AcreTrader Review

AcreTrader offers passive investment in farmland. While this is a safer investment with steady returns, it won't be for everyone. Read on.

Overall Score | 3.3 | ||

Annual Fee | 4.5 | ||

Minimum Deposit | 2.0 | ||

Customer Service | 4.5 | ||

Ease of Use | 4.5 | ||

Liquidity | 1.0 | ||

Pros and Cons

- Low fees

- Strong underwriting

- Low historical volatility

- Accredited investors only

- At least $10,000 minimum

- 5-20 year investment

Bottom Line

Platform offering alternative investments in farmland with steady returns

- What is AcreTrader?

- Why Invest in Farmland?

- Who AcreTrader is Best for

- Pros and Cons

- What to Know About AcreTrader

- How AcreTrader Compares

Farmland as a real estate investment may not be what first comes to mind. But think about it.

Like Mark Twain once famously said, "Buy land, they're not making it anymore." That's exactly what makes farmland so appealing. It will always be in demand.

Luckily, you don't need to buy a whole farm. AcreTrader lets investors buy small shares of land.

Is it worth it? What kind of returns you can expect? Read on to see if AcreTrader is the right alternative investment for you.

What is AcreTrader?

AcreTrader was founded in 2013 by current CEO Carter Malloy. With a background in private equity, he grew up in a farming family in Arkansas, so agriculture was always in his blood.

AcreTrader was created with the goal of making agricultural investments accessible to the masses.

Like other crowdfunding platforms, AcreTrader lists different farms on its platform with their relevant stats. This includes what types of crops will be grown, expected cash yield, fees, timeline, and more.

Accredited investors can then choose which properties they want to invest in. The minimums vary by deal, but are generally around $10,000 to $25,000.

As the investor, you collect annual cash dividends (usually in the 2% - 5% range) each December. The biggest portion of the expected return comes from when the land is eventually sold in 5-10 years, likely at a higher price.

Here's what you can expect from AcreTrader:

| Eligibility | Accredited investors only |

| Minimum investment | $10,000 - $25,000 |

| Target annual net returns | 7% - 9% |

| Annual cash dividends | 2% - 5% |

| Annual management fee | 0.75% |

| Other fees | Closing fee (typically 2%) |

| Typical holding period | 5-10 years |

| Account types | Individual, Self-directed IRA, Trust, Entity, Solo 401k |

Why Invest in Farmland

No matter what the world is doing, we need food. That's what makes farmland a strong investment. Here are some good reasons:

- Scarcity and demand:

We can't make any new land. As population grows and land becomes more scarce, the value of good farmland will only increase over time. - Stable returns:

Over the past few decades, farmland has delivered around 11.5% average annual returns.[1] It has seen positive returns every year since 1990. The value is not correlated to the stock market or as negatively impacted by worldwide events. - Passive income:

You also get yearly passive income from crops. Usually, annual crop yields are between 2-8%. This is higher than most dividend stocks.

Who AcreTrader is Best for

You may consider AcreTrader if you:

- Are an accredited investor

- Have at least $10,000 minimum investment

- Want a more stable investment outside of stocks and bonds

- Don't need your money for at least 5-10 years

What are the Pros and Cons?

Eager to invest in farmland with AcreTrader? Review these quick pros and cons for the main takeaway.

Pros

- Ability to choose which properties you want to invest in

- Strong underwriting process

- Farmland has strong historical returns and is not tied to the stock market

- Fees are low relative to other alternative investments

- Farmers pay annual rent ahead of time, so there's less risk of default

- AcreTrader team partners with farmers to ensure mutual success

Cons

- Only available to accredited investors

- Not a lot of properties offered

- Low liquidity (money is locked up for 5-10 years or more) and no secondary market

How Does AcreTrader Work?

|

The AcreTrader team is made of finance and agricultural experts who find the most attractive farmland opportunities in the market. Here's how their process works:

- Farm purchase:

