How to Start an LLC in West Virginia

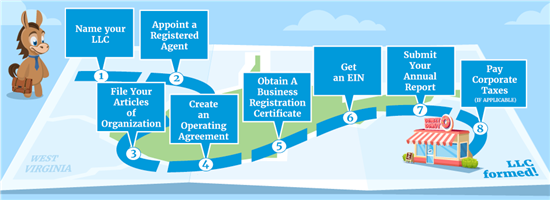

Starting an LLC in West Virginia can be easy and simple as long as you know what to do. Find out how to do it in 8 steps with this detailed guide.

|

Starting an LLC in West Virginia? It's a good choice, we agree.

You'll get many benefits, like better credibility, liability protection, and access to the state's business incentives.

In this guide, we'll tell you how to do just that. In 8 easy steps.

We'll also discuss some requirements unique to West Virginia. Let's start.

8 Steps to Start an LLC in West Virginia

|

There are similar steps to starting an LLC, regardless of the state. But West Virginia has its specific requirements.

Let's start with your business name.

Name your LLC

The first step to forming a West Virginia LLC is picking a business name. You can pick anything you want as long as it meets the state's guidelines.

West Virginia has naming conditions and certain restrictions may apply. For example, your LLC name must:

- Contain words that indicate it's an LLC (e.g., LLC, Limited Liability Company, limited company, etc.)

- Be unique and distinguishable from other registered businesses in the state

- Not imply it's associated/affiliated with any government agency or department

- Not indicate an illegal, criminal, or unlawful business purpose

- Not contain the word "Olympic" or other trademarks of the International Olympic Committee

Not sure about your name yet? Like most states, West Virginia lets business owners reserve their LLC name to avoid losing it to other companies. Just file an Application for Name Reservation (Form NR-1) with the Secretary of State's office and pay the $15 filing fee.

You have 120 days to create your LLC and formally register the reserved name as its official business name. Otherwise, you'll have to renew the reservation after it expires to keep the name.

If you want to know if your chosen LLC name is still available, you can use the state's online database to check. Or you can call the state secretary's Business Division at (304) 558-8000 to request an informal business name check.

Make it domain-friendly

Aside from the state guidelines, it's also important to consider your potential domain name. Even if you don't plan on creating a website anytime soon.

Your LLC and domain names don't have to be an exact match. But making them as close to each other as possible will make it easier for customers to find your business online.

And if you can secure your domain name, you can prevent other companies from using it as their own. You can use domain registrars like GoDaddy or Namecheap to check if it's still available.

Using a DBA/Trade Name in West Virginia

Business owners generally have more options when naming LLCs compared to sole proprietorships and partnerships. But you can always register a trade name (aka a DBA) for more flexibility.

Do this through the West Virginia One-Stop Business Portal or mail. To apply by mail, just file an Application for Trade Name (Form NR-3) with the Secretary of State's office. It costs $25 per filing (+ $1 processing fee for online applications).

Trade names in West Virginia should be unique and available. No other company should have registered it as their business name. You can check if yours is still available using the same online database as your LLC name search.

In West Virginia, it costs $100 to start a domestic LLC, and it costs $150 for foreign LLCs.[1] But the state waives these fees for veteran-owned businesses.

Appoint a registered agent

Registered agents (aka "agents for service of process" in West Virginia) receive important documents on behalf of a company. These include lawsuits, annual report reminders, tax notices, etc.

Your registered agent can be any individual or another business as long as they meet the following requirements:

- At least 18 years old

- A resident of West Virginia

- Authorized to operate in West Virginia (for registered agent services)

- Has a physical street address in the state

- Can accept legal documents during regular business hours

What if I don't have a registered agent?

In West Virginia, the Secretary of State can act as your LLC's registered agent if you don't assign your own. This means all service of process documents meant for your business will be redirected to their office instead.[2]

Yes, West Virginia lets you be your own registered agent as long as you meet the requirements. But think about if you really want to, as this can take your time and attention away from your business. It'll also risk your privacy because your information will become part of the public record.

File Your Articles of Organization

To officially create a West Virginia LLC, you need to file your Articles of Organization (Form LLD-1) with the state and pay the filing fee.

If West Virginia isn't your home state (foreign LLC), file an Application for Certificate of Authority (Form LLF-1) instead.

Some of the information you need to provide in your formation documents include the following:

- Business name

- Entity type (LLC or PLLC)

- Main company address and mailing address (if different)

- Physical office address in West Virginia and mailing address (if different)

- Registered agent's details (name and registered office address)

- Email and website addresses (if any)

- LLC members' details

- Type of company (at-will or term)

- Management structure (member- or manager-managed)

- Official business purpose

The quickest way to form your West Virginia LLC is by filing through the state's online business portal. But you can still submit your form via mail by dropping it off at 1 of the 3 state-approved business centers. You can find their details in the official form.

After submitting your documents, you'll just have to wait until the state approves your application. It takes approximately 5 to 10 business days to process online applications. While it can take as long as 3 to 4 weeks for mailed applications.

You can also opt for expedited processing for an extra fee. You have 3 choices: 24-hour (+$25), 2-hour (+$250), and 1-hour (+$500). Also, make sure all your data is correct and accurate before filing the paperwork to avoid delays.

You can correct mistakes in your documents by filing your Articles of Correction (Form LLD-F-1) with the state. There's also a $25 filing fee.

Create an operating agreement

An operating agreement documents everything about your company's operations. It includes info such as how it'll be run to what happens when it's dissolved.

West Virginia doesn't require its LLCs to have one. But it's always best to have your own. Without one, your LLC will need to follow the state's default laws and regulations. And this might not really suit your company's needs.

That said, because it's not really required, West Virginia has no strict outline for operating agreements. But some of the information you can include are:

- Members' roles, duties, and responsibilities

- Initial contributions and ownership interests

- Voting rights and decision-making protocols

- Rules for member admissions and departures

- Management structure

- Division and distribution of profits and losses

- Bookkeeping methods

- Compensation terms

- Dissolution

A detailed operating agreement gives you and the other members a reference point when handling potential problems. This could be internal conflicts or misunderstandings.

It can even reinforce your LLC's liability protection. Especially if it helps prove it's a separate entity from the owner.

To dissolve a West Virginia LLC, you just have to fill out and file your Articles of Termination (Form LLD-9) with the state. There's also a $25 filing fee.

Obtain a Business Registration Certificate

West Virginia requires all companies to get a Business Registration Certificate (aka "general business license"). You can get this from the state's tax department after the state approves your application.

Just fill out Form WV/BUS-APP, file it with West Virginia's Tax Commissioner, and pay the $30 registration tax. Or get it through their online business portal (what you used for LLC applications).

Yes, all registered companies, including LLCs, must get a Business Registration Certificate before doing business in West Virginia. You might also need additional permits/licenses depending on your specific industry.

Get an EIN

Besides getting your Business Registration Certificate, you also need to apply for an Employer Identification Number (EIN). It's mandatory even if you don't have employees.

It's a 9-digit number that acts as your company's unique identifier. It works like Social Security Numbers (SSNs) for individuals.

You can apply directly with the IRS or hire someone else. Hiring a third party usually costs extra. But applying directly is entirely free of charge.

Exceptions for an EIN:

Single-member LLCs (without employees) are the only exceptions. As a business owner, you can use your SSN instead. But getting a separate one is still highly recommended.

For one, you can't open a business bank account without an EIN. And LLCs need dedicated bank accounts to separate the company's finances from personal finances. This proves you're separate entities and reinforces the LLC's liability protection.

Submit your annual report

Annual reports ensure that the state's records are accurate and updated. All active West Virginia LLCs must file an annual report, even if their information hasn't changed.

Submit yours through their online business portal or by mail. If you're doing it online, you can choose not to create an account since the state allows business owners to file as guest users.

It costs $25 per filing (+ $1 processing fee for online submissions). You can submit it on or before the deadline (June 30 of every year). There's an extra $50 late fee if you file after June 30.

Pay corporate taxes (if applicable)

Like other states, West Virginia LLCs are considered pass-through entities by default. So you'll only pay income taxes as part of your personal tax returns.

That's unless you choose to be taxed like C-Corporations, which pay taxes twice (individual and corporate).

Besides income taxes, other important taxes to consider are:

- Self-employment taxes

LLC owners need to pay self-employment taxes because they're not considered employees of the business, unless they opt for a C- or S-Corp tax status.The federal self-employment tax rate is currently 15.3% (12.4% goes to social security, while 2.9% goes to Medicare).

- Sales and use tax

If your business sells taxable goods and services, you'll also need to pay the state's sales and use tax. West Virginia has a fixed rate of 6.00%.However, some municipalities also impose their own local rates (capped at 1.00%), so your LLC might pay a combined sales tax of up to 7.00%. You can check the State Tax Department's page to see the specific rate in your area.

- Unemployment compensation tax

If you have or want to hire employees, you have to pay the state's unemployment compensation tax. New employers typically pay 2.70%, with a 1.00% surtax. While experienced employers typically pay around 1.50% to 8.50%.[3]

Your LLC may also need to pay industry-specific taxes, depending on its industry and business activities. Some examples include:

- Beer wine tax

- Soft drink tax

- Tobacco tax

- Fuel tax

- Cannabis tax

Make sure you double-check with the state's Tax Division to see which ones apply to your business.

What to Do After Forming a West Virginia LLC

After your LLC is approved, there are a few other things you need to do. Here are some of them:

Obtain the necessary business licenses and permits.

Aside from the Business Registration Certificate, your LLC may need additional licenses or permits depending on its location, business activities, and industry.

For example, if you're an accountant or lawyer, you'll need a professional license to operate legally in the state. Some municipalities also require companies to get local licenses and permits before being allowed to conduct business in the area.

You can check this page to see which ones you might need.

Open a business bank account.

Having a dedicated LLC bank account is crucial because it separates your business finances from your personal ones.

Comingling funds can weaken your company's liability protection, which will make your personal assets fair game if your business encounters trouble, like having unpaid debts.

A separate bank account can also make it easier for your LLC to build its credit history and apply for additional funding.

Get business insurance.

Business insurance can give your company additional protection against losses. And it might actually be required in some cases. For example, West Virginia requires all businesses with employees to have workers' compensation insurance.[4]

Other ones you can get for your business are general liability, commercial property, and professional liability insurance. You can also combine several types into one comprehensive policy, like a Business Owner's Policy (BOP).

Benefits of Starting a West Virginia LLC

Starting a West Virginia LLC can offer many benefits for your business, like:

- Limited liability protection

With an LLC, you won't be held personally responsible for the company's legal issues. For example, creditors can't take your house or car as payment for the company's unpaid debt. - Multiple tax options

LLCs are taxed like sole proprietorships (single-member LLCs) or partnerships (multi-member LLCs) by default. Its business income taxes are paid as part of the owner's personal tax returns. But you can also choose to be taxed like a corporation if you want additional tax benefits, like not having to pay self-employment taxes. - Strategic location

West Virginia is close to major metropolitan areas, giving it access to a broader and more diverse customer base. It's also close to large supply and distribution hubs, which makes it easier to grow and expand your business. - Lower costs

Part of West Virginia's continuous efforts to cultivate a more business-friendly climate is lowering the overall costs of doing business in the state.For example, it doesn't have an annual franchise tax, unlike California or Texas. It also has lower initial filing fees. Forming a domestic LLC only costs $100.

- Support and incentives from the state

West Virginia offers plenty of programs and incentives for businesses under its jurisdiction. For example, it waives state filing fees for veteran-owned LLCs.[5] You also enjoy additional tax benefits when you start a business in one of its opportunity zones.

Bottom Line

Starting an LLC in West Virginia can benefit your business in more ways than one. You could get liability protection and access to different business incentives.

But it's important to familiarize yourself with the process to ensure everything goes smoothly. You'll also want to know requirements specific to West Virginia.

Not all of these steps are required by the state. But if you follow these 8 steps one by one, you'll set up your LLC in no time.

References

- ^ West Virginia Secretary of State. Fee Schedule for Services and Registration, Retrieved 4/12/2023

- ^ West Virginia Code. Chapter 31B. Uniform Limited Liability Company Act, Retrieved 04/13/2024

- ^ Bloomberg Tax. West Virginia Raises Unemployment Taxable Wage Base, Retrieved 04/13/2024

- ^ WV One Stop Business Portal. Insurance Requirements, Retrieved 04/114/2024

- ^ WV One Stop Business Portal. Veteran Resources, Retrieved 04/15/2024

Write to Alyssa Supetran at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|