Chase Sapphire Reserve Credit Score: What You Need to Know

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

You usually need an excellent credit score for Chase Sapphire Reserve® (See Rates & Fees) (720+). But this is not the only factor. Here's how to improve your approval odds.

How to Get Approved for Chase Sapphire Reserve

|

![]() Chase Sapphire Reserve (See Rates & Fees) is one of the hottest luxury travel reward cards on the market. If you're an avid traveler, you must check out the latest Chase Sapphire Reserve promotion.

Chase Sapphire Reserve (See Rates & Fees) is one of the hottest luxury travel reward cards on the market. If you're an avid traveler, you must check out the latest Chase Sapphire Reserve promotion.

But it's not so easy to get.

We break down the different factors Chase will usually consider, and what you can you do to maximize your approval chances.

We'll explain more below. But first, let's highlight the current Chase Sapphire Reserve promotions you should not ignore.

60,000 Bonus Points

$300 Annual Travel Credit

1:1 Point Transfer to Leading Airline and Hotel Loyalty Programs

What is the Best Chase Credit Card to Get?

| For | Credit Card |

|---|---|

| Travel | Chase Sapphire Reserve® |

| Small Business | Ink Business Preferred® |

| Cash Back | Chase Freedom Unlimited® |

The only way to find out if you're eligible is

Credit Score Needed for Chase Sapphire Reserve

You usually need an excellent credit score. But sometimes, even that won't guarantee an approval. And sometimes, you can be approved with a lesser-than-excellent score too.

There are multiple "credit scores" available. But in general, 720 is considered an excellent score. Most Chase Sapphire Reserve cardholders have "excellent" scores over 720, with an average of around 750. But people have also reported being approved with "good" credit scores under 700, some even as low as 650.

This is because the credit score is not the only thing that Chase considers when reviewing your application. They will look at other factors as well. We go over what they are next.

Chase Sapphire Reserve Application

Chase's 5/24 Rule

First, you must know about this important policy. Chase's 5/24 rule is the biggest reason people with excellent credit get rejected.

Chase 5/24 policy says that if you have opened 5 or more credit/charge cards in the past 24 months, you will not be approved for Chase card products. Even if your credit history is impeccable, you'll automatically be declined.

This goes for credit cards with any bank. Even if you've been added as an authorized user, it'll still count.

If you're over this limit, don't even bother applying. If you're not, prioritize this application over any others. And read on to see what else Chase considers.

Factors That Chase Considers

Many things are taken into account during the decision process. Consider these factors to help improve your Chase Sapphire Reserve approval odds:

- Your credit score: Chase will usually pull your credit report from a couple of the three credit bureaus (Equifax, Experian, and TransUnion). Your scores may be different across each bureau. So banks will usually look at more than one to get a more complete overview.

- Your total open cards: A lot of open cards could mean that you're not good at handling your money. Or that you open a lot of cards for the sign-up bonuses. Chase is looking for loyal customers, so they may not want to invite you into the Sapphire family.

And remember the 5/24 rule. 5 or more new card accounts in the past 2 years will be automatic rejection.

- Average age of your accounts: This is a card for experienced credit card users. If your other cards accounts are still pretty new, this doesn't give Chase much info on whether you can handle credit responsibly.

- Your total credit limit: Chase Sapphire Reserve is a Visa Infinite card, so the minimum credit limit is $10,000. If you're new to credit and have low limits with your other credit cards, Chase may not be comfortable approving you for $10,000 either.

Note: If you already have other Chase cards with high credit limits, Chase may not issue you another card. Typically, Chase has a maximum credit limit they'll extend to each user (usually a percentage of your income). In this case, you can ask to move over some of the credit limit unto the Sapphire Reserve.

- Your credit utilization: This means how much of a balance you're carrying compared to your total limit. Ideally, you should never go over 30%. A high percentage is a signal that your income does not support your spending. It's best if you apply for this card after you have paid off your balance on your other cards.

- Your income: With an annual fee of $550, the Reserve is a luxury credit card targeted towards heavy spenders. Chase may also look at your income to make sure it can support it, particularly if your credit score is lower. Generally, you'd need an income of at least $50,000 (though most cardholders have incomes closer to 6 digits).

Tip: If you're a couple living together, remember that you can put both of your incomes. If you still get financial help from your parents, you can add in their income too.

- Your recent hard inquiries: People have reported being rejected because there were too many inquiries on their credit recently. This tells banks that you're desperate for credit. If you're very interested in this card,

apply for it first before other card applications. - Prior relationship with Chase: Most Reserve cardholders already carried another Chase credit card. And about a third is also a Chase banking customer. If all your accounts with Chase are in good standing, a prior relationship may win you some points.

Tip: Some cardholders already have the Chase Freedom. The Freedom is an ideal companion since you get up to 5% back on rotating categories.

If you think you may not meet any of these factors, it doesn't mean you can't get approved. Read on.

What Can You Do If You Don't Get Approved?

If you get a rejection, it may not be the end. Here are a couple of things you can do:

- Call the reconsideration hotline: If you believe you have great credit and meet the criteria, you can talk to a representative. Chase has a line where you can explain your situation. This can help them better understand you and possibly reconsider the decision. Here are some tips:

- Be polite and ask if there's any more information you can provide.

- Be ready to explain any recently opened credit accounts or credit inquires. Maybe you took out a mortgage or just switched to a new cell phone provider.

- Explain why you want the card. Don't just talk about the sign-up bonus. Talk about how you would use it (maybe you travel frequently and love their travel partners).

- If you have other Chase cards with high limits, ask if you can move some of the credit limit over.

The reconsideration number is 1-888-270-2127.

- Be polite and ask if there's any more information you can provide.

- Work on building your credit: If you still get denied, or you know you're not quite there yet, then just work on building your credit.

- Work on paying off the balances on your other credit cards. Don't miss or be late with any payments.

- You can ask for credit limit increases on your other cards, which will 1) help with the credit utilization ratio, and 2) show Chase that you can be trusted with credit.

- Refrain from opening new credit accounts, unless it's for something other than a credit card (like a mortgage or car loan).

- Consider opening a banking account with Chase. Or apply for another Chase card first (but make sure you won't hit the 5/24 limit). A prior relationship may help your odds

- Work on paying off the balances on your other credit cards. Don't miss or be late with any payments.

Remember, you don't only have one chance. You can

How Credit Score is Determined

|

| © CreditDonkey |

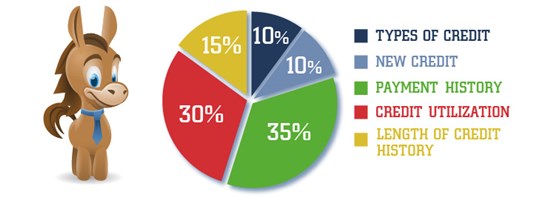

Your credit score is made up of five factors:

- Payment history (35%): Do you pay your bills on time and do you have a balance?

- Credit utilization (30%): How much credit you're using compared to what you've been given

- Length of your credit history (15%): Length of time you've had credit accounts and activity

- Types of credit (10%): What kind of credit you have (credit cards, car loan, student loan, etc.)

- New credit (10%): # of new applications for credit or inquiries

Bottom Line

Chase Sapphire Reserve is not the easiest card to get, but don't be discouraged. Just having an excellent credit score does not mean guaranteed success. Nor does a less-than-excellent score mean automatic rejection. There are many factors that go into the final decision. But the bottom line is that it all depends on how well you can manage credit. Good luck.

Is Chase Sapphire Reserve the right rewards card for you? Compare Chase Sapphire Reserve and Preferred to see which is right for you.

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

For rates and fees of the Chase Sapphire Reserve® card, please click here.

For rates and fees of the Ink Business Preferred® Credit Card, please click here.

For rates and fees of the Chase Freedom Unlimited® card, please click here.

Disclaimer: The information for the Chase Freedom has been collected independently by CreditDonkey. The card details on this page have not been reviewed or provided by the card issuer.

Read Next: