Capital One Routing Number: What You Need to Know

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

What is the routing number for Capital One? Find the right one for your account with our guide.

Routing numbers are 9-digit numbers that banks use to identify themselves. Think of them as addresses that let other banks know where to find your money.

You need your routing number for many tasks, including:

- ACH payments

- Setting up direct deposit

- Receiving benefits from the government, including tax refunds

- Transferring money between accounts at different banks or investment firms

- Automatic bill payment

- Domestic wire transfers

Capital One has two routing numbers associated with their two business entities, Capital One Bank (USA), N.A. and Capital One, N.A.

Keep reading to find the right Capital One routing number for your transactions.

Capital One Routing Numbers by State

Your routing number is associated with the institution or entity where you opened your account. You can find that entity on your bank statement located to the right of your account number.

Here are the routing numbers by bank institution:

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073502 |

If you are unsure what institution holds your money, keep reading for other ways to find your Capital One routing number.

Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions. Routing numbers are only used for transfers directly between bank accounts.

Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account.

Tip: Save for what matters most with a savings account. Enjoy the benefits of earning interest while keeping your money secure.

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

UFB Portfolio Savings - Earn up to 3.26% APY

- Earn up to 3.26% APY.*

- No monthly maintenance fees.

- No minimum deposit required to open an account.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Enjoy peace of mind with FDIC insurance up to the maximum allowance limit – Certificate #35546.

High-Yield Savings Premier - 3.80% APY

- No account fees

- Option to open individual or joint account

- FDIC insured up to $250,000 per depositor

- Only $500 minimum opening deposit

Other Ways to Find Your Capital One Routing Number

|

| © CreditDonkey |

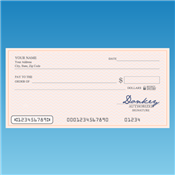

Use a Check

Find the routing number in the lower left-hand corner of the check corresponding to your checking account. It's the first 9 digits located at the bottom of each check.

Go Online

Access your online bank statement by logging in to your account. To the right of your account number will be your Capital One bank entity. Once you know your bank entity, you can determine your routing number using the list provided above.

Call Customer Service

If you don't have online checking or a check handy, call Capital One at 888-810-4013. After you provide a few details to identify yourself, a representative will be able to confirm your account's routing number.

The first four digits pertain to the Federal Reserve. The next four digits are unique to your bank. Consider those the bank's address for the Federal Reserve. The final digit is a mathematical calculation of the first eight digits—it's used to prevent check fraud.

Routing Numbers for Domestic/International Wire Transfers

Wire transfers are a faster way to send money than an ACH transfer, though they typically cost a small fee. In order to send a wire, you'll need to fill out Capital One's Outbound Wire Request Form and mail/fax it for processing.

To Make a Domestic Wire Transfer

Use the routing number that corresponds with your account's bank entity. The Capital One Bank (USA), N.A. routing number for wire transfers is the same as the routing number used for direct deposits and ACH transfers.

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073612 |

Incoming (Domestic and International): $15.00

Outgoing (Domestic): $25.00

Outgoing (International) in foreign currency: $40.00

Outgoing (International) in USD: $50.00

You'll also need the following information for domestic wires:

- The name of the person to whom you're wiring funds (the "beneficiary") as it appears on their account

- The name and address of the beneficiary's bank

- The routing number of the beneficiary's bank

- The beneficiary's account number

To Make an International Transfer

Use the Capital One SWIFT code HIBKUS44.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are the international equivalents of the US routing numbers. They direct the money to the correct bank for international transfers.

You'll also need the following information for international wires:

- The name of the person to whom you're wiring funds (the "beneficiary") as it appears on their account

- The name and address of the beneficiary's bank

- The beneficiary's bank account number; for many international transfers, this is called the IBAN number

- The SWIFT code of your bank and the bank you are sending to

- Currency being sent

- Purpose of transaction

Before submitting a wire transfer for processing, it's a good idea to double-check you have all the necessary information entered correctly.

Cheaper and Faster Way to Send Money Internationally

The quickest and cheapest way to send money internationally is to use a money transfer service (instead of Capital One).

Which Capital One Routing Number Should You Use?

Domestic Money Transfer Activity

Use the ABA routing number associated with your account's Capital One entity:

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073502 |

Domestic Wire Transfers

Use the Capital One wire transfer routing number associated with your account's Capital One entity:

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073612 |

International Wire Transfers

Use Capital One SWIFT code HIBKUS44.

Bottom Line

You'll likely need your Capital One routing number when managing your finances. Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer.

Chase Total Checking® - $400 Bonus

- New Chase checking customers can receive $400 when you open a Chase Total Checking® account and make direct deposits totaling $1,000 or more within 90 days of coupon enrollment.

- Unlock more offers with Chase. Get up to $500 per calendar year by referring friends and family. Plus, get cash back from top brands with Chase Offers when you use your debit card.

- Chase Total Checking® has a $15 monthly service fee, you can easily avoid the fee with direct deposits totaling $500 or more, or a minimum average daily balance each statement period.

- Chase Overdraft Assist℠ – no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Chase Mobile® app makes banking simple. Manage accounts, pay bills, send money to friends with Zelle® and deposit checks on the go with Chase Quick Deposit℠.

- Chase has the largest branch network in the U.S. with thousands of ATMs and branches. Use the Chase locator tool to find a branch or ATM near you.

- Chase helps keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

Bank of America Advantage Banking - Up to $500 Cash Offer

- The cash offer up to $500 is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2026.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* into that new eligible account within 90 days of account opening. Your cash bonus amount will be based on the total amount of your Qualifying Direct Deposits received in the first 90 days.

Cash Bonus Total Qualifying Direct Deposits $100 $2,000 $300 $5,000 $500 $10,000+ - If all requirements are met 90 days after account opening, Bank of America will attempt to deposit your bonus into your new eligible account within 60 days.

- Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Wells Fargo Everyday Checking Account - $325 Bonus

- Get a $325 new checking customer bonus when you open an Everyday Checking account and receive $1,000 or more in qualifying direct deposits.

- Wells Fargo Bank, N.A.

Member FDIC

U.S. Bank Business Essentials - $400 Bonus

Promo code Q1AFL26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

Business Essentials: $400 bonus with $5,000 new money deposits, daily balance, and 6 qualifying transactions.

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank Mobile Check Deposit, electronic or paper checks, Bill Pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.

Member FDIC

CIT Bank Platinum Savings - 3.75% APY

- 3.75% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Write to Andrea Sielicki at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|

Compare: