Current Review

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Is Current a good fit for you? Discover its benefits and drawbacks, and see how it sizes up against apps like Chime in this review.

| |||

Build Credit While You Bank | |||

Overall Score | 4.4 | ||

Savings | 4.0 | ||

Minimum Deposit | 5.0 | ||

Checking | 5.0 | ||

Price | 5.0 | ||

Mobile App | 5.0 | ||

Customer Service | 3.0 | ||

Ease of Use | 5.0 | ||

Education | 3.0 | ||

Pros and Cons

- High savings rate

- Up to 15x cash back at 14k stores

- Ability to deposit cash

- No web platform

- Email-based support only

- Requires direct deposit to earn the boosted bonus

Bottom Line

Simple, digital-only banking app with impressive bonus and cashback

Current (View Product Disclosures) is a digital-only app trying to make banking easier in the modern world. The platform also features a teens-only plan to help young adults learn to manage money.

But how much does it cost? And is it trustworthy?

Learn about the benefits, risks, and costs associated with Current in this review.

What is Current?

Current is an online banking app with no monthly fee. It offers a Visa debit card, free withdrawals at 40,000+ ATMs, and up to 4.00% bonus on up to $6,000 balance in savings.

Current is actually a financial technology company. Banking service is provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC. This enables funds to be entitled to up to $250,000 of pass-through deposit insurance coverage from the FDIC.

To date, there are over 4 million users. Current was founded in 2015 by Stuart Sopp, the former Head of Trading at Morgan Stanley and Citi.

The company has received $402.4M in venture capital funding, including most recently a $220M Series D funding round in April 2021.

Yes. Deposits are handled by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC.[1] That means that your deposits are guaranteed by the government up to $250,000.

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Current Savings - Up to 4.00% bonus

- 4.00% bonus on up to $6,000 balance if you receive and maintain a qualifying direct deposit of $200 or more in a rolling 35 day period. (Otherwise, 0.25%)

- Simply add money to your Savings Pods and enable the Boost feature.

- Earn bonus on up to 3 Savings Pods, up to $2,000 balance each.

- Bonuses accumulate daily.

Who is Current Best For

Current may be right for you if you:

- Are okay with only banking through an app

- Have smaller savings goals and want a high bonus rate

- Use your debit card a lot and want cashback rewards

- Want an account for your teen

Current is also good if you have past banking mistakes and can't qualify for a traditional banking account. It does not check your credit or ChexSystems.

Current Pros and Cons

|

Pros:

- $0 monthly fee

- up to 4.00% bonus on up to $6,000 balance in savings

- Up to 15x cash back at 14,000 participating retailers

- Fee-free ATM access at 40,000 locations nationwide

- Up to $200 in fee-free overdrafts (for qualified customers)

- Get direct deposits up to 2 days earlier

- Cash deposits at 60,000 stores nationwide

- Instant gas hold removals (more on this later)

Cons:

- No online banking (only accessible within the mobile app)

- Fee to deposit cash

- No checkwriting

- Check deposits can take up to 5 business days

- Only email-based customer support

- Requires direct deposit to earn the boosted bonus

Banking services are provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC. You can view more information by reading Current's terms of service.

How Much Does Current Cost?

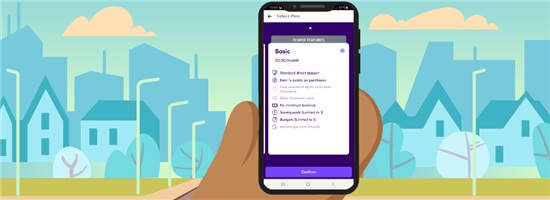

Current offers two accounts:[2]

Current Account: No Monthly Fee

Teen Account: No Monthly Fee

|

Quick Comparison

| Basic | Teen | ||

|---|---|---|---|

| Cost | Free | Free | |

| Direct Deposit | Up to 2 days early | Standard | |

| Debit Card | Exclusive Card with Tap to Pay | Standard White or Black chip card | |

| Savings | 3 Savings Pods with up to 4.00% bonus on up to $6,000 balance | 1 Savings Pod and Giving Pod for donations | |

| Budgeting | Budgets for each category | Budget for a single category | |

| Visit Current to Learn More | |||

Current waives a lot of typical banking fees. It charges:

- No minimum balance requirements

- No overdraft fees

- No external or internal money transfer fees

- No fees at 40,000+ Allpoint ATMs

If you use an out-of-network ATM, you will be subject to a $2.50 fee.[3] International ATM withdrawals come with a $3 fee.[4]

How Does Current Work?

|

To sign up for a Current account, follow these steps:

- Download the app on the Google Play Store or Apple App Store (or enter your phone number on Current's website to be sent a download link).

- Provide personal information including your name, phone number, email address, mailing address, and Social Security number.

- (Optional) Connect Current to a debit card or bank account to fund your account.

After signing up, you will be sent a debit card by mail. Your debit card will arrive by USPS within 7-10 business days.

Luckily, you don't have to wait 7-10 days to start using your account. Current gives you a virtual card that you can add to your digital phone wallet and use while you wait for your physical card to arrive.

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Current Features

Intrigued by what Current has to offer? Below, take a look at some of their popular features to know whether Current is the right banking app for you.

1. High Bonus Rate on Savings

Current offers an outstanding bonus rate on savings. All users have the option to open up to 3 Savings Pods. You can earn up to 4.00% bonus on up to $6,000 balance ($2,000 of deposits per pod).

Savings Pods are great for creating separate savings goals, like for vacation, emergency fund, or upcoming large purchase.

You can turn on round-ups for a pod. This feature will round-up your transactions and automatically deposit them into your pod, so you will be saving without thinking.

And you can move money in and out of your Savings Pods anytime you want. Unlike a traditional savings account, you're not limited to 6 transfers per month.

But the downside is that you must maintain a payroll direct deposit of $200 or more per month to earn the boosted bonus. Otherwise, you'll earn the base rate. You only earn bonuses on a maximum of $2,000 per pod. This is kind of a bummer since many online savings accounts give you a high rate on your entire balance.

Current Savings - Up to 4.00% bonus

- 4.00% bonus on up to $6,000 balance if you receive and maintain a qualifying direct deposit of $200 or more in a rolling 35 day period. (Otherwise, 0.25%)

- Simply add money to your Savings Pods and enable the Boost feature.

- Earn bonus on up to 3 Savings Pods, up to $2,000 balance each.

- Bonuses accumulate daily.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

2. Overdraft Protection

Not only does Current not charge overdraft fees, but it will also even give you a free pass if you do accidentally overdraw your account.

Current's Overdrive feature gives you fee-free overdraft up to $200. This feature is completely free as long as you qualify for it. It covers in-store or online purchases made with your debit card.

How to Qualify for Overdrive:

- Have an active Current account in good standing

- Be 18 years of age or older

- Receive $500 or more in qualifying direct deposits in each 30-day period

A qualifying direct deposit is an ACH transfer from your employer, payroll provider, or Social Security. Peer-to-peer transfers or mobile check deposits don't count.

3. Cashback at Popular Retailers

If you use your Current debit card at one of Current's 14,000 merchant partners, you can earn up to 15x points. These points are redeemable for cash or other items in the Current Shop.

Current's partners include popular national retailers (like Forever 21 and Burger King), as well as local businesses. It's a great way to support your local shops while earning rewards at the same time.

How to Earn Cashback:

- Find participating retailers in the Points tab in the Current app

- Shop with your Current Visa card

- Get points in your account

- Redeem them for cash for other items

4. Instant Cash Deposit

One impressive feature offered by Current is the ability to deposit cash into your account, but there's a $3.50 fee per transaction.[5] You can instantly add cash at over 60,000 stores nationwide using your Current account.

Cash deposits are available at convenient places like CVS, Walmart, and local grocery stores. You can add up to $500 cash per transaction (up to $1000 per day, and $10,000 per month).

How to Deposit Cash with Current:

- Log into the app to locate a cash deposit location near you

- Tap "View Barcode" from the map

- Show the barcode to a cashier at the checkout counter

- Give your money to the cashier

- Instantly view your money deposited into your account

5. Current Gas Hold Removal

When you visit a gas station and pay with a card, a "hold" is typically placed on your account for (usually) $100.

This is because, unlike most point-of-sale transactions, the total amount you are going to spend is unknown until you're done pumping.

For most banks, this hold can remain in place for up to 10 days until the transaction is finalized.

However, Current instantly removes all gas holds — saving you from the possibility of overdrawing your account before the hold is lifted.

6. Current Teen Account

Current also offers a Teen account that doesn't have a monthly or annual fee. This account helps give parents the ability to teach their children about spending and savings.

With the Teen account, parents can blacklist certain retailers, set spending limits, and automate allowance payments.

Another popular feature offered by Current inside the Teen account is the ability to assign chores and set the payment for each completed chore.

Convenient Teen Account With Debit Card

- Easy transfers, set spending limits, automate allowances

- Age: 13 years and older

- Fees: No monthly or annual fee

Current Crypto

Current now offers the ability to buy and sell crypto from the same app. There are no trading fees.

You can buy 27 popular coins, including Bitcoin, Ethereum, Dogecoin, and Shiba Inu. You only need $1 to purchase pieces of coins.

When you sell a coin, the cash will be available instantly in your Current account to use. You don't need to wait days for the trade to settle.

Additional Features from Current

Current offers more features that might convince you to open up an account. Review the points below to decide if Current is a good fit for your finances.

Faster direct deposits

If you enroll in direct deposit through the Current app, you can get your paycheck up to 2 days earlier.

Fee-free ATM withdrawals

You can withdraw cash at over 40,000 Allpoint ATMs with no fees. Just find your nearest location in the Current app. They're usually at places like drug stores, grocery stores, and local financial institutions.

Mobile check deposit

Just snap a photo of your check to deposit it into your account from anywhere. The limit is $2,000 per check. Note that it can take up to 5 business days for checks to clear.[6]

Current Pay

Current Pay lets you pay and request money from other Current users instantly. It's free to send and receive money.

Money management tools

Get insights on your spending habits and patterns on the home screen of Current's mobile app. Current also lets you create budgets for different categories of spending.

Current Customer Complaints

Overall, Current boasts high average ratings from customers. A lot of the customers love how easy it is to use and the overdraft program.

Parents also like the Current Teen account where they can teach their children about spending and saving.

| Rating Source | Rating |

|---|---|

| Google Play Store | 4.6 stars, 138k ratings |

| Apple Store | 4.7 stars, 128k ratings |

| Trustpilot | 3.8 stars, 2,100 reviews |

But a lot of customers also complain about the slow customer support, since it's email-only. And it takes many days for check deposits to clear, which is hard if you're waiting for the funds.

Another alarming customer complaint seemed to pop up again and again: fraud risk. Some customers say that fraudulent charges were made on their account and little-to-no help was provided by Current Customer Support.

Representative Negative Review:

— jdubhair31, Apple App Store Review, 10/24/2020

How to Contact Customer Support

There are two ways to contact customer service for Current.

- Using the chat feature inside the app, where you will be directed by a chatbot to a human representative

- Filling out a form on the website and waiting for an email response.

Given the lack of direct lines of communication, it's not surprising that many customers become frustrated with Current customer service when they have issues like suspected identity theft.

However, most simple (and less urgent) questions can be answered with their online FAQ support center.

Current Alternatives

Given the complaints above, you may be curious to hear about alternative options. Below, see how Current compares to other popular apps like Chime and Greenlight.

Current vs Chime

Current and Chime are both digital-only financial companies offering impressive, modern features that traditional banks don't. This includes earlier direct deposit features, no-fee overdrafts, and "round-ups" to help you add to your savings.

Current offers a better bonus on savings with qualifying direct deposit. Chime's savings account earns 1.0% APY. But you earn it on your entire balance, whereas Current's is only up to $6,000.

One advantage of Chime is that it offers a Credit Builder account to help you increase your credit score. No credit check is required.

However, Chime doesn't offer a Teen account, which makes Current the easy choice for parents who want to help their teens learn financial literacy.

| ||

| Visit Site | Learn More | |

Current | Chime | |

|---|---|---|

Build Credit While You Bank - | Get Started - | |

Benefits and Features | ||

| Savings | Up to 4.00% bonus on your Savings Pod, on up to a total of $6,000 | 1.00% Annual Percentage Yield (APY).

|

| Checking | Earn up to 15x points on purchases at participating merchants | No monthly service fee; no minimum balance; no overdraft fees; no foreign transaction fees |

| Monthly Fee | ||

| Kids Debit Card | ||

| Minimum Deposit to Open | ||

| Mobile App | ||

| ATMs | Free access to 40,000+ Allpoint ATMs | Over 50,000 fee-free MoneyPass, Allpoint, and Visa Plus Alliance ATMs |

| Visit Site | Learn More | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Current: Current is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC. Chime: Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC. | ||

Current vs Greenlight

Current is geared toward teenagers and their parents while Greenlight focuses primarily on younger children, approximately elementary school age.

Both apps offer similar features and parental controls like transaction monitoring, spending limits, chore rewards, and the ability to blacklist certain retailers.

The primary differences between Greenlight and Current are the price point and the ability of Greenlight users to invest money in the stock market.

Current doesn't charge monthly or annual fee for their teen account compared to $5.99 per month for Greenlight. There's no subscription fee for Current Teen Account, however it requires a linked parent account.

The Bottom Line: Is Current Worth It?

Overall, Current offers a nice suite of features that makes it a good choice if you want a simple banking platform with no monthly fees.

Some of the most impressive features you'll get when you open a Current account include:

- up to 4.00% bonus on up to $6,000 balance

- Great overdraft protection

- Instant cash deposits

- Up to 15x in cashback

- User-friendly mobile app

- Faster direct deposits

But of course, no app is without its cons.

From customer reviews, it seems Current could stand to improve their customer service and security. If you usually don't need banking help and are okay with using just an app, Current could work for you.

References

- ^ FDIC. BankFind: Choice Financial Group, Retrieved 1/23/2023

- ^ Current. What types of accounts does Current offer?, Retrieved 3/23/2022

- ^ Current. Can I use my Current card at ATMs?, Retrieved 3/23/2022

- ^ Current. Can I use my card Internationally?, Retrieved 3/23/2022

- ^ Current. Is there a fee to add cash?, Retrieved 7/22/2022

- ^ Current. How do I deposit a check into my Current Account?, Retrieved 1/23/2023

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

Write to Justin Barnard at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: