Largest Banks in the World

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

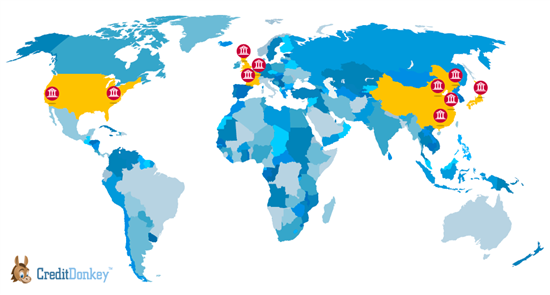

The world's ten largest banks are headquartered across Asia, Europe, and America. Which is the biggest bank in the world? And how do U.S. banks compare. Find the answers below.

|

There are several ways to measure a bank's size. However, financial analysts most often use two categories: number of assets and a metric called "Tier 1 capital" to compare.

In the list below, we've also noted "Return on Assets," which refers to how well the bank generates profit from the assets it owns. This figure is calculated by dividing a bank's net operating profit after tax by its assets. The higher the percentage, the better return the bank generates.

Top 10 World's Largest Banks by Assets

|

| Largest Banks by Assets © CreditDonkey |

| 1 | Industrial & Commercial Bank of China | $4.03 trillion | China |

|---|---|---|---|

| 2 | China Construction Bank Corp. | $3.38 trillion | China |

| 3 | Agricultural Bank of China | $3.29 trillion | China |

| 4 | Bank of China | $3.09 trillion | China |

| 5 | Mitsubishi UFJ Financial Group | $2.81 trillion | Japan |

| 6 | JPMorgan Chase & Co. | $2.62 trillion | United States |

| 7 | HSBC Holdings | $2.56 trillion | United Kingdom |

| 8 | Bank of America | $2.35 trillion | United States |

| 9 | BNP Paribas SA | $2.34 trillion | France |

| 10 | Crédit Agricole Group | $2.12 trillion | France |

Source: S&P Global Market Intelligence Report

- ICBC

Headquartered in Beijing, the state-owned Industrial & Commercial Bank of China was founded in 1984. It provides banking services to China and more than 40 other countries across six continents.The bank — ranked by Forbes as the world's largest public company — services commercial and individual clients.

Assets: $4.03 trillion

Return on Assets: 1.08% - China Construction Bank Corp.

Based in Beijing, China Construction Bank Corp provides corporate, commercial, and personal banking services. It is one of the "Big Four" Chinese state-owned state banks that operates in 29 countries and regions.As of 2019, China Construction Bank was the world's third-largest public company.

Assets: $3.38 trillion

Return on Assets: 1.1% - Agricultural Bank of China

Ranked as the fourth-largest company in the world, the Beijing-based Agricultural Bank of China is the third member of China's state-owned "Big Four" banks.With over 300 million retail customers, the bank services a range of international locations from Sydney to Seoul.

Assets: $3.29 trillion

Return on Assets: 0.9% - Bank of China

Bank of China, located in Beijing, is the oldest and most international of the Chinese "Big Four" banks.It offers insurance, pension, investment banking, and other services to personal, commercial, and corporate clients across six continents. According to Forbes, it is the eighth-largest public company in the world.

Assets: $3.09

Return on Assets: 0.9% - Mitsubishi UFJ Financial Group

Headquartered in Tokyo, Japan, Mitsubishi UFJ serves over 50 countries and regions around the world. As a retail, commercial, and corporate bank, Mitsubishi UFJ offers a wide range of products and services that include asset management and personal banking.Assets: $2.81 trillion

Return on Assets: 0.31% - JP Morgan Chase & Co

JP Morgan Chase, the first American bank on this list, has clients ranging from individuals to giant corporations in over 100 markets. A leader in investment and commercial banking, this New York City-based bank trades on the New York Stock Exchange. It is a member of the Dow Jones Industrial Average stock market index.Assets: $2.62 trillion

Return on Assets: 1.24% - HSBC Holdings

Based in London, UK, HSBC serves over 40 million customers across 65 countries through its four business pillars: retail banking and wealth management, commercial banking, global banking and markets, and global private banking.Employing over 230,000 people, HSBC trades on the New York, Bermuda, Hong Kong, London, and Paris stock exchanges.

Assets: $2.56 trillion

Return on Assets: 0.78% - Bank of America

As the world's eighth largest bank — and second-largest American bank — Bank of America keeps its headquarters in Charlotte, North Carolina. It serves consumer and small business clients in addition to the wealth management, corporate and investment banking, and trading services it provides to corporations and governments.With about 66 million clients in over 35 countries, Bank of America was ranked the fifth-largest company in the world by Forbes.

Assets: $2.35 trillion

Return on Assets: 1.2% - BNP Paribas SA

BNP Paribas is one of the leading banks in Europe. It has locations in over 72 countries, providing traditional lending and consumer banking as well as investment banking and savings and protection insurance.Through its subsidiary Bank of the West, BNP Paribas reaches over 2 million U.S. households.

Assets: $2.34 trillion

Return on Assets: 0.39% - Crédit Agricole Group S.A.

The French bank Crédit Agricole has 51 million customers across 47 different countries. A real estate investor, lender, and asset manager, Crédit Agricole serves multinational corporates as well as individuals through 11,000 branches worldwide.Assets: $2.12 trillion

Return on Assets: 0.4%

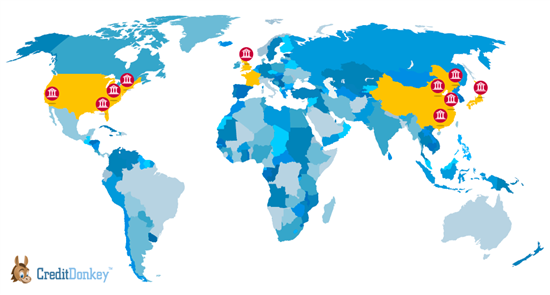

Top 10 World's Largest Banks by Tier 1 Capital

|

| © CreditDonkey |

Tier 1 capital refers to the core capital funds a bank uses to operate on a daily basis. It's mostly made up of shareholder's equity and retained earnings.

Here are the world's 10 largest banks ranked by tier 1 capital:

| Rank | Bank Name | Country | $bn Tier 1 Capital |

|---|---|---|---|

| 1 | ICBC | China | $337.54 |

| 2 | China Construction Bank | China | $287.46 |

| 3 | Agricultural Bank of China | China | $242.90 |

| 4 | Bank of China | China | $229.97 |

| 5 | JP Morgan Chase & Co | US | $209.09 |

| 6 | Bank of America | US | $189.04 |

| 7 | Wells Fargo & Co | US | $167.87 |

| 8 | Citigroup | US | $158.12 |

| 9 | HSBC Holdings | UK | $147.14 |

| 10 | Mitsubishi UFJ Financial Group | Japan | $146.74 |

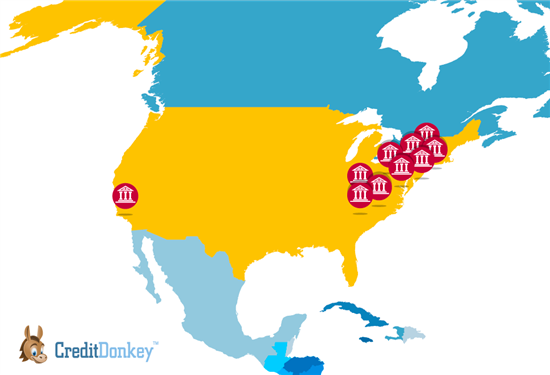

Ten Largest Banks in the U.S.

|

| © CreditDonkey |

| Rank | Bank Name | Total Assets |

|---|---|---|

| 1 | JPMorgan Chase & Co. | $2.74 trillion |

| 2 | Bank of America Corp. | $2.38 trillion |

| 3 | Citigroup Inc. | $1.96 trillion |

| 4 | Wells Fargo & Co. | $1.89 trillion |

| 5 | Goldman Sachs Group Inc. | $925.35 billion |

| 6 | Morgan Stanley | $875.96 billion |

| 7 | U.S. Bancorp | $475.78 billion |

| 8 | PNC Financial Services Group Inc. | $392.84 billion |

| 9 | TD Group US Holdings LLC | $384.07 billion |

| 10 | Capital One Financial Corp. | $373.19 billion |

Source: S&P Market Global Intelligence Report

Checking Account Promotions

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

HSBC Premier - Earn Up to $7,000

- Send and receive money with Zelle® right from our mobile app

- Manage your money safely, easily and fee-free around the world - from Global Money Transfers to multi-currency needs

- Enjoy peace of mind with unique travel benefits available through our credit cards

Here's how the offer works: Open a new HSBC Premier checking account by March 31, 2026. Add New Assets to your Premier checking account, Premier Savings account, Premier Relationship Savings account, Managed Portfolio Account and/or Spectrum account (Eligible Accounts) by March 31, 2026, and maintain the New Assets through June 30, 2026.

- Get a $1,500 Cash Bonus: Add and maintain New Assets of $150,000 to $249,999

- Get a $2,500 Cash Bonus: Add and maintain New Assets of $250,000 to $499,999

- Get a $3,500 Cash Bonus: Add and maintain New Assets of $500,000 to $999,999

- Get a $7,000 Cash Bonus: Add and maintain New Assets of $1,000,000+

If all offer requirements are met, the bonus will be paid by August 31, 2026.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

U.S. Bank Business Essentials - $400 Bonus

Promo code Q1AFL26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

Business Essentials: $400 bonus with $5,000 new money deposits, daily balance, and 6 qualifying transactions.

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank Mobile Check Deposit, electronic or paper checks, Bill Pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.

Member FDIC

Free Business Checking - Earn $500 Bonus

To earn the $500 bonus, customers must apply for a Bluevine Business Checking account anytime between now and 03/31/2026 using the referral code CD500.

After opening your account, deposit a total of $5,000 within the first 30 days. After 30 days, maintain a minimum daily balance of $5,000 while also completing at least one of the following eligibility requirements every 30 days for 90 days:

- Deposit at least $5,000 from eligible merchant services to your Bluevine account OR

- Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers OR

- Spend at least $2,000 on eligible transactions with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

Banking services provided by Coastal Community Bank, Member FDIC

Basic Business Checking - Up to $200 Bonus

- Open a Basic Business Checking account using promo code START200 by June 30, 2026.

- Every dollar counts when you're starting out. That's why new businesses can earn up to $200 opening a new Basic Business Checking account today.

- No initial deposit requirement

- No minimum balance requirement

- No monthly maintenance fees

- Free domestic incoming wires. Two (2) outgoing domestic wire fees reimbursed per month.

- Unlimited domestic ATM fee reimbursements

- Unlimited item processing (debits, credits, and deposited items)

- Cash deposits via MoneyPass and Allpoint networks

25% Discount on Scale Plan

Get Scale Plan for $90/month instead of $120/month. This offer is for a limited time only and may change without notice.

Key Select Checking® - $500 Bonus

- Open a Key Select Checking® account online by May 22, 2026.

- Make the minimum opening deposit of $50 and make a total of $5,000 or more in eligible direct deposits within the first 90 days of account opening.

- Your $500 cash bonus will be deposited into your account within 60 days of meeting requirements. Account must not be closed at the time of gift payment.

Compare Savings Accounts

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

High Yield Savings Account - 3.86% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Axos ONE - Earn up to 4.21% APY

- Earn up to 4.21% APY* on savings, and 0.51% APY* on checking when you meet requirements.

- Get your money up to 2 days early.

- No monthly maintenance, minimum balance, account opening, or overdraft fees.

High Yield Savings - 3.50% APY

- 3.50% APY

- $100 minimum opening deposit

- No monthly service fees

Personal Savings - Earn 3.80% APY

- Earn 3.80% APY

- No minimum balance requirement

- No monthly service fee

High-Yield Savings Account - 3.79% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

High-Yield Savings Account - Up to $1,500 Bonus

- Select a savings offer and sign up: Choose and fund at least one high-yield savings account or CD on the Raisin platform to get started. Be sure to enter bonus code HEADSTART during sign-up to be eligible for a cash bonus.

- Deposit funds: The more you save, the more you can earn. Make a qualifying deposit(s) within 14 days of opening your account to set your bonus tier.

- Maintain your deposit(s): Maintain your deposit(s) for 90 days from your first deposit date to earn your bonus.

| Deposit | Cash Bonus |

|---|---|

| $10,000 - $24,999 | $70 |

| $25,000 - $49,999 | $175 |

| $50,000 - $99,999 | $350 |

| $100,000 - $199,999 | $750 |

| $200,000 or more | $1,500 |

Current Savings - Up to 4.00% bonus

- 4.00% bonus on up to $6,000 balance if you receive and maintain a qualifying direct deposit of $200 or more in a rolling 35 day period. (Otherwise, 0.25%)

- Simply add money to your Savings Pods and enable the Boost feature.

- Earn bonus on up to 3 Savings Pods, up to $2,000 balance each.

- Bonuses accumulate daily.

Bottom Line

China dominates the world's largest banks list, holding the top four spots in both assets and tier 1 capital rankings. In the U.S., JPMorgan Chase and Bank of America are the two largest.

Write to Andrea Sielicki at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|