CIT Bank Routing Number

Want to transfer money in or out of your CIT Bank account? Read this review to find your ABA routing number.

Routing numbers are 9-digit numbers that banks use to identify themselves. Think of them as an address that lets other banks know where to find your money.

You need your routing number for many tasks, including:

- ACH payments

- Setting up direct deposit

- Receiving government benefits, including tax refunds

- Transferring money between banks or investment firms

- Automatic bill payment

- Domestic wire transfers

CIT Bank Routing Number

Banks with branches in more than one state typically have more than one routing number. However, since CIT Bank is an online bank, all customers use the same one.

CIT Bank routing number for all personal banking accounts is 124084834.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Finding Your CIT Bank Routing Number

|

| © CreditDonkey |

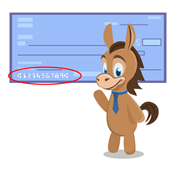

Here are two other ways to find your CIT Bank routing number:

Use a Check

For checking accounts, you can find the routing number in the lower left-hand corner of the checks corresponding to your account. It's the first 9 digits located at the bottom of the check.

Call Customer Service

Call CIT Bank at 855-462-2652. After you provide a few specific details to identify yourself, a representative will be able to confirm your account's routing number.

The first four digits pertain to the Federal Reserve. The next four digits are unique to your bank. Consider those the bank's address for the Federal Reserve. The final digit is a mathematical calculation of the first eight digits—it's used to prevent check fraud.

Routing Numbers for Domestic Wire Transfers

From your CIT Bank account, you can wire money to other bank accounts located in the U.S. Other accounts can also wire funds to you.

To receive a domestic wire transfer, use the routing number 124084834.

You'll also need the following:

- Recipient's name as it appears on the account

- Location of the recipient's bank (including city and state)

- Account number

- Bank routing number

CIT does not charge for incoming wire transfers. Outgoing wires are free for customers with an average daily balance greater than $25,000. Otherwise, you'll pay $10 per wire.

Routing Numbers for International Wires

CIT Bank currently does not service outbound international wire transfers. However, you can receive an international wire transfer to your CIT Bank account.

Simply provide the routing number 124084834. CIT Bank does not have a SWIFT code, which is the international equivalents of the U.S. routing numbers.

To send a domestic wire transfer from your CIT account, fill out the CIT wire transfer paperwork. Then:

- Upload it to the Document Center in your online account OR

- Fax it to a CIT Bank representative using the fax number (866) 914-1578.

Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions. Routing numbers are only used for transfers directly between bank accounts.

Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. When you pay your credit card online, you may need to use your bank account routing number to set up the link between your credit card account and checking account, like you would for any other bill.

Bottom Line

You'll likely need CIT Bank's routing number when managing your finances. Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer using your CIT bank account.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Personal Savings - Earn 3.80% APY

- Earn 3.80% APY

- No minimum balance requirement

- No monthly service fee

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Write to Andrea Sielicki at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: