How to Get a Small Business Loan

Getting a small business loan can be tricky. It depends on your qualifications and lender requirements. Learn how to successfully get a loan.

|

Applying for a small business loan can seem overwhelming. Being unprepared could lead you to rejection, and rejection stings.

Not to mention, you would have wasted all your time if the application process took a while. And wasted time can delay your schedule or business plans.

Good thing it doesn't have to be that way. This article will let you know what you need to do to apply and get that approval.

What is a Small Business Loan?

A small business loan is a loan provided by lenders for small businesses. You can use it to finance various business operations or help with expansion. For example, you could use the funds for:

- Your working capital and payroll

- Purchasing business equipment or inventory

- Refinancing other business debt

Keep in mind that some lenders will limit the use to specific purposes.

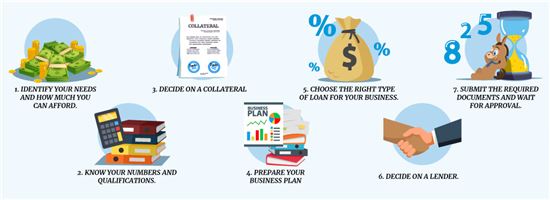

Step-By-Step Guide to Getting a Small Business Loan

|

You wouldn't want to apply for every business loan out there. The loan is like a shoe, it doesn't fit every foot. Here's a breakdown of actionable steps to find the right fit.

1. Identify Your Needs and How Much You Can Afford

You'll be taking on a loan because you see a need for it. You need to be clear and specific about where you plan for the money to go. The purpose of your loan will determine the amount. You'll need to specify both in your business plan.

This purpose could be for:

- Working capital

- Training new hires

- Equipment and machinery (purchasing or upgrading)

- Inventory or supplies

- Real estate (purchasing, constructing, or acquiring)

- Refinancing other business debt

Borrowing larger loans could be expensive due to interest rates. But borrowing too little would defeat the purpose of the loan. By identifying where you'll use the funds, you can then identify how much you need (for example, you'll need $100,000 to purchase new real estate).

A business loan calculator will help you break down your payment schedule. You'll see if you can afford the monthly payments.

To help get you started, you can check out the Service Corps of Retired Executives (SCORE), which is a free mentoring service.

2. Know your numbers and qualifications

Lenders will have varying requirements when it comes to numbers. Reviewing yours beforehand can save time by only applying for loans you qualify for.

- Credit Scores. Good credit scores are at least 670 for a personal credit score and 80 for a business credit score. Lenders use these to evaluate how well you manage your debt.

Pro tip: Go through your credit reports regularly. Sometimes, creditors report incorrect information, which negatively affects your scores. If you have bad credit, online lenders may be more lenient with their requirements.

- Revenue. You need ample cash flow and the minimum required monthly or annual revenue. Usually, lenders want to see at least $10,000 to $30,000 monthly revenue.

- Amount of Debt. Lenders look at your amount of debt to ensure they're not larger than your income. They use the debt-to-income ratio (DTI) for this.

DTI shows how much of your earnings are used to repay debts. For example, if you make $10,000 a month and pay $3,000/mo in debt, your DTI is 30%. Ideally, you'll want a DTI below 36% but lenders can go for up to 45%.

- Time in Business. Lenders will commonly require you to have been in business for at least 2 years. Many businesses fail within the first year. The longer you are in business, lenders will be more confident in how well you manage your company.

Some online lenders only require 6 months of being in business. You need to have solid business financials in this period.

- Business Industry. Some industries are riskier than others. This risk is based on how likely it is for the business to fail. Riskier businesses may have a harder time getting a loan.

Generally, the best time to get a loan is when your business is financially well. This will give lenders confidence that you'll be able to repay the loan.

3. Decide on a Collateral

Many lenders will need collateral of some sort before they give you a loan. Collateral mitigates the risks for lenders. This lets them seize your assets should your business fail to make payments.

You should decide what you're willing to put up as collateral. Depending on the loan, assets you can use as collateral include:

- Real estate properties

- Equipment and machinery

- Vehicles

- Inventory

- Unpaid Invoices

- Cash or savings

- Investments (e.g., stocks, bonds, and cryptocurrencies)

If there's no specific collateral required, lenders may require a personal guarantee instead. This means lenders can go after your personal assets if you default on the loan.

Collateral and personal guarantee pertain to specific assets you pledge. A blanket or UCC lien, however, will give lenders the right to seize any and all of your assets should you default. This presents a huge risk to borrowers but the most security for lenders.

4. Prepare Your Business Plan

The main goal of your business plan is to communicate your business needs well. Think of this as your business story. It will help build lender confidence when they see how well you manage funds, how you plan to use the loan, and how you plan for repayment.

Some critical sections to include are:

- Financial analysis. This includes your past revenue and projections for the next three to five years. It dictates if you're a profitable business.

You can attach your income statements, cash flow statements, capital expenditure budgets, balance sheets, and profit and loss (P&L) statements in this section.

- Market analysis. Your target market and marketing strategy will let lenders know that you know your industry well.

- Products and services. Your business model and pricing structure show how your business can succeed.

- Organization. This pertains to your organizational chart and management positions. This will show lenders how your company works.

They'll want to know the responsibilities of each person and their qualifications. Some lenders require a resume.

5. Choose the Right Type of Loan for Your Business

There are many small business loans available, but not all of them are good for the same purpose. The most suitable loan will depend on your goals and needs.

Here's an idea of the type of loans to look at:

- For starting a business. Microloans are ideal for new businesses or startups. Microlenders are also more lenient regarding credit score requirements.

- For expanding a business. Term loans may be suitable for established small businesses. You can use this loan for anything, including working capital, inventory, or a new office. Businesses with solid financial backgrounds may find it easier to apply.

- For temporary cash flow gaps. A business line of credit is the most flexible option. You can draw and redraw loan amounts as needed without taking out a new loan. It's usually used for inventory, payroll, or working capital.

You can also opt for invoice financing if you're a business-to-business (B2B) company. That way, you can get a cash advance while waiting for client payments.

- For specific purposes. Loans such as real estate loans, equipment loans, auto loans, or professional practice loans are best for long-term and specific business goals. They can be repaid in longer periods due to larger loan amounts.

6. Decide on a lender

Once you've chosen a type of business loan, it's time to look at potential lenders. Banks and credit unions are best for established businesses because they have tougher requirements.

Online lenders are more suitable for startups. They require a few months or 1 year of being in business. If you're just starting out, microlenders will be the best option.

Here are the different types of lenders:

- Traditional banks and credit unions. These institutions offer SBA loans, term loans (including real estate and equipment loans), and lines of credit. They're usually more stringent with the requirements compared to other lenders.

The application process can also take more time. It can take a day or months depending on your documents before you can get approved. Conveniently, however, you can apply in person or online.

Banks also likely offer larger loans. So if you have big purchases like properties, for example, it's best to borrow from them.

- Online lenders. They are also called alternative lenders. They often have more flexible requirements and approval times. You can get a response within a few minutes to a couple of hours.

They offer business lines of credit, invoice financing, or term loans.

- Microlenders. Microlenders are nonprofit organizations working with the SBA or independently. They have a mission to help small businesses that often don't qualify for a loan.

Different lenders will have varying requirements. It's best to compare and "shop around" before committing to one.

When choosing a lender, be sure to look at their:

- Minimum and maximum loan amount. They should be suitable for the amount you need based on your strategy or business plan.

- Rates and repayment terms. Different loans have varying rates and repayment methods. More than interest rates, it's best to look at the Annual Percentage Rate (APR) to get an overview of the actual yearly cost of your loan.

- Lender fees. Lenders have application fees that affect the total cost of your loan. This could include origination fees, early and late repayment fees, guarantee fees (for SBA loans), and other service fees.

- Better Business Bureau Rating. To ensure you're borrowing from a reputable company, you'll want to look for an "A" rating.

7. Submit the required documents and wait for approval

You've prepared your business plan and your calculations. You've chosen your type of loan and your potential lenders. Now's the time to officially submit your application.

Let's summarize what you will need on hand:

- Business financial statements. You will need your cash flow statements, income statements, balance sheets, profit, and loss statements, and projected financial statements.

These are generally attached to your business plan.

- Personal financial statements. If you're an owner with more than 20% of stake in your business, then you'll likely be asked to submit personal financial statements.

If you're applying for an SBA 7(a) or 504 loan, you'll need to fill out this form.

- Tax returns. Lenders will likely ask for your personal and business income tax returns from the previous three years.

- Legal documents. You'll need your business certificate, identification (EIN and/or SSN), leases, and any third-party disclosures.

Are Small Business Loans Hard to Get?

Small business loans will be hard to get if you don't qualify for the lender's requirements. You'll first need to build your personal and business credit scores and have a strong financial background.

Regarding approval time, online lenders can provide the loan within minutes to a few days. Traditional lenders, such as banks and credit unions, may take longer (like a few months).

The time it takes will depend on whether you have the requirements readily available.

The main challenge, however, is getting qualified. Keep in mind that meeting the minimum requirements doesn't guarantee approval.

Types of Small Business Loans

|

Because there are many small business loans to choose from, knowing their differences will help you pick what's suitable.

You can compare options by considering the loanable amount, repayment method, loan terms, collateral needed, and type of lender.

Let's talk about each type in detail.

SBA Loans

SBA loans are loans guaranteed by the U.S. Small Business Administration. A "guarantee" means if your business defaults, the SBA will pay for a percentage of the loan. This reduces the risk for lenders.

The SBA also sets a maximum interest rate. So it's ideal for small businesses that may not qualify or get good terms for a regular loan. They're not a lender themselves. They have approved lenders they work with.

7(a) loans, 504 loans, microloans, and express loans are some of the most common SBA loan programs.

- SBA 7(a) loans. For various business purposes such as working capital, refinancing debts, and purchasing supplies

- SBA 504 loans. For purchasing business facilities, real estate, and equipment

- SBA Express loans. For similar purposes of 7(a) and 504 loans, but you can get a response within 36 hours

- Microloans. For starting and growing small businesses

- Loanable amount. The maximum loanable amount for standard 7(a) loans and 504 loans is $5 million[1][2], while it's $500,000 for Express loans.[3]

- Loan term. Maturity terms for SBA 7(a) loans are up to 25 years for real estate, 10 years for working capital and inventory, and 10 years for equipment.[4]

On the other hand, 10- and 20-year maturity terms are available for SBA 504 loans.[5]

- Collateral. Collateral isn't required for loans up to $25,000, but this will still depend on the partner lender.

For loans over $25,000 up to $350,000, collateral is required as much as possible close to the loan amount. If business assets aren't enough, trading assets may be required.

- Type of lender. SBA loans are available from traditional banks and credit unions. Wells Fargo is one of the most active SBA lenders. It provides long-term financing of up to $5 million.

Term Loans

With term loans, you'll receive a lump sum from a lender. And you'll have to repay during a selected term.

You can choose from short-term, intermediate-term, and long-term loans. These installments can be repaid monthly, bi-monthly, weekly, or daily.

Some long-term loans can be repaid annually or semi-annually.

- Loanable amount. The minimum and maximum amounts vary per lender. Usually, there's a minimum of $10,000 up to a maximum of $500,000.

- Loan term. Repayment depends on the loan term. Short-term loans can be repaid in 1-2 years. Intermediate-term loans go about 2-5 years. Long-term loans can be up to 25 years.

Term loan payments are equal in amount. But some loans may have a balloon payment at the end of the period. A balloon payment refers to a large payment at the end of the loan to fully repay the balance.

- Collateral. Both secured and unsecured term loans are available. Any assets with values equal to or more than the loan amount are accepted.

- Type of lender. Term loans are available for traditional institutions like banks and credit unions, or from online and alternative lenders.

OnDeck is a popular online lender for short-term loans. You can borrow from $5,000 to $250,000. For long-term loans, you can check out Smartbiz. They can lend from $30,000 to $5 million.

Business Line of Credit

Business lines of credit are popular for a reason. It's a flexible option where you can take cash from a credit line as needed. It works similarly to a business credit card.

You can draw and redraw funds from the credit line within the draw period. And you can repay what you've drawn to replenish the loan amount.

It's suitable for unexpected purchases, working capital, or seasonal expenses.

- Loanable amount. Depending on your lender, you can get business lines of credit from $1,000 up to $250,000.

With business lines of credit, interest is only applied to the amount you've drawn or borrowed, and not the entire loanable amount.

- Loan term. Some business lines of credit that are not revolving can have repayment terms of 3, 6, 12, or 18 months. Revolving credit lines remain useable until you or the lender decides to close the account.

- Collateral. Both secured and unsecured options are available. You can use receivables or inventory as collateral.

- Type of lender.These are available from banks, credit unions, and online lenders. Fundbox and Bluevine are two popular lenders. You can borrow up to $150,000 and $250,000 respectively.

Microloans

Microloans are smaller loan options you can use to start and grow a small business. If you struggle to qualify for traditional or larger loans, then microlenders may be able to help you out.

These loans give special focus to minority groups such as immigrants, veterans, or women in business. Microlenders usually have a mission to help small businesses in their local area thrive.

- Loanable amount. Microloans backed by the SBA can offer up to $50,000,[6] but other microlenders can lend up to $250,000. The minimum loan amount can be as low as $500.

- Loan term. Repayment terms vary per microlender. Those that work with the SBA are limited to up to six years. Other microloans typically have terms of three months to five years.

- Collateral. Both secured and unsecured options are available. But secured loans are more likely to require little collateral.

- Type of lender. Microlenders are usually nonprofit organizations that work with the SBA. However, credit unions also offer microloans.

Accion Opportunity Fund is a great microlender. You can choose from their Progress Loan or SOAR fund, both with loanable amounts of $5,000 to $100,000.

It's best to find microlenders in your area. Nonprofit organizations typically limit serving businesses in specific locations.

Commercial Real Estate Loan

As the name suggests, a commercial real estate loan or commercial mortgage loan is used for purchasing a new business property.

You can also use them for the construction and development of your current properties. Keep in mind that this is for income-producing properties only.

- Loanable amount. You can borrow from $25,000 to $500,000. But SBA-guaranteed commercial real estate loans can offer up to $5,000,000.

- Loan term. Terms usually last 5 to 10 years. But amortization periods are often longer, which can be up to 25 years.

- Collateral. This loan is collateralized by the property you'll be purchasing.

- Type of lender. Lenders are traditional institutions such as banks, insurance companies, private investors, and pension funds. But some credit unions and online lenders also offer the same.

Some lenders limit the loan amount to $1 million, but you can get up to $10 million with U.S. Bank.

Equipment Financing

Equipment financing is specifically for purchasing business equipment. You can use it to replace broken equipment or make upgrades as part of your expansion.

You can use it for heavy construction equipment, printers, or even company vehicles. You can also choose to purchase new or used ones.

- Loanable amount. You can get equipment loans from $1,000 up to $500,000. But SBA loans can lend up to $5,000,000.

- Loan term. The term usually lasts the expected lifespan of the equipment.

- Collateral. The loan is collateralized by the equipment you purchase.

- Type of lender. You can find equipment loans from traditional lenders such as banks and credit unions, or online lenders.

Bank of America is a great option since it has no maximum amount. However, the loan starts at $25,000.

Auto Loans

You can purchase company vehicles through auto loans. Some lenders limit the vehicle weight for this option, but offer vehicle financing through equipment loans.

These are suitable for purchasing vans and trucks for business operations. But you can also use them to refinance vehicles you already own.

Keep in mind that some lenders have a maximum vehicle age requirement.

- Loanable amount. You can borrow from $10,000 to $500,000. But many of the lenders do not disclose the maximum loan amount. Some lenders require a down payment.

- Loan term. Business auto loans generally have four- to seven-year terms.

- Collateral. The vehicle to be purchased itself is the collateral.

- Type of lender. You can get business auto loans from traditional institutions such as banks and credit unions.

You have more room with your vehicle options with Capital One. They can offer from $10,000 to $5 million of auto loans.

Invoice Financing

Invoice financing is a cash advance you can get from a lender from your outstanding invoices.

It's suitable for bridging cash flow gaps. You can get paid by lenders upfront instead of waiting on your clients' payments.

Keep in mind that you still must collect the payments from your clients. This will serve as your repayment for the loan.

- Loanable amount. Lenders can advance up to 90% of your outstanding invoices.

- Loan term. You can repay lenders as soon as your clients pay your business on or before the due date of the outstanding invoices.

- Collateral. Your invoices serve as collateral.

- Type of lender. Invoice financing is usually offered by fintech companies and online lenders. FundThrough Express can lend you $500 to $15,000 in 12 weekly installments.

Merchant Cash Advance (MCA)

Similar to invoice financing, a merchant cash advance is a business cash advance based on your debit and credit card sales.

It's a good option if you're an online store whose cash flow is mainly from debit and credit card sales.

You'll receive a lump sum with no restrictions on how it can be used. You can use it for your inventory, working capital, marketing, or payroll, for example.

- Loanable amount. You can find lenders offering $300 to $3 million.

- Loan term. Repayment for MCAs is through a percentage of your daily or weekly sales. Since payment varies depending on your sales, there is no specific term length.

The more sales you have, the faster you'll be able to repay. You'll likely pay 10% to 20% of your daily sales until the cash advance is fully paid back.

- Collateral. MCAs don't usually require collateral.

- Type of lender. Lenders are merchant cash advance companies that are likely online or alternative lenders. Rapid Finance can be a good option with loan amounts of $5,000 to $500,000.

FAQs

How can a small business get a loan for a beginner?

If you're a startup or a newly established small business, you can opt for micro-loans to expand or grow. You can also look at alternative loans such as crowdfunding or peer-to-peer lending. Online lenders can be more lenient with requirements also.

How much money can a small business get in a loan?

Minimum and maximum loanable amounts vary. You could get $5,000 (or less) to $5 million depending on the lender and type of business loan. Long-term loans offer larger loans. The amount you could borrow will also depend on your qualifications.

How do I get money to start a business without a loan?

If you choose not to opt for a small business loan, then you could start by borrowing from family and friends. However, they, as private lenders, will still likely want to hear your sales pitch. Just remember to put the loan terms in writing.

What disqualifies you from getting a business loan?

You won't get approved if you fail to meet the lender's requirements. It could be due to poor credit, insufficient cash flow, or an unconvincing business plan. Keep in mind that meeting the minimum requirements is still no guarantee of approval.

Bottom Line

Getting a small business loan is a long process. Although an application can take minutes (especially for online lenders), the preparation is what takes time.

To get a small business loan, you'll have to first identify its purpose. Then study if your business financials qualify for typical lender requirements. You'll want to have enough collateral if you're opting for a secured loan. And your business plan should be convincing enough to increase the lender's confidence in your business.

Study the types of small business loans and choose what is most suitable. Then you can start looking at potential lenders based on that type of loan.

After choosing your lender, you can finally apply and submit your documents. You can apply for small business loans online or in person. Approval time varies from minutes to months.

References

- ^ U.S. Small Business Administration. What is a 7(a) loan? , Retrieved 10/22/22

- ^ U.S. Small Business Administration. What is the 504 loan program?, Retrieved 10/22/222

- ^ U.S. Small Business Administration. SBA Express, Retrieved 10/22/22

- ^ U.S. Small Business Administration. 7(a) loan program Maturity terms, Retrieved 10/22/22

- ^ U.S. Small Business Administration. How do I pay back my 504 loan?, Retrieved 10/22/22

- ^ U.S. Small Business Administration. Microloans, Retrieved 10/22/22

Write to Karen Eloriaga at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

|