% of their revenue to chargebacks.

While chargebacks are common, there are steps you can take to reduce them. The first step is to take precautions before they happen.

But if you do get a chargeback that you believe has no merit, you have every right to fight it. Read on for the complete guide to dealing with chargebacks.

- Take action quickly

- Talk to the customer directly first

- Gather compelling evidence

- Write a chargeback rebuttal letter (with sample template)

8 Ways to Prevent Chargebacks:

What is a Credit Card Chargeback?

|

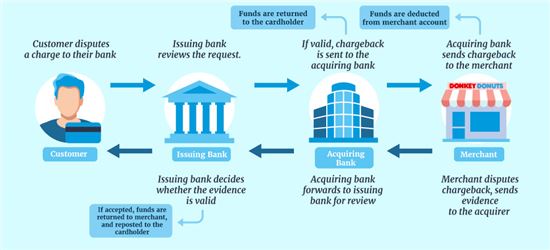

A credit card chargeback happens when the customer disputes a charge with their credit card issuer. If the bank reverses the charge, the bank will first pay back the customer, and then seek to recover the funds from the merchant.

Chargebacks were meant to protect the customer from credit card fraud. But they're also often used as a form of refund. If a customer is unsatisfied with an item or service, they can ask for their money back from their bank instead of from the merchant.

Chargebacks really hurt small businesses. All in all, a single chargeback and cost you up to 3x the original sales amount. That's why it's important to fight the ones you can.

How to Fight Chargebacks

|

First, make sure you can actually fight the chargeback.

If it was a legitimate purchase and you believe that the customer's complaint is invalid, you should fight it. Unfortunately, the bank will usually take the customer's side. You, as the merchant, must prove the transaction was legit and that you fulfilled your part.

Here are the steps you can take to fight a chargeback.

1. Take Action Quickly

You have a limited time to respond to a chargeback.

Typically, responses must be sent in 30 days for Visa and 45 days for Mastercard, while Discover and American Express only give you 20 days.

However, your processor may have its own timeframe. In reality, you may have fewer than 20 days.

During this short period of time, there's a lot of things you need to do. Follow the suggestions below.

2. Talk to the Customer Directly

Contact the customer and ask what the issue is. Maybe they didn't realize another family member made the order. Or maybe they weren't satisfied with the item.

Many customers go through the bank to get their refund because they think it's quicker and easier. Some may not even realize this method hurts the merchant.

A lot of chargebacks can be resolved simply by communicating. This is also a chance for you to get on the customer's good side. If you can reach a solution with them, make sure they talk to their bank to drop the dispute.

If you can't resolve it among yourselves, then move onto the next step.

3. Gather Compelling Evidence

If you still believe you're in the right, then be prepared for a "fight". To contest the chargeback, you must show strong evidence that the transaction was valid.

When you get a chargeback, the bank will give you a reason code (see list of reason codes at the end). You want to gather supporting documents to argue against the reason code.

Compelling evidence includes things like:

- Sales receipt or signed invoice

- Photographic evidence of customer making the purchase

- Any written communication with the customer

- CVV and AVS match

- IP address match with billing or shipping address

- Delivery confirmation

- Proof that the item was as advertised

- Copy of your return policy

4. Write a Rebuttal Letter

The rebuttal letter is your one chance to explain the reason for the dispute and why the transaction was legitimate. Bank agents are busy, and you must present your case clearly.

Keep it concise at one page or less. It should only stick to the facts. Don't show any personal emotions. Include the following:

- Merchant name and ID number

- Dispute number

- Chargeback date

- Chargeback reason code

- Item being contested and amount

- Date of purchase

- Actions you've taken to settle the issue with the customer

- Explanation of the supporting documents you've gathered

It's extremely important to get all the facts correct in the letter. If you have incomplete or wrong info, it could work against you.

Keep reading for an example of a rebuttal letter.

Chargeback Rebuttal Letter Sample

Here is a sample of a chargeback rebuttal letter. You can refer to this as a template, but of course, each letter will be different depending on the reason code.

Merchant ID number: XXXXXXXXX

Dispute ID: XXXXXXXX

Chargeback date: xx/xx/xxxx

Chargeback amount: $xxx

Chargeback reason code: [code #]

Dear Sir or Madam,

I am writing this rebuttal letter in response to chargeback XXXXXXXX.

We are an online store that sells [describe your product or service]. On xx/xx/xxxx, the customer placed an order for [item] for $xxx.xx. On xx/xx/xxxx, we received a chargeback under the reason code 11.3 No Authorization. The customer is claiming that this purchase was not authorized.

We would like to submit compelling evidence that the purchase was legitimate.

- Attachment A: Copy of the customer's transaction on xx/xx/xxxx using a credit card ending in XXXX.

- Attachment B: Evidence that the customer's billing address matches the shipping address.

- Attachment C: Evidence that customer's IP address matches the area of the shipping address.

- Attachment D: Delivery confirmation that the package was delivered on xx/xx/xxxx to the shipping address.

- Attachment E: Email communication with the customer, who confirmed he received the item.

This evidence strongly supports that the customer was engaged in the transaction. Therefore, we request for the chargeback to be reversed in our favor. If anything else is needed, please feel free to contact me.

Sincerely,

[Your Name]

[Business Name]

[email address]

[phone number]

Keep in mind: there's no guarantee you'll win, even if you were in the right.

This is why your first line of defense should be preventing chargebacks so you don't have to deal with them in the first place.

In the second part of this guide, we'll go over how you can prevent and reduce chargebacks.

Causes of Chargebacks

Chargebacks happen when a customer disputes a charge to their credit card issuer. To learn how to prevent chargebacks, you'll need to understand what causes them.

In general, chargebacks happen due to four main reasons:

- Credit card fraud: A purchase is made with a stolen credit card.

- Merchant error: The merchant/staff made an error when processing.

- Unsatisfied customers: Item was damaged, not as described, didn't arrive, etc.

- Friendly fraud: The customer did make the purchase, but then disputes it for whatever reason. Most of the time, it's an innocent mistake. But sometimes, the customer is trying to get out of paying for something.

In general, you can only fight chargebacks due to friendly fraud. If it was criminal fraud or an error on your part, then you'll have to pay for it. You can fight friendly fraud if you have compelling evidence that the purchase was legit.

What Does a Chargeback Cost?

A single chargeback has a lot more repercussions than just the loss of a sale. You'll also deal with:

- A chargeback fee that usually ranges from $15-$50

- Time spent dealing with the chargeback

- Merchandise replacement

- Money you invested in the item

- Marketing costs

- The processing fee you paid for that sale

- Shipping costs

In total, one chargeback can cost you up to 3 times the original sales amount.

And what's more than that? If you get a lot of chargebacks, you could be seen as a risky merchant, which could incur higher processing rates. And in the worst case, your processing provider can even withhold funds, or suspend or close your merchant account.

Is It Worth Fighting a Chargeback?

If you believe you have fulfilled your part as a merchant (i.e. provided the correct item or service), then it is worth fighting the chargeback. Anything you win will not only save you money, but also reduce your chargeback ratio.

However, depending on the situation, not all of them may be worth fighting.

For example, if the value of the sale is really small, it may be better just to accept the chargeback. Otherwise, the time and internal resources it takes to fight the chargeback may not be worth it.

Also, if you don't have enough compelling evidence to support the reason code, the chances of winning is low. It may not be worth spending the resources to fight it if you're unlikely to win.

What is an Acceptable Chargeback Rate?

For normal businesses, a 1% maximum chargeback rate is considered acceptable. This still makes you a reliable merchant.

Each credit card association has their own thresholds:

- Visa: 0.9% and 100 or more chargebacks each month (standard monitoring); 1.8% and 1000 or more chargebacks each month (excessive)

- Mastercard: 1.5% for two consecutive months or 100 or more chargebacks each month

- Discover: No hard rules, but under 1% recommended

- Amex: No hard rules, but under 1% recommended

Once you're in the excessive chargeback program, you'll be assessed fines. And you can even be disqualified from processing payments if you don't reduce your chargebacks.

Calculate your chargeback ratio below:

How to Prevent Chargebacks

|

The first focus should be on prevention. It is much easier to prevent chargebacks than to fight them. Here are some things you can do to reduce future cases.

1. Use Credit Card Verification Tools

Over 75% of chargebacks are due to fraud from stolen cards. That's a pretty scary statistic. The best prevention is to detect fraud and stop the transaction early on.

Some fraud detection tools you can include are:

- Ask for CVV code. This at least verifies the customer has the physical card in hand.

- Use an address verification system (AVS) to verify that the billing address entered matches the address on file on the cardholder account.

- Use 3-D Secure tools (verified by Visa, Mastercard SecureCode), which has the card issuer validate the identification of the card user. It also reduces your liability.

This service may cost an extra small fee per transaction. But it's worth it to catch fraud attempts early on.

2. Investigate Suspicious Orders

Many providers will alert you if they detect a suspicious transaction. This gives you a chance to investigate the order and take action early.

By doing some detective legwork, you can weed out some fraudulent orders. A few ways include:

- Call the customer and confirm details about the order, address, email, etc. This could tell you a lot. Lots of fraudsters use fake numbers. And if the person can't answer simple questions, it could be a sign.