Acretrader has a very thorough vetting process. They only accept about 1% of the land they research. Once quality farmland is identified at the right price, AcreTrader purchases the land outright with cash. - LLC creation:

The farm and legal title are placed into a unique LLC. If you invest in a farm, you own a piece of the LLC. - Farm management:

AcreTrader takes care of all this. The farmers pay their annual rent before planting crops. This reduces risk of default. Throughout the planting cycle, AcreTrader works with the farmers to ensure land maintenance and sustainability. - Invest:

You just need to choose which farm you want to invest in. See our more detailed section on how to get started investing. - Distributions:

Cash dividends are distributed every December. This comes from the rent AcreTrader charges and crop yields. - Sell:

When AcreTrader feels that the market conditions are right, usually 10-15 years down the road, they will sell the land. You will get your principal bank and any additional gains from appreciation.[2]

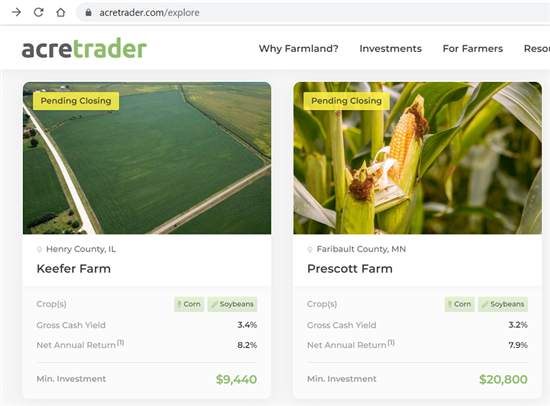

What Kind of Deals are Available?

AcreTrader usually lists 1-2 new farms every week. Here are some recent offerings, so you have an idea of what you can invest in.

Each deal has its own minimum investment and expected returns.

| Investment Deal | Min. Investment | Gross Cash Yield | Net Annual Return |

|---|---|---|---|

| Erie Farm (Miami County, IN) | $14,370 | 3.2% | 8.1% |

| Mullen Farm (Imperial County, CA) | $16,580 | 4.4% | 8.1% |

| Odell Farm (Livingston County, IL) | $20,075 | 3.2% | 8.0% |

| Huntsman Ave Pistachio Orchard (Fresno, CA) | $25,000 | 9.2% | 10.9% |

| Dailey Farm (Champaign County, IL) | $12,970 | 2.9% | 7.9% |

In the case that a deal is not closed, Acretrader will refund your investment. You can also cancel at any time before a deal is closed.

How Much Does AcreTrader Cost?

Joining the AcreTrader platform to view their listings is free (they usually only have one farm open to new investors at any time).

Management fee

AcreTrader charges investors a 0.75% annual management fee, which is assessed based on the value of each property.[3]

Closing fee

Each investment also will have pass-through closing fees. This is typically 2% of the total offering value.[4]

Overall, a 0.75% management fee is very reasonable in the alternative asset class space, and compares favorably to the 1% - 2% charged by competitor FarmTogether.

Who is Eligible to Invest in AcreTrader?

Currently, only accredited investors are eligible to invest on the AcreTrader platform.

To be an accredited investor you must have an annual income of at least $200K ($300K for couples) or a net worth of at least $1 million, excluding your primary residence.[5]

AcreTrader realizes this requirement is a drawback and goes against their mission of making farmland investments accessible to the masses. They're currently working on opening their platform to all U.S. investors.

How Do You Get Paid?

Cash dividends are paid every December to investors. Most of AcreTrader's farms offer 2% - 5% cash yield. This is in addition to appreciation in value of the farm.

When the farm is sold, you'll receive your principal back and any appreciation.

Typically the investment period is 5-10 years, or even up to 20 years sometimes. There's no hard rule. The property will be sold based on market conditions and what opportunities come along.

Can You Sell Your Investment?

At the moment, AcreTrader has no secondary market. Once you've entered the investment, you should expect to hold it for the whole hold period, which is at least 5 years and up to 15 or 20.

