Engagement Ring Calculator

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

If you recently decided to propose to your girlfriend, there may be a lot of thoughts and emotions running through your head.

|

But the most urgent question on your mind might be: how much should I spend on the ring?

The traditional rule is to spend 2 months salary on a diamond. That means if you make $60,000 per year, you need to spend $10,000 on the engagement ring.

But any rule based on just your salary is ridiculous. What about existing debt or your future goals? Use this calculator instead to get a better sense of your budget.

The average couple spent $5,225 on an engagement ring in 2020.[1] But you don't need to set yourself to any standards. Come up with a budget that works for you and your partner's lifestyle and goals.

Below, discover which essential factors to weigh for an appropriate ring budget, plus tips on the best time to buy and what features to look for.

Factor #1: Income

|

"Your engagement ring budget should be two months of your salary." Sound familiar?

But get this: The "two months rule" is just an invention of De Beers. Back in 1940, the diamond company created a marketing campaign to encourage husbands to spend generously on the ring.

Unfortunately, it stuck around for so long that many still believe it.

Nowadays, it's not recommended to base your engagement ring budget on your salary alone. It's just one part of the total equation.

For our calculator, we looked to the real experts (i.e., not giant diamond companies) for guidance. For example, Certified financial planner Kaleb Paddock advises his clients to spend no more than 5% of their salary on an engagement ring[2]

- 3 months' salary: That's 25% of your earnings on a ring.

- 1 month's salary: This is probably more realistic for young couples today. This is less than 10% of your annual salary. It could be used as the goal, but only you know your personal situation.

Factor #2: Lifestyle

|

When you're figuring out how much to spend, consider what kind of lifestyle you and your loved one currently have. This seems like an obvious factor, but it's easy to get carried away and overspend.

Some factors that determine your lifestyle might be:

- How often you go out to eat

- What you spend on entertainment (e.g., streaming services, concerts, sporting events, movies)

- What you spend on clothes, cosmetics, or health equipment

- How often you take a vacation

A frugal lifestyle might be: mostly cooking at home or eating on the cheap, infrequent travel, and spending frugally on clothes or other personal items.

A luxurious lifestyle might include: eat outing often (or getting expensive meals), taking a few vacations a year, and spending a fair amount of disposable income on clothes and entertainment.

A middle class lifestyle might be somewhere between the two: dining out occasionally, one or two vacations, and splurging on personal items once in a while.

It can be hard to pin yourself to one specific lifestyle category. (Some people may have a lot of disposable income but love to cook every meal. And that's OK!)

But if you're not sure where you fit, it's better to err on the side of a less expensive lifestyle, as this will give you a more modest budget to work with.

Factor #3: Credit Card Debt

|

Next up on the list, outstanding credit card debt.

There are many types of debt you might have:

- Student loans

- Medical debt, or

- Auto loans

However, credit card debt usually comes with high interest rates that can be dangerous to your financial health, especially if you carry a balance.

Other types of debt, such as federal student loans, mortgages, or business loans, usually offer lower interest rates that aren't as damaging as consumer debt can be.

Plus, those types of debt can actually build wealth or add value to your life, which - in time - may offset their cost.

The average budget for debt payment is 5-15%, and many people spend close to 25% of their income paying off debt.

With that in mind, our calculator will shave a bit off your budget if you have a fair amount of outstanding credit card debt. It's important to make paying off your high-interest consumer debt a priority, and your fiancée-to-be will thank you for it (trust us).

Factor #4: Savings

|

Even if you don't know how much you'll spend (or when you'll pop the question), it's smart to start saving up.

Not only will it help ease your stress, it also means less money is coming out-of-pocket when it's time to buy the ring.

Any amount that you have currently saved up will help, though $1,000 is where you'll start to make a significant dent in your engagement ring budget.

If you have less than that, no worries. The calculator won't factor it in, but you can rest assured that you'll be spending less when the time comes.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

Factor #5: Big Upcoming Expenses

|

The engagement ring is a big deal, but it's only one aspect of the life you're starting together. After the wedding, you might have big plans to travel, move in together, or even start a business.

If so, you'll want to consider how those things will affect your engagement ring budget.

The two big expenses that many newlyweds take on just after getting married are:

- The honeymoon, and

- Buying a house

Here's how those expenses will affect your budget:

If you're paying for a honeymoon...

We recommend shaving 10% off your budget.

The average honeymoon costs around $5,000[3], so if you're able to set aside just $100-$200 dollars each month before you propose, you'll have a good amount saved up by the time you say "I do."

If you're paying for a down payment...

We recommend cutting the budget by 20% and devoting that money to your down payment fund instead.

If you and your SO decide to get an FHA loan, you'll have the advantage of a lower down payment[4], but it's still a big expense for most couples. The more prepared you are, the better.

If you're paying for both...

The calculator will deduct 30% from your budget. We can't overstate the importance of saving up ahead of time. When it's time to make those purchases, you'll be glad you were a little more conservative with your engagement ring budget.

Average Engagement Ring Cost

|

While the national average shouldn't dictate your own budget, it can be interesting to see what the general spending trends are.

In 2019, Americans spent an average of $7,750 on an engagement ring (up from $6,163 in 2017).

As far as diamond size goes, the average center diamond size for an engagement ring is between 0.8 and 1.2 carats.

And although the national average is just over $7,000, 81% of Americans think the engagement ring shouldn't cost over $5,000.

That's why it's important to have an appropriate budget set and to talk about engagement ring spending with your S.O. And don't worry, it doesn't ruin the surprise. In fact, she'll most likely appreciate your initiative and responsibility. (How romantic!)

How to Save on an Engagement Ring

|

After you've come up with your budget, it's still a smart idea to find ways to save money. Here are some of our best tips for cutting the cost of your significant other's engagement ring:

- Don't shop during peak times

Avoid buying a ring between Thanksgiving and Valentine's Day, as that's when prices are highest. - Know before you go

Before you buy, research the 4Cs (carat, clarity, cut, and color) so you'll have the knowledge you need to negotiate the best deal. - Go just under whole and half carats

You can save almost 20% just by buying a diamond a fraction of a carat smaller (0.9 instead of 1.0). And no one will be the wiser. - Don't get too caught up on quality

Diamond color and clarity are not as important as you think!Instead, focus on getting an excellent cut, which makes the diamond more brilliant and can hide flaws.

For the best balance of price and quality, we recommend H color and VS2 clarity. This will ensure that you get a white diamond that appears eye-clean, yet won't break the bank.For more of these expert tips, see our full article on how to get a diamond for best value.

- Customize the ring online

Diamonds at online diamond retailers can be as much as 50% cheaper than popular mall jewelry stores.

Search for Beyond Conflict-Free Diamonds

Shop for diamonds at Brilliant Earth, a CreditDonkey recommended partner for socially-responsible diamonds.

How to Budget for the Diamond and Setting

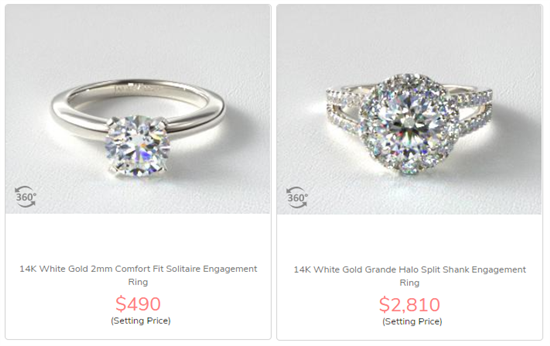

The total cost for an engagement ring is made up of two parts:

- The center diamond

- The ring itself (the setting)

You will have to decide how to allocate your budget. Most women already know the style of ring they want, so it's best to narrow that down first. And then see how much you have left for the diamond.

A setting can cost a few hundred for a simple solitaire, to thousands of bucks for an extravagant halo. The more intricate the design and the more small diamonds there are, the more the ring will cost.

|

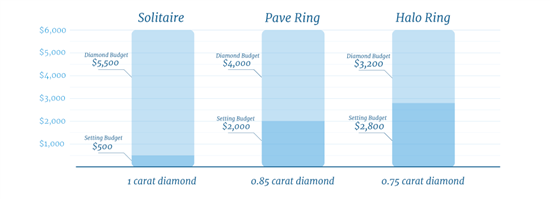

Here's a graph of different diamond & setting breakdowns, based on a $6,000 engagement ring budget. These are the three most popular setting styles.

|

With a simple solitaire, you can afford to get a 1-carat diamond with the remaining budget. If you spend more on the setting, you'll have to go with a smaller diamond.

However, notice that the diamond size difference is actually not that big. For smaller budgets, allocating more to the setting can make a bigger impact.

In fact, the halo ring is one of our favorites for maximizing budget. It has a circle of small diamonds around the center diamond. You can save money by purchasing a smaller diamond, but the halo setting will make it look huge and fancy.

Can You Finance an Engagement Ring?

Many jewelry stores offer in-store financing options, usually between 6 months to 24 months.

Some offer 0% deferred interest if you can pay off the purchase within a certain timeframe. This can be a good option, but be sure that you can pay it all back before the promotional period ends.

The terms are very tricky. Deferred interest means that if you don't pay off the amount by the stated time, you'll be charged interest from the date of purchase. This can add up to a mountain of interest even if you only have a small balance left.

If you have good credit, a better option could be to open a new credit card with a 0% promotional APR. This could give you more time to pay it off.

See our article on engagement ring financing to learn more about your options.

Bottom Line

Thinking about your engagement ring budget can be a sure-fire way to give yourself a headache, but it doesn't have to be so stressful! And there is absolutely no reason to follow any arbitrary 2 or 3-month spending rules.

Just make sure you're spending an amount that's proportionate to your lifestyle, debts, and savings, and you'll be in the best position to start a financially healthy life with your spouse-to-be. Congrats to you both!

References

- ^ How Much Does the Average Engagement Ring Cost?, CreditDonkey, 2021.

- ^ "You don't need to spend three month's salary on an engagement ring". CNBC, 2020.

- ^ Study: Average Honeymoon Cost. CreditDonkey, 2020.

- ^ Study: Average Down Payment on a House. CreditDonkey, 2020.

Holly Zorbas is a assistant editor at CreditDonkey, a diamond jeweler comparison and reviews website. Write to Holly Zorbas at holly.zorbas@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|