- Check if the IP address and phone number match the same general area as the billing address.

- Check that the email address used exists and is legit.

- Check if there have been other orders made from the same IP address.

If any of the above points don't check out, cancel the order. If it's already been processed, the best thing to do is immediately issue a refund before it becomes a dispute.

- Larger orders than your usual ticket sizes

- International orders

- Overnight orders

- Orders with multiples of the same item

- Orders with only expensive items

- Shipping address was changed after placing the order

- Multiple declined order attempts before being accepted

- Different shipping address and billing address, especially if they're in different countries

3. Improve Customer Service & Communication

Disputes happen when customers can't get their issues resolved with customer service. So they feel like they have no option but turn to the bank to get their money back.

Make sure your customers can reach you easily. Offer multiple channels of communication (phone, website, chat, email, social media). Have staff answer calls and reply to messages in a timely manner.

Good, speedy service goes a long way to happy customers. Even if they weren't satisfied with the purchase, you can still avoid disputes by handling the issue swiftly.

4. Be Honest and Transparent

No one wants to feel like they've gotten the "bait and switch." Make sure your product photos and descriptions are accurate to what you are actually selling. Also disclose any minor damages.

Have your return/exchange policy clearly stated on your website and/or receipt. Make it easy for customers to return. Your customers should be able to reach you easily to settle returns among yourselves.

5. Track Shipping and Delivery

Keep customers updated on when the item will be shipped and provide a shipping tracking link for customers to monitor.

If the item is out of stock or will take a while to ship, make that clear before the "buy" button. Provide a realistic delivery date, so the customer knows what to expect. Plus, you'll have it documented.

For especially large-ticket items, ask for a signature on delivery. For valuable or fragile items, consider shipping insurance so you're covered if the package gets damaged or lost.

6. Train Staff on Best Processing Practices

Mistakes happen. To reduce processing errors, give proper training to your staff on how to enter orders properly, identify potential fraud, and use other verification methods. Some best practices include:

- If the card has a chip, don't swipe it. Swiping will shift the liability to you if there's a payment dispute.

- Verify customer identity with photo ID. If it's a phone order, get a CVV and AVS match.

- Always get a signed receipt if possible.

- Make sure transactions are only processed one time. Refund duplicate transactions immediately.

- Make sure you've gotten a valid authorization approval before processing transactions.

- Process batches daily, so your customers aren't surprised when they see a charge on their credit card statement days later.

- Duplicate charge

- Incorrect amount

- Charged in wrong currency

- Processed an expired card

7. Set Up Your Statement Descriptor Correctly

A lot of friendly disputes occur because the customer doesn't recognize the charge on their credit card statement. Maybe your business has a different legal name, and that's the one showing up on statements.

Luckily, this is a simple solution. Set up your merchant account so that the statement descriptor matches your store name or website domain. It should be familiar to customers.

Many processors also let you add a dynamic descriptor, which lets you set a custom explanation. For example, instead of just "ABC Car Rental", you can have it say "ABC Car Rental - Chicago."

You can even include a phone number or email as a secondary field. That way, customers have the option to call you and clarify the charge, instead of going straight to the bank to dispute.

- The customer doesn't recognize the charge on their statement

- It was an accidental purchase

- They no longer want a recurring subscription

- A family member made the purchase and didn't inform the cardholder

8. Manage Recurring Subscriptions

Subscription-type businesses are often labeled high-risk because of how common chargebacks are. Customers can dispute a charge and claim they're still getting billed for a subscription after they've canceled it.

To prevent this, it helps to send an email reminder a few days before an upcoming charge.

The customer has the option to cancel it before being billed. Make it easy for the customer to manage their subscriptions themselves on their online account.

List of Chargeback Reason Codes

|

For your reference, here's a list of chargeback reason codes for Visa, Mastercard, Discover, and Amex.

Visa Chargeback Reason Codes

| Code | Reason (for Visa) |

|---|---|

| 10.1 | EMV Liability Shift Counterfeit Fraud |

| 10.2 | EMV Liability Shift Non-Counterfeit Fraud |

| 10.3 | Other Fraud - Card-Present Environment |

| 10.4 | Other Fraud - Card-Absent Environment |

| 10.5 | Visa Fraud Monitoring Program |

| 11.1 | Card Recovery Bulletin |

| 11.2 | Declined Authorization |

| 11.3 | No Authorization |

| 12.1 | Late Presentment |

| 12.2 | Incorrect Transaction Code |

| 12.3 | Incorrect Currency |

| 12.4 | Incorrect Account Number |

| 12.5 | Incorrect Amount |

| 12.6 | Duplicate Processing/Paid by Other Means |

| 12.7 | Invalid Data |

| 13.1 | Merchandise/Services Not Received |

| 13.2 | Cancelled Recurring Transaction |

| 13.3 | Not as Described or Defective Merchandise/Services |

| 13.4 | Counterfeit Merchandise |

| 13.5 | Misrepresentation |

| 13.6 | Credit Not Processed |

| 13.7 | Cancelled Merchandise/Services |

| 13.8 | Original Credit Transaction Not Accepted |

| 13.9 | Non-Receipt of Cash or Load Transaction Value |

Mastercard Chargeback Reason Codes

| Code | Reason (for Mastercard) |

|---|---|

| 4804 | Multiple Processing |

| 4808 | Transaction Not Authorized |

| 4809 | Transaction Not Reconciled |

| 4811 | Stale Transaction |

| 4812 | Account Number Not on File |

| 4831 | Transaction Amount Differs |

| 4834 | Duplicate Processing of Transaction |

| 4837 | No Cardholder Authorization |

| 4841 | Canceled Recurring or Digital Goods Transactions |

| 4842 | Late Presentment |

| 4846 | Currency Errors |

| 4849 | Questionable Merchant Activity |

| 4850 | Installment Billing Dispute |

| 4853 | Cardholder Dispute-Defective/Not as Described |

| 4854 | Cardholder Dispute-Not Elsewhere Classified |

| 4855 | Goods or Services Not Provided |

| 4859 | Addendum, No-show, or ATM Dispute |

| 4860 | Credit Not Processed |

| 4863 | Cardholder Does Not Recognize - Potential Fraud |

| 4870 | Chip Liability Shift |

| 4871 | Chip Liability Shift - Lost/Stolen/Never Received Issue (NRI) Fraud |

Discover Chargeback Reason Codes

| Code | Reason (for Discover) |

|---|---|

| AA | Does Not Recognize |

| AP | Canceled Recurring Transaction |

| AT | Authorization Noncompliance |

| AW | Altered Amount |

| CD | Credit Posted Incorrectly |

| DP | Duplicate Processing |

| LP | Late Presentment |

| IN | Invalid Card Number |

| NF | Non-Receipt of Cash from ATM |

| PM | Paid by Other Means |

| RG | Non-Receipt of Goods or Services |

| RM | Dispute of Quality of Goods or Services |

| RN2 | Credit Not Processed |

| UA01 | Fraud - Card Present Transaction |

| UA02 | Fraud - Card Not Present Transaction |

| UA05 | Fraud - Chip Counterfeit Transaction |

| UA06 | Fraud - Chip and PIN Transaction |

| UA11 | Cardholder Claims Fraud |

American Express Chargeback Reason Codes

| Code | Reason (for American Express) |

|---|---|

| A01 | Charge Amount Exceeds Authorization Amount |

| A02 | No Valid Authorization |

| A08 | Authorization Approval Expired |

| C02 | Credit Not Processed |

| C04 | Goods / Services Returned or Refused |

| C05 | Goods / Services Cancelled |

| C08 | Goods / Services not Received |

| C14 | Paid By Other Means |

| C18 | "No Show" or Card Deposit Cancelled |

| C28 | Cancelled Recurring Billing |

| C31 | Goods / Services Not as Described |

| C32 | Goods / Services Damaged or Defective |

| F10 | Missing Imprint |

| F24 | No Cardmember Authorization |

| F29 | Card Not Present |

| F30 | EMV Counterfeit |

| M01 | Chargeback Authorization |

| P01 | Unassigned Card Number |

| P03 | Credit Processed as Charge |

| P04 | Charge Processed as Credit |

| P05 | Incorrect Charge Amount |

| P07 | Late Submission |

| P08 | Duplicate Charge |

| P22 | Non-Matching Card Number |

| P23 | Currency Discrepancy |

| R03 | Insufficient Reply |

| R13 | No Reply |

Bottom Line

Chargebacks are an unfortunate fact of having a small business, but there are ways to deal with it. First, providing good customer service and open communication can prevent a lot of disputes from turning into chargebacks.

Increasing security measures and investigating suspicious orders can help reduce chargebacks due to fraud.

Finally, if you get a chargeback and decide to contest it, be proactive and contact the customer to see if it's something you can resolve between yourselves. If that fails and you believe you are in the right, make sure you have enough compelling evidence to make your case.

Anna G is a research director at CreditDonkey, a credit card processing comparison and reviews website. Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Not sure what is right for your business?

|

|

|

|

|

|