AcreTrader is exploring adding a secondary market in 2022. This will give you the option to sell your shares after a 1-year lockup period. However, as of now, there's no guarantee that this market will happen.

How to Get Started with AcreTrader

- First, create an account here. You can browse the current offerings for free. Each one has their own minimum investment, cash yield, and net annual return.

Here are examples of some recently closed offerings:

![]()

- If see a farm you like, you will be asked to enter the number of shares you want to invest in. Each share is 1/10 of an acre. You'll see the minimum shares investment.

- Next, choose the ownership information. You can select between Individual, Entity, Trust, Self-directed IRA, or Solo 401k.

- The investment agreement will be automatically generated. Review and sign the agreement.

- Next is the payment information. You can fund by bank transfer, ACH, or wire transfer.

- Upload documents to verify your accredited investor status. This can be:

- Past 2 years of W2s, 1099, or tax returns to show income

- Account statements showing value of assets, dated within past 3 months

- A professional letter from a CPA, attorney, or financial advisor verifying on your behalf

- Past 2 years of W2s, 1099, or tax returns to show income

- Lastly, review and confirm all the information to complete the investment. This will reserve your shares.

Investments are not final until all documents are signed and your funding has been cleared. If you want to cancel for whatever reason, you can do so up to 7 days after signing.

Is AcreTrader Safe?

If AcreTrader goes bankrupt, your money won't be lost. Since each farmland is owned by an LLC, it's a separate entity from AcreTrader. You still retain your legal ownership through the LLC.

The LLC will still be responsible for management and distributions per the existing lifetime schedule of the farm.

When you fund your investment, your money is held securely in escrow at North Capital Investment Technology. Your accreditation documents are also reviewed by North Capital, and never by anyone on AcreTrader staff.

You can trust that your personal data is safe. AcreTrader uses 256-bit encryption so your transactions and financial information are all processed securely.

Even though farmland is relatively low-risk, remember that no investments are guaranteed.

Is AcreTrader a Good Investment?

No investment comes with zero risk. But farmland offers a very attractive risk/reward profile and acts as a great diversifier for a balanced portfolio of stocks and bonds.

Its low volatility and low correlation to stocks and bonds means farmland is more likely to hold its value even during a major recession like the 2009 financial crisis.[6] Plus, a sustained downturn in farmland values just hasn't happened before.

Farmland is also a very tangible investment with real value because it goes without saying that people will always need to eat.

While the world's population grows at about 1%/year, the amount of suitable land available for farming does not. It's a classic case of limited supply and increasing demand, which makes for a great investment.

AcreTrader's fees are also below the average for the alternative asset class space.

AcreTrader Competitors: Which is Best?

|

There are a couple of other real estate crowdfunding platforms that focus on farmland - FarmTogether and FarmFundr. Below, see how both compare to AcreTrader. Also see how it compares to Fundrise, if you'd rather invest in buildings.

|  | ||

| Learn More | Visit Site | Visit Site | |

AcreTrader | FarmTogether | Fundrise | |

|---|---|---|---|

Benefits and Features | |||

| Annual Fee | |||

| Minimum Deposit | $15,000 - $30,000 for most offerings | ||

| Phone Support | |||

| Live Chat Support | |||

| Email Support | |||

| Investment Types | Commercial, single family, multi-family, industrial | ||

| Accredited Investor Requirements | |||

| Dividends | Cash dividends are paid each December | Quarterly or annually, depending on harvest sales schedule or lease agreement for the year | Choose quarterly payouts or auto reinvest |

| Investment Period | 5+ years (with opportunities to liquidate on a quarterly basis) | ||

| Learn More | Visit Site | Visit Site | |

| Terms Apply. | |||

AcreTrader vs. FarmTogether

FarmTogether is a direct competitor to AcreTrader. Their platform follows the same structure as, where they go out and actively search for and research different farms to acquire and then list on their platform.

Both platforms have similar investment minimums, starting at $15K for FarmTogether and $10K for AcreTrader,[7] and both are only open to accredited investors.

FarmTogether's property listings tend to have higher risk/return profiles than AcreTrader, with total returns often falling in the 10% - 15% range, including cash yields from 3% - 9%.

Contrast this with the somewhat more conservative returns targeted by AcreTrader. Also keep in mind that AcreTrader's underwriting process appears more selective, with only 1% of candidates making the final cut.

FarmTogether's fees are a bit higher, with upfront transaction fees and annual management fees both averaging between 1% and 2%.

One aspect of the FarmTogether platform that we like is their secondary market, where investors can buy and sell their ownership in previously closed deals with other investors.

Although this market also has limited liquidity, it at least offers investors an option to cash out an investment earlier if they need the money for other uses. AcreTrader does not currently have a secondary market.

AcreTrader vs. Fundrise

Fundrise is one of the most popular real estate investing platforms. It offers investments in commercial, residential, and industrial properties.

Fundrise is open to all investors. The minimum to start is just $10.[8] You're automatically invested in a real estate portfolio containing up to 80+ projects. If you have at least $5,000, you can choose a more personalized portfolio for your goals.

Accredited investors with $100,000 minimum get access to private equity funds. Active investors who want to customize their investment portfolio can sign up for a Fundrise Pro membership.

Investors get quarterly dividends, so it could be a good source of passive income. There's also a little more liquidity. Every quarter, it offers a redemption program if you want to withdraw early (with a small penalty).

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

AcreTrader vs. FarmFundr

FarmFundr is another player in the crowdfunding farmland space. Their platform works in the same way as AcreTrader's and FarmTogether's, but the types of projects they offer are more diverse.

For example, one recent listing on their platform is seeking capital to convert a California walnut orchard to an organic certified farm.

Whereas AcreTrader pays investors dividends from the rent they collect from leasing the land, many of the projects on FarmFundr pay dividends based on the proceeds collected from the sale of the harvest itself.

This means the investor takes more of an equity role in that their potential upside (and also downside) is greater depending on how well the crop performed. Their platform shows target returns between 6% - 15%, which reflects this increased risk.

Another differentiating feature is FarmFundr's shorter holding periods, which vary from one to seven years.

We also like that FarmFundr takes an equity stake in each of their properties, ensuring that they have skin in the game. Just as with AcreTrader and FarmTogether, they also only accept accredited investors.

Bottom Line: Is AcreTrader Legit?

AcreTrader is absolutely legit. Farmland as an asset class has delivered strong and steady returns over the last couple decades that compare favorably to stocks, but with much less volatility.

As the world's population continues to grow rapidly, it's clear as night and day that there will always be strong demand for fresh foods and the fertile lands they are grown on.

AcreTrader offers a robust underwriting process to bring only the highest quality farmland offerings to accredited investors.

References

- ^ AcreTrader, What's the IRR of Farmland?, Retrieved 3/15/22

- ^ "How it Works": AcreTrader, 2021.

- ^ AcreTrader. FAQ: What are the costs associated with using AcreTrader?, Retrieved 8/14/2022

- ^ "AcreTrader FAQ": AcreTrader, 2022.

- ^ SEC. Accredited Investor, Retrieved 8/14/2022

- ^ "Historical Farmland Returns": AcreTrader, 2021.

- ^ FarmTogether. FAQ: What is the minimum investment size?, Retrieved 8/14/2022

- ^ Fundrise. What is the minimum initial investment?, Retrieved 8/14/2022

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Invest in Real Estate with $100

- Short-term real estate investments lasting just 6-18 months

- Open to non-accredited investors

- Low fees

Invest in Rental Homes with $100+

Browse rental home investments for free. No bank account required

Write to Andrew Fitzgerald at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Fundrise, LLC ("Fundrise") compensates CreditDonkey Inc for new leads. CreditDonkey Inc is not an investment client of Fundrise.

|

|

|

Compare: