Coinmama Review

Coinmama is a well-known cryptocurrency broker with high-quality customer service. Are their relatively high fees worth it? Read on to find out.

| |||

Buy and Sell Cryptocurrency Instantly | |||

Overall Score | 3.2 | ||

Cryptocurrency Trading | 3.5 | ||

Commissions and Fees | 2.5 | ||

Ease of Use | 5.0 | ||

Research | 1.0 | ||

Safety | 4.0 | ||

Pros and Cons

- Very simple interface

- Non-custodial exchange

- Many buying options

- High fees

- Limited range of cryptocurrencies

- No research tools

Bottom Line

Good international crypto exchange but has high fees and limited currencies

Looking for no-frills cryptocurrency trading?

Coinmama may be right for you.

But after recent security concerns, can you be sure your crypto is safe? Find out why it's worth using Coinmama, what their fees are, and how it compares to Coinbase in this review.

What is Coinmama?

Currently headquartered in Dublin, Ireland, Coinmama is a non-custodial cryptocurrency broker founded in 2013. They currently have over 2.7 million active investors in 190 countries worldwide.

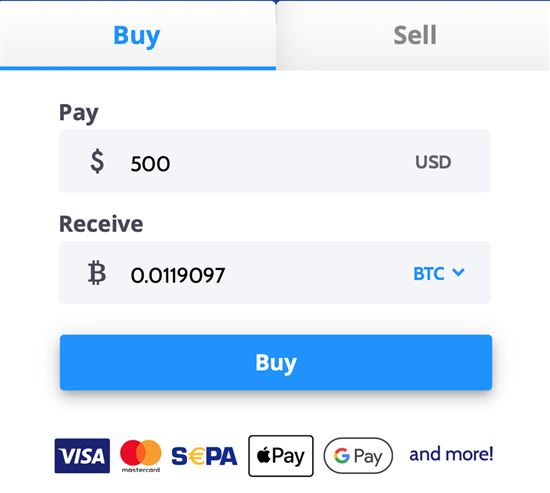

Coinmama offers a safe, quick way to buy and sell major cryptocurrencies like Bitcoin and Ethereum, with credit card, debit card, or bank transfer. They are the first crypto exchange to accept Apple Pay, and support Google Pay as well.

Coinmama is primarily geared toward customers who value simplicity and responsive support, and don't mind paying higher fees to get it. This makes it an appealing choice for beginners in the cryptocurrency space, but probably not the first choice for advanced or intermediate investors.

While some popular cryptocurrency platforms are exchange marketplaces, matching independent buyers and sellers, Coinmama is an exchange broker, meaning they hold cryptocurrency and sell it directly to investors.

Yes. Coinmama is a regulated entity registered as Money Service Businesses with FinCEN (Financial Crimes Enforcement Network), a bureau of the U.S. Treasury. They offer 24/7 support, and because they are a non-custodial brokerage, you retain control of your private keys.

How Does Coinmama Work?

|

Coinmama allows users all over the world to buy and sell cryptocurrencies like Bitcoin and Ethereum via credit or debit (Visa and Mastercard), SWIFT or SEPA transfer.

You can buy up to $30,000 USD worth at a time if you use your bank account, and you'll receive your coins in about 10 minutes when you make a purchase.

It's important to note that because Coinmama is a non-custodial broker, they can't hold your cryptocurrency for you once you buy it. This means you'll need a wallet to put it in before you get started.

Coinmama makes money through fees, which are relatively higher than other exchanges.

They currently offer 9 major cryptocurrencies, a small number relative to other major exchanges:

- Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Cardano, Litecoin, Tezos, Ripple, and Doge.

- Coinmama is available nearly everywhere. In fact, it's easier to list the countries where it's not available, which are: Iran, North Korea, Cuba, Syria, and the Ukrainian/Russian Crimea region.

In the U.S., Coinmama is available in the following 43 states:

- Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, District of Columbia, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Virginia, Utah, Washington, West Virginia, Wisconsin, and Wyoming.

Pros and Cons

|

Coinmama keeps it simple and shines for its customer service. Review the pros and cons to decide whether Coinmama is the right platform for you.

Pros

- Easy to use and get started

- Available worldwide

- Excellent customer support

- Non-custodial brokerage

- Doesn't save or or hold credit card information, ensuring safe transactions

Cons

- Extremely high fees

- Moderate security features

- No extra features

- Relatively limited coin selection

Features

Compared to other cryptocurrency brokers, Coinmama is pretty bare-bones—which is what makes it appealing to beginners who might be overwhelmed by too many options.

They don't currently offer any features other than buying and selling crypto. Their real selling points are their wide availability and ease of use.

Coinmama currently only operates on a desktop site. They do not have a mobile app.

Coinmama will send you your money or cryptocurrency shortly after you execute your trades. Coinmama does not hold assets, which means there's no worrying about them not giving you your money. You cannot deposit money into Coinmama either—only use it to buy crypto using one of their listed payment methods.

Fees to Look Out for

Compared to other cryptocurrency exchanges, Coinmama's fees are extremely high. Here's a breakdown of what you can expect to pay.

- Coinmama's Market Rate is 2% above the average listed on services like TradeBlock XBX (XBX + 2%)

- Commission Fees

2.93% - 3.90% - Debit/Credit Transactions incur a 5% momentum fee

- SEPA Bank Transfers have no additional fee

- SWIFT Bank Transfers incur a £20 (~$27.5) fee for orders under $1,000

- Buying Limits: Coinmama has tiered buying limits starting at $5,000 USD and $15,000 EUR/GBP/AUD/CAD/JPY a month at Level 1 membership

The combination of Coinmama's market rate, plus commission fees, plus the debit/credit momentum fee puts their rate at a high 10.90% for purchases.

For comparison, Gemini, another popular exchange, charges roughly 2% for transactions, as long as you use bank or wire transfers.

Coinmama Loyalty Program

Coinmama offers discounts and customer service benefits to frequent traders through their tiered loyalty program.

- Crypto Curious: The base level, just for signing up. No benefits.

- Crypto Enthusiast: By maintaining a cumulative purchase value of $5k over a rolling 90 day period, users can earn a 12.5% fee discount and fast-tracked customer support.

- Crypto Believer: By maintaining a cumulative purchase value of $18k over a rolling 90 day period or a lifetime purchase over $50k, users earn a 25% fee discount and queue-less customer support.

Coinmama Fees Example

For a $1,000 Bitcoin purchase, you can expect the following fees:

| Fee | Rate | Cost |

|---|---|---|

| Coinmama Market Rate | 2.0% | $20 |

| Coinmama Commission Fee | 2.93% - 3.90% | $38.10 |

| Purchase Method: SWIFT Bank Transfer (over $1,000) | Free | $0 |

| Purchase Method: Credit/Debit Card | 5.0% | $50 |

| Exchange Rate | Your bank may charge conversion fee for currencies other than USD or EUR | Varies |

| Total Cost | $1,108.10 |

There's always risk when it comes to investing, and cryptocurrency is particularly volatile—meaning it has dramatic changes in price over relatively short periods of time. This is how some people have gotten very rich, and others have lost a great deal. As crypto becomes more mainstream, it may become a less risky investment option, but for now, you should exercise caution. Generally speaking, you should never invest more than you're willing to lose.

Security Measures and User Privacy

Results are mixed when it comes to security and privacy on Coinmama.

On the one hand, because they are a non-custodial exchange and require you to store your own cryptocurrency, you have full control of your private keys.

You must have a crypto wallet in order to use Coinmama, ideally a physical or "cold wallet," which are considered more secure.

On the other hand, in 2019, they were part of a hack that affected 20 other websites, and were reported to have lost personal information on approximately 450,000 customers.

Enabling Two-Factor Authentication through a mobile authentication app is a good way to prevent unwanted users from gaining access to your account. Find the option in the 'Profile and Security' section when logged in.

Coinmama is a legitimate company, following U.S. regulations, registered as Money Service Businesses with FinCEN (Financial Crimes Enforcement Network), a bureau of the U.S. Treasury. As such, they'll require identifying documents when you sign up.

All in all, if security is your primary concern, you're better off with an exchange like Gemini, which puts security first, though lacks the customer service reputation of Coinmama.

Physical cryptocurrency wallets—that is, ones that you can hold in your hand, are called Cold Wallets. Software-only wallets are called Hot Wallets. Cold wallets are generally considered more secure, and preferred by security-minded investors. The most popular cold wallets are the Ledger Nano X and the Trezor Model T.

Common Complaints

Coinmama has received a number of complaints from users unhappy with the amount of documentation required to sign up. However, the reality is that they don't ask for more than typically required for standard Know Your Customer (KYC) and Anti Money Laundering (AML) policies.

Reassuringly, even complaints found off their platform regularly receive replies from Coinmama.

Can you get scammed on Coinmama?

It is possible to get scammed on Coinmama, or any crypto exchange, and investors must always be vigilant. On their blog, Coinmama lists a number of common scams to watch out for:

- Fake brokers or traders (or fake Bitcoin investment/financial advisors)

- Impersonator sites

- Social media scams

Can Coinmama steal my money?

No. Since Coinmama does not hold user funds, they cannot steal your money.

Create an Account

Creating an account on Coinmama only takes a few minutes, but it does require a photo ID and a smartphone with a camera.

- Go to their website and you'll find a link to set up your account before you start trading.

- They'll request personal information like name, date of birth, residence, and contact info.

- Next, you'll verify your email address.

- In order to get started trading, you'll need to submit photos of the front and back of a government-issued ID, as well as of yourself holding it.

- Once you've submitted that, all you have to do is wait for verification to be completed, which can take about 15 minutes.

You can also get started just by buying some Bitcoin on their homepage, and go from there.

|

| Screenshot of Coinmama |

Contact Customer Service

Customer service is where Coinmama stands out from other exchanges.

You can contact them via chat (via the speech bubble icon in the bottom right corner) or their contact form 24/7. They typically respond within a couple of minutes.

If you have a quick question, you can also access their extension knowledge base in their Help Center.

