Compound Interest Calculator

Unearth the potential of your savings with this compound interest calculator. See how your money can multiply over the years.

|

Compound interest is an essential part of how people save and invest their money, and it's even how some people are able to retire early.

So how exactly does compound interest work? And what makes it so powerful? Find out in the break-down below.

What Is Compound Interest?

|

Compound interest is when you earn interest on the interest you've already earned.

How does it work? Basically, compound interest looks at all the interest you've earned so far and treats it as part of your balance.

Then, each new interest payment is calculated with all that past interest in mind, instead of just looking at the amount you started with.

That means that each new interest payment is higher than the last, even when the interest rate stays the same.

Let's say you open a savings account, and deposit $100 to start out. This account has a 2% interest rate that compounds monthly.

At the end of Month #1, the bank multiplies your balance ($100) by 2% and adds that to your account:

$100 + [100 x 0.02] = $102 ($2 is the interest payment)

After Month #2 is over, it's time for another interest payment. Here's what happens behind the scenes:

$102 + [102 x 0.02] = $104.04 ($2.04 is the interest payment)

The interest amount increased because your balance was bigger than it was at the end of Month #1.

The scenario above assumes you're not making any regular deposits to your balance. Since most people will make regular deposits to a savings account, that compound interest will earn even more.

Why is Compound Interest So Powerful?

|

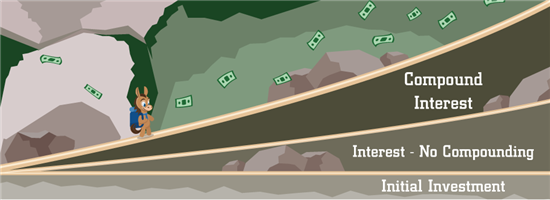

Compound interest is powerful because it grows at a much faster pace than simple interest does.

Because of this, time can play a huge part in growing your money. The earlier you start accruing interest, the more you'll have. (And we mean a lot more.)

But when it comes to owing money, compound interest is not ideal. Because the debt grows faster, paying it off quicker is the best solution.

Compound Interest vs. Simple Interest

To put it simply, the way simple interest is calculated is based only on the original amount, or the principal.

Because of this, simple interest is ideal when it's used for money you owe (like a car loan or personal loan) because it will always grow more slowly than compound interest.

By contrast, compound interest is best for money you earn because it grows much more quickly.

|

| © CreditDonkey |

While similar to the interest rate, the APY is different in that it factors in compounding interest. The APY takes into consideration how often your bank compounds interest, whether it be quarterly, monthly, or even daily. The APY, therefore, gives you a more accurate idea of how much interest you will earn than just the simple interest rate.

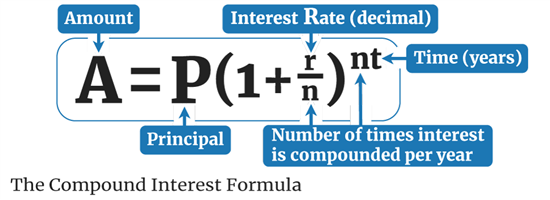

How the Compound Interest Calculator Works

The calculator in this article lets you see how compound interest grows your investment in a number of years. It also lets you compare your initial investment at two different interest rates to see

- Enter your initial investment.

This is the current balance of your account. Compound interest and regular contributions do most of the work in growing your money, so don't worry too much about what your initial investment is. - Set your regular contributions.

Making regular contributions to your account is a crucial part of growing your money. A higher balance = more interest! There's no right or wrong amount to contribute, just be sure it's an amount you can commit to set aside consistently. (You can always go back and adjust your contributions.) - Enter how many years your investment will grow.

Maybe it's for retirement 35 years from now, or a college fund in 10 years, or even a new car just 3 years down the line. This calculator will tell you how much you can expect to have by that time. - Add the interest rate (or two, for a comparison).

Check with your account to see what your interest rate is. The calculator gives you two interest options to let you compare how fast two different accounts might grow, with all other factors being equal. - Set the compound frequency.

Compound frequency is how frequently interest compounds in your account. If your account compounds monthly, that means interest is calculated and added to the balance every month.Some accounts compound annually (once per year) and some even compound daily (once per day). This can also be referred to as "compounding periods."

Well, no. But he did make an excellent example of how powerful it can be. When he passed away, he willed $4,400 each (in today's money) to the city of Philadelphia and the city of Boston. The money was placed in a trust that was required to sit idle for a period of time before it was utilized.

Why? Franklin wanted to harness the power of compounding interest to maximize the funds before the cities could use it. By 1990, the value of those $4,400 investments had ballooned to $6.5 million!

Bottom Line

Compound interest is an essential part of the finance world. On a personal level, though, it's a huge factor in determining when many people can make big financial moves or even retire.

If your savings need a jolt, be sure to look into high-APY savings and investment accounts that harness the power of compounding interest. Your future self will be glad you did.

Holly Zorbas is a assistant editor at CreditDonkey, a personal finance comparison and reviews website. Write to Holly Zorbas at holly.zorbas@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|