They also have a presence on Twitter, Facebook, LinkedIn, and Telegram.

Coinmama is not accredited with the BBB, and does not appear on their site. Coinmama has a relatively high rating on Trustpilot compared to other exchanges, of 3.7.

Coinmama Alternatives

Users have a number of options for buying and selling cryptocurrencies other than Coinmama, but what you choose depends on what your priorities are.

Coinmama vs Coinbase:

| ||

| Visit Site | Learn More | |

Coinmama | Coinbase | |

|---|---|---|

Buy and Sell Cryptocurrency Instantly - | Earn $5 in bitcoin on your first trade on Coinbase - | |

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Minimum Deposit | ||

| Cryptocurrencies Supported | ||

| Countries Supported | ||

| Fiat Currencies Supported | ||

| Digital Wallet | ||

| Transaction Fee | Greater of Minimum Flat Fees or Variable Fees (1.49%+) by Location and Payment Method. Minimum Flat Fees:

| |

| Copy Trading | ||

| Limit Orders | ||

| Margin Trading | ||

| Spread | ||

| Crypto Loans | ||

| Bank Account Purchase Fee | ||

| Debit Card Purchase Fee | ||

| Credit Transaction Fee | ||

| Mobile App | ||

| Wire Transfer Fee | Only available for orders over $50,000 | |

| SEPA Bank Transfer Fee | ||

| Other Fees | Swift bank transfer: £20 (~$27.5) fee for orders under $1000 | Instant Card Withdrawal: up to 1.5% + minimum fee of $0.55 |

| Address Allowlisting | ||

| Anonymity | ||

| Biometric Login | ||

| Cold Storage | ||

| Maximum Trading Amount | Level 1 Account: $15,000 / day; Level 2 Account: $50,000 / day; Level 3 Account: $1,000,000 | |

| Two-Factor Authentication | ||

| Visit Site | Learn More | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Coinmama: Pricing information from published website as of 04/13/2021. Coinbase: Pricing information from published website as of 04/13/2021. | ||

Coinmama stands out when it comes to customer service, with some of the highest reviews on public review sites.

However, with no mobile app, limited coin selection, and some of the highest fees in the industry, you'd be hard-pressed to justify the expense of using it over a popular exchange like Coinbase.

There are two points where Coinmama scores better than Coinbase, and one is international availability. Coinmama is available nearly everywhere, and if other exchanges aren't where you are, it's certainly better than nothing.

The other is its non-custodial nature: Because Coinmama never holds your assets, you don't have to worry about withdrawing them.

If you're extremely security conscious, or Coinbase is unavailable, choose Coinmama. Otherwise, Coinbase is the less costly choice.

Coinmama vs Kraken:

| ||

| Visit Site | Learn More | |

Coinmama | Kraken | |

|---|---|---|

Buy and Sell Cryptocurrency Instantly - | Buy and Sell Cryptocurrencies - | |

Benefits and Features | ||

| Minimum Deposit | ||

| Cryptocurrencies Supported | ||

| Countries Supported | ||

| Fiat Currencies Supported | USD, EUR, CAD, AUD, GBP, CHF, JPY | |

| Digital Wallet | ||

| Transaction Fee | ||

| Copy Trading | ||

| Limit Orders | ||

| Margin Trading | ||

| Crypto Loans | ||

| Bank Account Purchase Fee | ||

| Debit Card Purchase Fee | ||

| Credit Transaction Fee | ||

| Mobile App | ||

| Wire Transfer Fee | Only available for orders over $50,000 | |

| SEPA Bank Transfer Fee | ||

| Other Fees | Swift bank transfer: £20 (~$27.5) fee for orders under $1000 | 1-time address setup fees for first-time deposits of many cryptocurrencies, varies by currency |

| Address Allowlisting | ||

| Anonymity | ||

| Biometric Login | ||

| Cold Storage | ||

| Two-Factor Authentication | Google Authenticator or Yubikey | |

| Visit Site | Learn More | |

Coinmama: Pricing information from published website as of 04/13/2021. Kraken: Pricing information from published website as of 04/13/2021. | ||

Kraken scores even better than Coinbase when it comes to fees, making it an obvious choice over Coinmama.

It has a lot more features, including a mobile app and margin trading.

Coinmama is slightly easier to use, but Kraken is definitely the stronger contender here.

Bottom Line: Should you use Coinmama?

Coinmama is easy to use, easy to sign up for, and widely available internationally. They are a non-custodial exchange, meaning you don't have to worry about them running off with your money.

Plus, they have an excellent track record when it comes to customer service, which many of the other exchanges cannot claim. But their high fees and lack of extra features make them hard to recommend.

The biggest pro about Coinmama is the many payment options. You can buy coins with bank transfer, credit card, debit card, or Apple Pay.

Deposit $100 and Get $10 from eToro USA LLC

- Sign up for an eToro account

- Deposit $100

Trade from "Anything to Anything" in Just 10 Seconds

Trade between cryptocurrencies, precious metals, and national currencies.

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk.

Jeremy Harshman is a creative assistant at CreditDonkey, a crypto comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: